Valvoline Inc (VVV) Reports Strong Growth in Q1 2024 Earnings

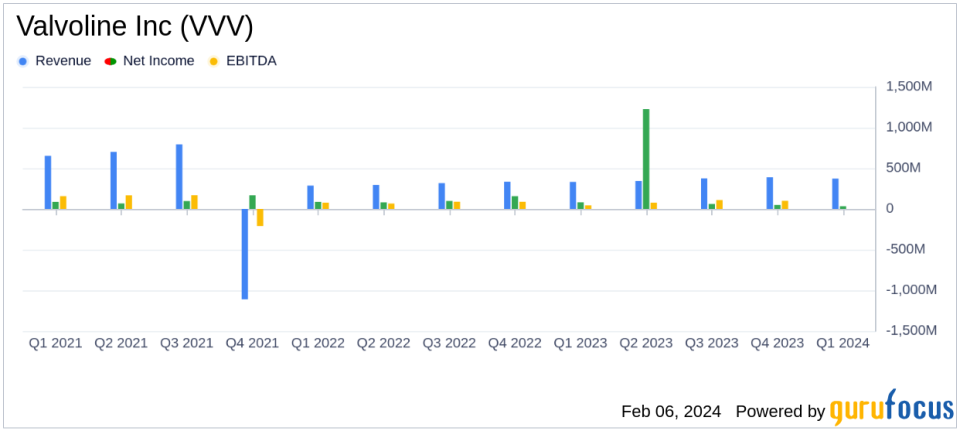

Revenue Growth: Sales from continuing operations increased by 12% to $373 million.

Profitability Enhancement: Income from continuing operations rose by 26%, with EPS up by 73%.

Adjusted Earnings: Adjusted EBITDA and adjusted EPS grew by 23% and 81%, respectively.

Expansion: 38 new stores added, bringing the total to 1,890 system-wide stores.

Shareholder Returns: Over $170 million returned to shareholders through stock repurchases.

Liquidity Position: Cash and cash equivalents balance stood at $540 million against a total debt of $1.6 billion.

On February 6, 2024, Valvoline Inc (NYSE:VVV) released its 8-K filing, announcing the financial results for the first quarter of fiscal year 2024, which ended on December 31, 2023. The company, a leader in automotive maintenance with a focus on lubricants and other maintenance products, reported a robust start to the year with significant growth in sales and profitability.

Valvoline Inc (NYSE:VVV) is renowned for its production, marketing, and sales of automotive maintenance products, including a wide range of lubricants. The company's strong presence in the United States contributes the majority of its revenue, with a growing network of retail outlets and installers serving a broad customer base.

Financial Highlights and Operational Performance

The company's sales from continuing operations reached $373 million, a 12% increase compared to the previous year. This growth was primarily driven by a 7.1% rise in system-wide same-store sales (SSS), indicating a robust demand for Valvoline's offerings. The reported income from continuing operations stood at $34 million, marking a 26% increase, while earnings per diluted share (EPS) saw a significant jump of 73% to $0.26. Adjusted for certain non-operational activities, the adjusted EBITDA and adjusted EPS increased by 23% and 81%, respectively, highlighting the company's strong operational efficiency and profitability.

The quarter also saw Valvoline expand its retail footprint, adding 38 new stores, split evenly between franchised and company-operated locations. This expansion underscores the company's strategic growth initiatives and commitment to increasing its market presence.

Financial Position and Shareholder Value

Valvoline's balance sheet reflects a solid liquidity position, with cash, cash equivalents, and short-term investments totaling $540 million. The company's total debt stands at $1.6 billion. In terms of shareholder returns, Valvoline has demonstrated a strong commitment to returning value, repurchasing over $170 million of its stock during the quarter, with $40 million remaining under the current share repurchase authorization.

President & CEO Lori Flees commented on the results, expressing gratitude towards the team and franchise partners for their hard work. Flees highlighted the company's successful start to the fiscal year, with growth in same-store sales and network expansion. She also emphasized the company's focus on returning value to shareholders through stock repurchases.

"We began the year delivering another quarter of growth with a 7.1% increase in system-wide same-store sales," said Lori Flees, President & CEO. "Our network growth is off to a great start for the year with 38 total store additions this quarter, with half coming from franchise."

Outlook and Strategic Priorities

Looking ahead, Valvoline remains on track with its full-year guidance, focusing on driving the full potential of its existing business, accelerating network growth, and expanding services to meet the evolving needs of customers and the automotive market.

Valvoline's strong performance in the first quarter of fiscal 2024 sets a positive tone for the year ahead. With a clear strategy and commitment to growth and shareholder value, the company is well-positioned to navigate the challenges and opportunities that lie ahead in the automotive maintenance industry.

For more detailed financial information and to access the full earnings release, please visit Valvoline's investor relations website.

Explore the complete 8-K earnings release (here) from Valvoline Inc for further details.

This article first appeared on GuruFocus.