Vanda Pharmaceuticals Inc (VNDA) Faces Revenue Decline Amid Patent Challenges and Generic ...

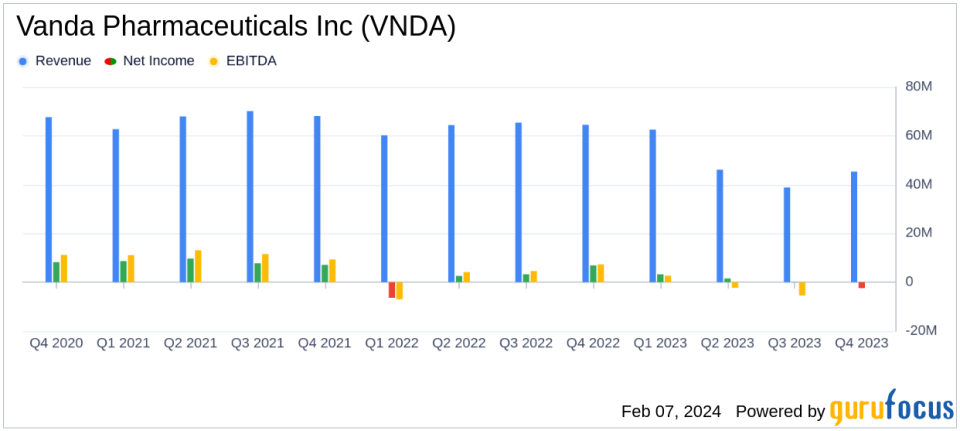

Revenue: Full year 2023 revenues decreased by 24% to $192.6 million compared to the previous year.

Net Income: Net income for the full year 2023 was $2.5 million, down from $6.3 million in the previous year.

Product Sales: HETLIOZ sales fell by 37% due to generic competition, while Fanapt saw a modest 4% decline.

Cash Position: Cash and cash equivalents ended at $388.3 million, a 17% decrease from the end of 2022.

Acquisitions and Pipeline: The acquisition of PONVORY and progress in clinical development pipeline, including three FDA PDUFA target action dates in 2024.

On February 7, 2024, Vanda Pharmaceuticals Inc (NASDAQ:VNDA) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The year was marked by significant challenges, including the at-risk launch of generic versions of HETLIOZ in the U.S., which led to a notable decline in revenue.

Vanda Pharmaceuticals Inc is a biopharmaceutical company that focuses on the development and commercialization of novel therapies for high unmet medical needs. The company's portfolio includes HETLIOZ for Non-24-Hour Sleep-Wake Disorder and nighttime sleep disturbances in Smith-Magenis Syndrome, as well as Fanapt for schizophrenia. The recent addition of PONVORY aims to strengthen the company's market presence.

Financial Performance and Challenges

The company's financial performance in 2023 was significantly impacted by the introduction of generic competitors to HETLIOZ, leading to a 47% decrease in its net product sales in the fourth quarter compared to the same period in 2022. Fanapt also experienced a decrease in sales, though more modest at 7%. The acquisition of PONVORY added $1.6 million in net product sales for the brief period post-acquisition in December 2023.

The net loss for the fourth quarter was $2.4 million, a stark contrast to the net income of $6.9 million in the same quarter of the previous year. The full year also saw a decrease in net income, down to $2.5 million from $6.3 million in 2022. This decline in profitability is a critical concern for investors, as it reflects the challenges Vanda faces in maintaining its market position against generic competition.

Financial Achievements and Industry Significance

Despite the setbacks, Vanda Pharmaceuticals Inc managed to end the year with a strong cash position of approximately $388 million. This financial achievement is significant for a biotechnology company like Vanda, as it provides the necessary resources to fund ongoing clinical trials, research and development efforts, and potential strategic acquisitions like that of PONVORY. Such financial stability is crucial for sustaining operations and investing in future growth opportunities within the biotech industry.

Analysis of Financial Statements

Key details from the financial statements reveal the following:

"Total net product sales from HETLIOZ, Fanapt, and PONVORY were $192.6 million for the full year 2023, a 24% decrease compared to $254.4 million for the full year 2022."

"Cash, cash equivalents and marketable securities (Cash) was $388.3 million as of December 31, 2023, representing a decrease to Cash of $78.6 million, or 17%, compared to December 31, 2022."

These metrics are important as they provide insight into the company's revenue-generating ability and its liquidity position, both of which are critical for its long-term viability and ability to fund future growth.

Company's Outlook and Legal Updates

The company's outlook for 2024 remains cautious due to uncertainties surrounding the U.S. market for HETLIOZ. Legal challenges continue, with Vanda filing suit against the FDA's conduct in reviewing the insomnia sNDA and pursuing approval for HETLIOZ in the treatment of jet lag disorder. Additionally, Vanda is engaged in litigation to protect its trade secrets and confidential information.

For value investors and potential GuruFocus.com members, Vanda Pharmaceuticals Inc's situation presents a complex picture. While the company is navigating significant commercial and regulatory challenges, its strong cash position and ongoing clinical developments suggest potential for future growth. The company's ability to manage these hurdles and capitalize on its pipeline will be critical in determining its financial trajectory in the coming years.

For more detailed information and analysis, readers are encouraged to visit GuruFocus.com for comprehensive investment insights and updates on Vanda Pharmaceuticals Inc (NASDAQ:VNDA) and the broader biopharmaceutical industry.

Corporate Contact: Kevin MoranSenior Vice President, Chief Financial Officer and TreasurerVanda Pharmaceuticals Inc.202-734-3400pr@vandapharma.comSOURCE Vanda Pharmaceuticals Inc.

Explore the complete 8-K earnings release (here) from Vanda Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.