Vanguard Commentary: Continued Runway for US Consumer Demand

The U.S. consumer has remained surprisingly resilient, keeping the economy vibrant despite the Federal Reserve's efforts to rein in inflation by keeping interest rates elevated. And runway remains for households to continue to drive strength in the economy, according to two Vanguard researchers. A continued strong labor market, reasonable credit usage, and favorable wealth effects provide the backdrop for continued consumer health.

We continue to observe strength across consumer groups that can be sustained further, said Josh Hirt, a Vanguard senior economist. This is one aspect driving our skepticism that inflation will continue to ease as fast as many anticipate.

A virtuous cycle where job growth, wages, and consumption fuel one another informs our view that consumer demand can persist.

The positive feedback loop among jobs, wages and demand

What's driving consumption is this enduring cycle, said Bob Behal, Vanguard head of structured product research. More jobs lead to higher wages, which increases demand for goods and services, which perpetuates more jobs and fewer layoffs. Until something breaks the cycle, it's a positive feedback loop.

We're not saying the consumer has endless capacity. But the data paint a healthy picture of the consumer in the near term and continuation of consumption and performance trends.

Leverage appears manageable

Evidence of resilience is apparent in all manner of consumer data. The ratio of revolving debtOpens in a new tab (credit card debt and home equity loans) to both disposable personal income and GDP growth has been surprisingly low, still falling short of its pre-pandemic trend.

From a historical perspective, U.S. consumers in aggregate are reasonably leveraged relative to income currentlyand remain below levels where they were before COVID, Hirt said.

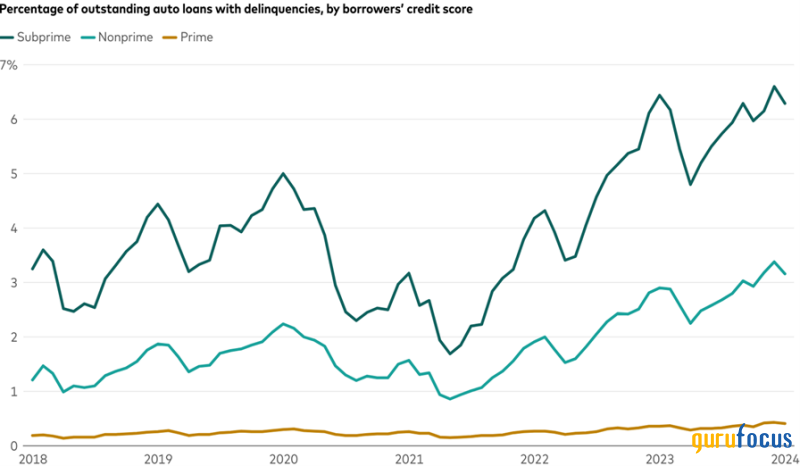

At a more granular level, rates of auto loan delinquencies suggest that debt is manageable for most borrowers, Behal said. Delinquency rates among borrowers whose credit is rated primethose with credit scores of 660 or higherhave barely increased over the past five years. Delinquencies have gone up for subprime and nonprime borrowers but together they comprise only a quarter of auto loans outstanding.

Deterioration in the credit markets is isolated to a sub-segment of the population and is rising from a very low base, Behal said. Even though it's a real risk, we're not seeing broad-based deterioration. Overall consumer health remains fairly robust even though normalization is occurring.

Increase in auto loan delinquencies is negligible among prime borrowers

Notes: Delinquencies are auto loans that are overdue 60 days or more. Subprime borrowers are those with credit scores lower than 620, nonprime borrowers are those with scores from 620 through 659, and prime borrowers are those with scores of 660 and higher. Although not shown on this chart, roughly three-quarters of all auto borrowers are in the prime category. Subprime and nonprime borrowers make up the remaining quarter.

Sources: Vanguard calculations, using data from 1010data and SEC EDGAR, as of December 31, 2023.

Real estate is driving a wealth effect

Higher wages, robust equity market gains, and increased savings have contributed to a wealthier, more stable consumer over the past few years, and higher home values have had an even greater impact.

What stands out in household wealth gains since COVID is the outsized impact that housing wealth has contributedaround double the typical impact, Hirt said. To the degree that wealth effects support consumption, housing wealth is more comprehensive and higher-quality.

The chart below shows the change in share of net worth from different assets in each income group.

Home values have been the biggest boost to wealth across income levels

Notes: The chart shows the change in distribution of household net worth from the start of 2019 through September 2023 in each income percentile group. The top 1% income bracket was left out of the chart because they usually exhibit anomalous trends. Deposits are checkable deposits, currency, time deposits, and other short-term investments besides money markets.

Sources: Vanguard calculations, using data from the Federal Reserve Board of Governors, as of September 30, 2023.

What's interesting is that, while home values have now increased the strength of all consumers, not just at the higher end of the spectrum, the middle cohorts saw the biggest gains, Behal said. And those middle cohorts also saw the largest wage gains.

All this bolsters our earlier researchOpens in a new tab that there's still capacity on the part of the consumer to keep the economy going, Hirt said.

Note: All investing is subject to risk, including the possible loss of the money you invest.

This article first appeared on GuruFocus.