Vanguard, genocide, and the $18 million campaign to get you to vote

On Nov. 15, Vanguard will hold an enormous shareholder meeting and proxy vote for the first time in almost a decade. If you’re a customer of the world’s largest mutual fund company, you’re also a shareholder, which is why you’ve likely been hounded by calls, emails, and paper mail to try to get you to vote.

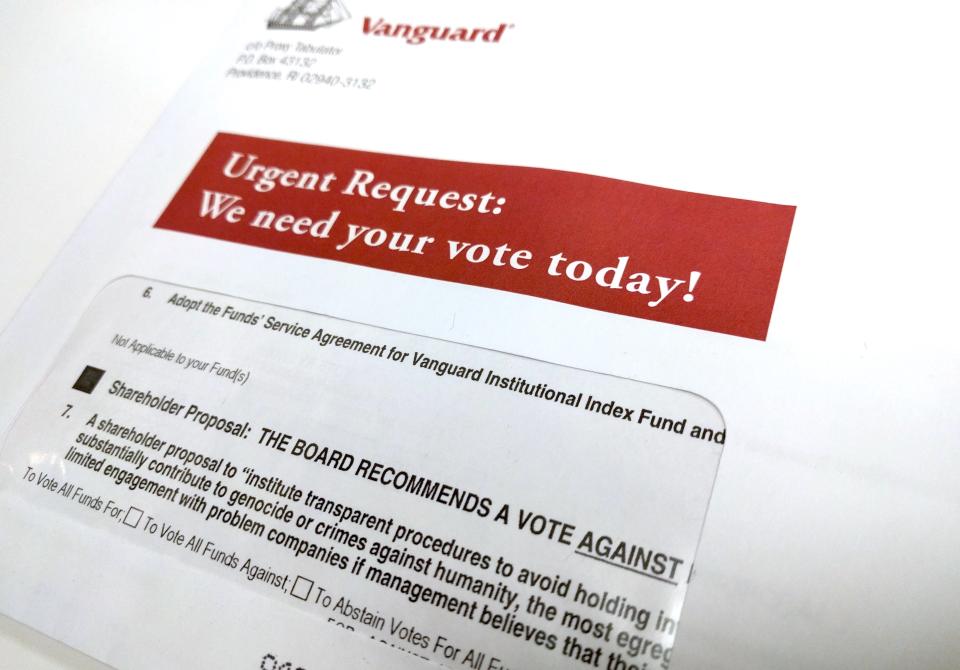

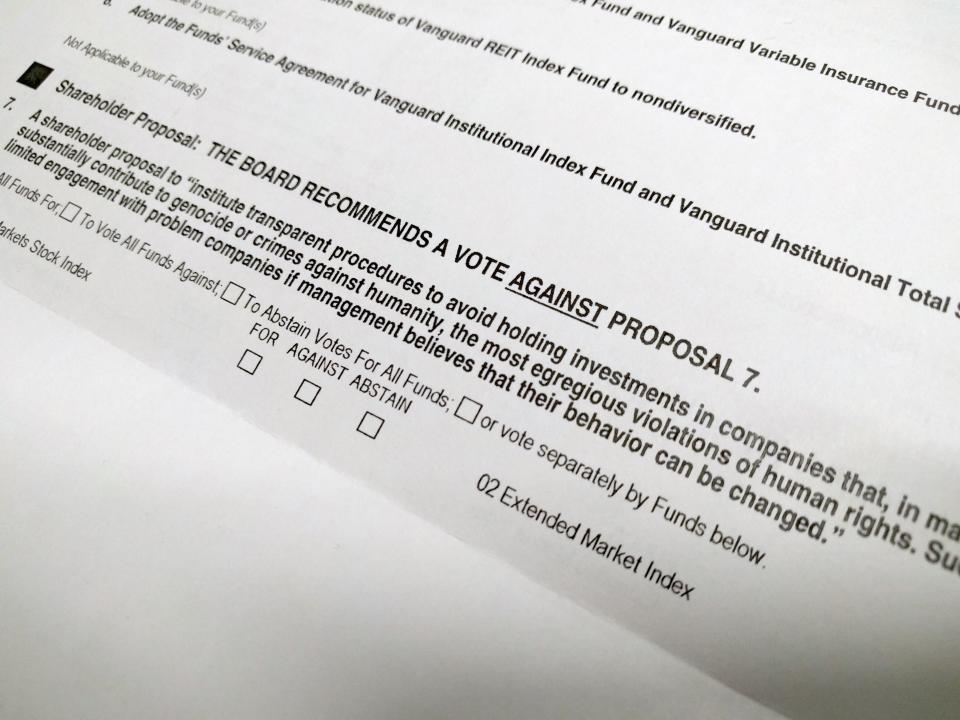

Tucked into the ballot after boilerplate proposals is an interesting item — Proposal 7 — put forth by activist investor group Investors Against Genocide. The proposal moves to have Vanguard not invest in companies that, “in management’s judgement, substantially contribute to genocide or crimes against humanity.”

“A shareholder proposal to institute transparent procedures to avoid holding investments in companies that, in management’s judgement, substantially contribute to genocide or crimes against humanity, the most egregious violations of human rights. Such procedures may include time-limited engagement with problem companies if management believes that their behavior can be changed.”

An example cited in the proposal was PetroChina, which has a connection to the genocide in Darfur. Vanguard’s management advises investors vote against the proposal.

Vanguard investors are surprised and angry

To many Vanguard investors, not investing in companies that “substantially contribute to genocide” is about as low a moral bar as there is, and they are outright angry at what they see as the company’s callousness. As the vote nears, investors are airing their confusion on Twitter, Reddit, and Vanguard forums.

Victoria Santoro, a Boston-based trial lawyer and Vanguard investor, is one of them. “When I got to the genocide item, I assumed the board’s recommendation would be to approve it,” she told Yahoo Finance. “I was very disappointed to find the opposite.” Santoro said she picked Vanguard over others due to its reputation for ethics.

Dr. Beverly Tchang, a doctor from New York and a Vanguard investor, had a similar reaction. “I found the proposal to be timely and appropriate. Especially since there has been so much coverage on the Rohingya recently,” she said, referring to a group of refugees fleeing Myanmar.

Tchang said she didn’t know specifics about PetroChina and Sudan, but argued that transparency was a low standard. “I don’t think [transparency] is too much to ask for,” she said.

Why Vanguard needs your vote

Vanguard, unlike most public companies, doesn’t hold an annual vote and generally only holds them when really necessary.

“Last time we did this was in 2009,” Arianna Stefanoni Sherlock, Vanguard’s head of corporate public relations, told Yahoo Finance. “Every time we do this, it’s a lot of time and money so we try to do this as infrequently as possible.”

Desperate for a needed quorum of one-third of shareholders for each fund, Vanguard is spending $17.6 million on a campaign to get its 20 million shareholders to vote to install board members.

When the last vote occurred, Vanguard had just a fraction of the assets it does now. The astronomic rise in passive investing has brought $3 trillion in new assets under the company’s management, bringing the total to $4.6 trillion. At that time, a similar measure appeared on the ballot but only earned between 7% and 17% of the vote, depending on the fund.

Those new assets mean a higher number of voters are required for a quorum. Should Vanguard fail to have a quorum, it would have to hold another vote until enough shareholders turn out — an expensive proposition and one that has happened before. Fidelity, a Vanguard competitor, had to postpone its meeting eight times from October to April. “We need investors to come out and vote,” Sherlock said.

Vanguard: ‘Divestment is an ineffective means to implement social change’

Vanguard’s detailed response in the proxy materials notes its concern for the issues but advises against Proposal 7 because it would, in the company’s view, handicap advisors’ fiduciary duty. Furthermore, the company maintains “divestment is an ineffective means to implement social change” and that the company is already “fully compliant with all applicable U.S. laws and regulations.”

“Constraints imposed by third-parties could impair the ability of portfolio managers to provide Fund shareholders investment returns that are competitive with similar funds,” the company’s statement reads.

Sherlock echoed these points to Yahoo Finance. “It is nuanced,” she said. “I’m hoping investors are really reading their materials. Our recommendation ‘against’ isn’t how we feel about the issue.”

Tchang and Santoro were both unimpressed with arguments set forth by Vanguard. “Vanguard’s position that [the measure] won’t change genocide is inarguable, and therefore useless, precisely because we don’t have that information,” said Tchang, pointing to the catch-22 of transparency.

“Hiding behind a justification that they are following U.S. law is the bare minimum,” Santoro said. “Everyone is supposed to follow U.S. law. I hope very much that the Vanguard board is extremely active in vetting their portfolio companies.”

Activism, symbolic policy, or the seeds for a lawsuit?

Within Vanguard’s rationale are some larger issues, perhaps artlessly hinted at — but not fully explained — by the company in the proxy documents.

“I don’t view it as, ‘oh Vanguard is insensitive to genocide’,” Jill Fisch, a professor at the University of Pennsylvania’s Law School and an expert in corporate governance and litigation, told Yahoo Finance.“As a general rule, a recommendation against this type of shareholder proposal doesn’t reflect a fundamental disagreement.”

According to Fisch, an adopted vote could have hidden consequences and the Vanguard board wishes to be conservative. If the Proposal 7 passes, it could have an unpredictable effect. For example, should Vanguard shareholders identify and allege non-compliance, they may sue Vanguard and that could result in a court-ordered divestiture or damages paid.

“You don’t want the company to subject itself to litigation,” Fisch said. This legal exposure is why adopting measures to comply with policies that are already in compliance may not be as easy as it seems.

Tensie Whelan, a professor at NYU’s Stern School of Business who studies business and ethical concerns, said the generality of the measure might concern Vanguard further, even though it’s hedged by statements like “in management’s judgement” and “substantially contribute” — as if a small contribution to genocide would be kosher.

Instead of being held by a shareholder initiative, companies prefer to comply on their own terms. Whelan said companies often respond to these concerns with assurances that they are already in compliance, as well as showing they hear investors’ concerns by meeting with them and appropriate non-government organizations (NGOs).

A program like that, Whelan said, could benefit Vanguard. They could say, “here’s what we’re doing now, what else should we be doing? What standards can we comply with, what auditing can we do?” Ideally for a company, these steps happen so it doesn’t have to go to a shareholder resolution.

As to that solution, Vanguard’s Sherlock didn’t share specifics of such plans with Yahoo Finance but noted that the company is in touch with Investors Against Genocide and takes these matters seriously.

“We have a robust investment stewardship function at Vanguard,” she said. “We are actively engaging with the companies we hold and addressing and voting on other proxies for other companies when we see issues of concern, when it might affect long-term value.”

The last clause, however, gets to the heart of the concern for Vanguard customers like Santoro. “I think they can do much better in terms of responsible investing,” she said. “It’s not all about returns anymore.”

What has been done in the past

These types of proposals aren’t totally rare, but are relatively uncommon, especially the language in Vanguard’s Proposal 7. According to Whelan, about 1,000 shareholder resolutions are put forth each year to public companies, and are important means for investors to signal an issue’s importance. Most are on proxy access and a growing number concern climate change, but around 26 involve human rights.

Generally, proxy advisory services side with the board, though there can be flexibility, according to Whelan. Any coziness toward crimes against humanity could amount to a money-losing PR nightmare, which would be of fiduciary concern to shareholders.

ISS, a large proxy firm, advises these types of votes on a case-by-case basis, and they pointed to perhaps the most similar case from 2015. BlackRock, another index fund provider, was faced with an almost identical proposal brought on by the same activist group, Investors Against Genocide:

“Shareholders request that the Board institute transparent procedures to avoid holding or recommending investments in companies that, in management’s judgment, substantially contribute to genocide or crimes against humanity, the most egregious violation of human rights.”

BlackRock justified recommending a vote against the proposal, contending the company is already required to comply with relevant laws and that these decisions are best left to management.

Egan Jones, another proxy advisory company, echoed ISS in a report on the Vanguard proposal. “Expecting a firm to abstain or avoid a line of legal business that might potentially result in moral negatives is, in general, a hopelessly costly endeavor doomed to failure or worse.”

Investors Against Genocide has put forth successful measures in the past, however. TIAA-CREF divested $58 million from Sudan-friendly oil companies including PetroChina after a successful campaign from the group, which withdrew a measure similar to Vanguard’s from a proxy ballot when the group’s divestment demands were met. T. Rowe Price also voluntarily adopted the group’s divestment demands.

The group has even managed to win a proxy vote when ING declined to take a stance, paving the way for a 59.8% victory. However, Investors Against Genocide’s website notes that ING has taken no action and investors want the company to disregard the vote.

First-time investors may throw a wrench into the situation

Vanguard’s $17.6 million effort to get shareholders out to vote may end up accidentally drumming up support for Proposal 7, because most individual investors usually do not vote. (Just 29% of shares owned by individual investors generally vote, according a study by PwC, and for mutual funds specifically the number is likely even lower.)

“Just by nature of growth we’ve seen in client base since 2009, I would say you could deduce that for lots of people it’s their first time doing this,” Sherlock said.

Thousands or millions of these new voters like Tchang and Santoro, who were brought to the ballot by Vanguard’s own efforts, may not react well to the board’s arguments or nuance. At the very least, they may find it difficult to vote against not investing in companies that “substantially contribute” to genocide.

“With increase of voting, you’ll have more people vote for [the measure],” Whelan said. “Generally voting is more by the institutions and they generally vote with management. An individual is more likely to vote for that.”

The rising popularity of index funds and passive investing and more socially-conscious millennial investors may significantly affect future voting on issues like this, said Whelan. While not every company needs to resort to expensive paid campaigns to get out the vote, the lack of participation of individual shareholder votes is something that may be addressed in the future. Policy changes or other measures will likely encourage these individuals to speak up on the ballot — not just through their traditional mode of selling. It’s important to remember: You can vote with your wallet, but you may also have a ballot.

Disclosure: Some of the author’s retirement savings are in Vanguard index funds. Vanguard’s cooperative business structure makes the author therefore a shareholder.

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: emann[at]oath[.com].

Read More:

Consumer watchdog is killing ‘payday loans’ — here’s what will take their place

Equifax’s breach is an opportunity to fix a broken industry

ATM fees have shot up 55% in the past decade

Big bitcoin-friendly companies like Microsoft and Expedia hedge their bet

The real reason Mexico will never pay for the Trump’s wall: It’d be ‘treason’

How Waffle House’s hurricane response team prepares for disaster

Trump weighs slashing one of the most popular tax deductions

A robot lawyer can fight your parking tickets and much more

Consumer watchdog is making it easier for consumers to sue banks