Vanguard Group Inc Adds Shares in Steelcase Inc

Overview of Vanguard's Recent Acquisition in Steelcase Inc

On October 31, 2023, Vanguard Group Inc made a notable addition to its investment portfolio by acquiring 9,516,334 shares of Steelcase Inc (NYSE:SCS), a leading furniture company. This transaction, which saw Vanguard adding 362,748 shares at a trade price of $10.91, reflects a strategic move by the firm to increase its stake in the industrial products sector. Despite the trade impact on Vanguard's portfolio being 0%, the trade position in Steelcase Inc now stands at a significant 10.16%.

Insight into Vanguard Group Inc

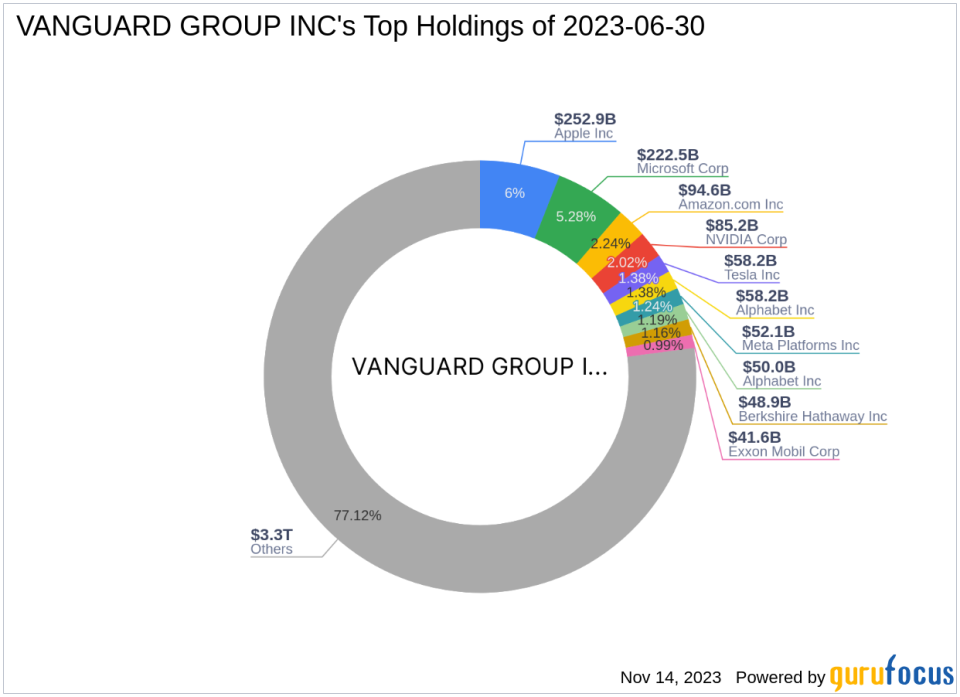

Vanguard Group Inc, established in 1975, is a firm renowned for its cost-efficient investment strategies and client-owned structure. With a philosophy centered on delivering the best investment success to all investors, Vanguard has consistently lowered costs for shareholders by leveraging economies of scale and eliminating sales commissions. The firm's introduction of index mutual funds has been a game-changer, further cementing its position as a leader in cost efficiency. Vanguard's global expansion and diverse product offerings have attracted over 20 million clients, ranging from individual to corporate investors. As of now, Vanguard's equity stands at an impressive $4,216.75 trillion, with top holdings in technology and healthcare sectors, including giants like Apple Inc (NASDAQ:AAPL) and Amazon.com Inc (NASDAQ:AMZN).

Steelcase Inc at a Glance

Steelcase Inc, with the stock symbol SCS, operates primarily in the United States and extends its reach to Europe, the Middle East, and Africa. Since its IPO on February 18, 1998, the company has specialized in providing architectural, furniture, and technology solutions across various market segments. The majority of its revenue is generated from the Americas segment, which caters to a diverse clientele including corporate, government, healthcare, education, and retail customers. Steelcase's commitment to innovation and quality has positioned it as a key player in the industrial products industry.

Impact of Vanguard's Trade on Steelcase Inc

The recent acquisition by Vanguard Group Inc is a strategic addition to its portfolio, which may signal confidence in Steelcase Inc's market position and future prospects. Although the trade impact is currently at 0%, the ownership percentage of 10.16% is a testament to the significance Vanguard places on this investment. This move could potentially influence the market's perception of Steelcase Inc and its stock performance.

Steelcase Inc's Market Performance

Steelcase Inc currently boasts a market capitalization of $1.36 billion, with a stock price of $11.93. The stock is deemed "Fairly Valued" with a GF Valuation of $13.02 and a price to GF Value ratio of 0.92. The stock has experienced a gain of 9.35% since the transaction date, although it has seen a decline of 64.53% since its IPO. However, the year-to-date performance has been positive, with a 62.53% increase.

Financial Health and Growth Prospects of Steelcase Inc

Steelcase Inc's financial health is reflected in its balance sheet rank of 6/10 and a profitability rank of 7/10. The company's growth rank stands at 3/10, indicating some challenges in this area. The cash to debt ratio is 0.24, with an interest coverage of 4.41. These metrics suggest that while Steelcase has a solid profitability foundation, there is room for improvement in growth and financial strength.

Comparative Analysis with Other Investment Gurus

Pzena Investment Management LLC is currently the largest guru shareholder in Steelcase Inc, with other notable investors including Joel Greenblatt (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss. The involvement of these seasoned investors further underscores the potential that Steelcase Inc holds within the investment community.

Concluding Thoughts on Vanguard's Investment in Steelcase Inc

Vanguard Group Inc's recent acquisition of shares in Steelcase Inc is a strategic move that aligns with the firm's investment philosophy and market outlook. With a solid market capitalization, fair valuation, and a positive year-to-date performance, Steelcase Inc presents an interesting case for value investors. The involvement of Vanguard and other prominent investors may signal a positive trajectory for the company, making it a stock to watch in the industrial products sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.