Vanguard Group Inc Adds Shares in Insmed Inc

Overview of Vanguard's Recent Portfolio Addition

Vanguard Group Inc, a prominent investment firm, has recently expanded its portfolio by acquiring additional shares in Insmed Inc (NASDAQ:INSM). On October 31, 2023, Vanguard Group Inc reported an addition of 1,089,800 shares in Insmed Inc, reflecting an 8.18% change in their holdings. The transaction was executed at a price of $25.06 per share, increasing Vanguard's total share count in Insmed to 14,410,356. This move signifies a slight yet strategic increase in Vanguard's stake in the biopharmaceutical company, with the position now representing 10.07% of Insmed's outstanding shares and 0.01% of Vanguard's portfolio.

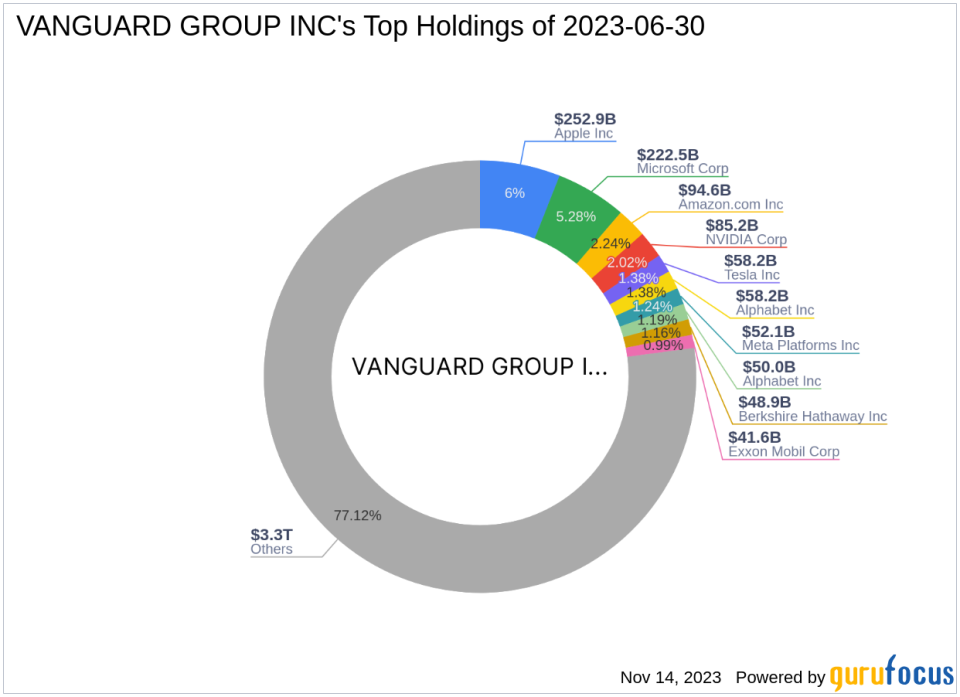

Insight into Vanguard Group Inc

Founded in 1975, Vanguard Group Inc has established itself as a leader in the mutual funds industry, adhering to a philosophy of fairness and cost-efficiency for investors. The firm's competitive strategy revolves around minimizing shareholder costs and maximizing fund returns. Vanguard's innovative approach, including the introduction of index mutual funds, has solidified its position as a cost-effective investment solution. With a diverse range of products and services, Vanguard caters to a vast clientele, managing an equity of $4,216.75 trillion across 4,552 stocks. The firm's top sectors include Technology and Healthcare, with leading holdings such as Apple Inc (NASDAQ:AAPL) and Amazon.com Inc (NASDAQ:AMZN).

Insmed Inc at a Glance

Insmed Inc, a USA-based biopharmaceutical company, has been on the forefront of developing treatments for serious and rare diseases since its IPO on June 1, 2000. Its flagship product, ARIKAYCE, is a significant advancement in the treatment of Mycobacterium Avium Complex lung disease. Despite a market capitalization of $3.51 billion and a stock price of $24.565, Insmed operates at a loss, as indicated by a PE Percentage of 0.00. GuruFocus deems the stock as modestly undervalued with a GF Value of $27.57 and a price to GF Value ratio of 0.89. The stock has experienced a year-to-date increase of 28.08%, although it has seen a decline of 1.98% since the reported transaction.

Impact of Vanguard's Trade on Its Portfolio

The recent acquisition by Vanguard Group Inc has a minimal immediate impact on its vast portfolio, given the 0.01% position size. However, the 10.07% holding in Insmed's outstanding shares is a testament to Vanguard's confidence in the biopharmaceutical firm's potential. This trade aligns with Vanguard's investment philosophy, which includes a significant focus on the healthcare sector, and may be indicative of a long-term strategic position.

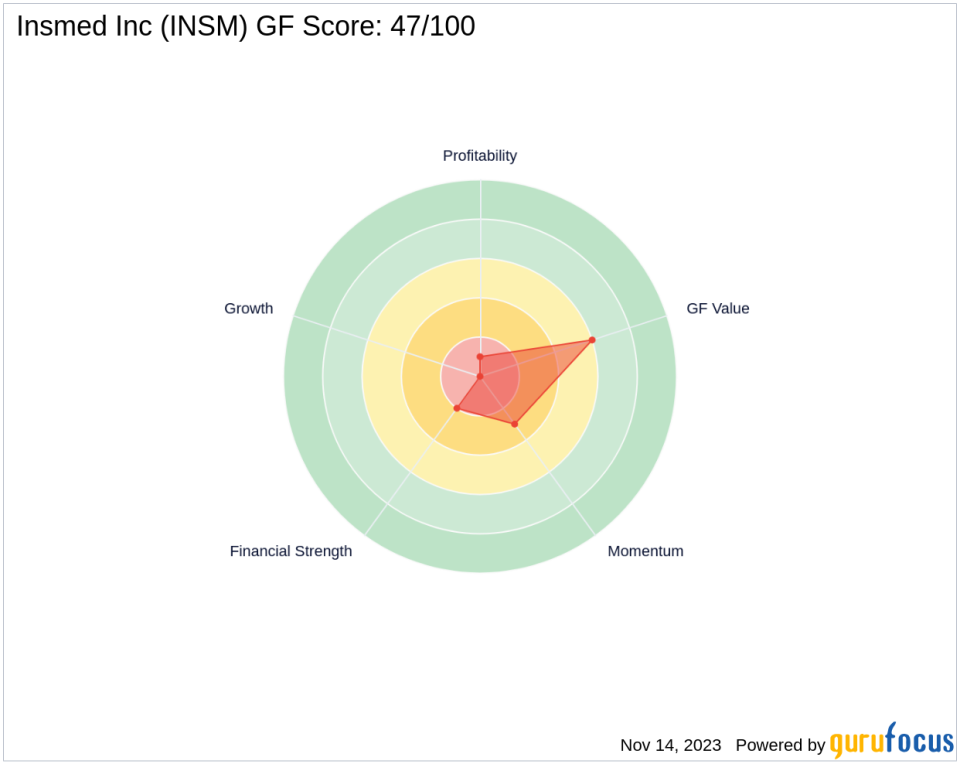

Market Context and Insmed's Valuation

Insmed Inc's current market valuation and stock price dynamics offer an interesting context for Vanguard's investment. The company's modestly undervalued status according to GuruFocus metrics, combined with a GF Value Rank of 6/10, suggests a potential for growth. However, the stock's negative Gain Percent since the transaction and a significant drop since its IPO highlight the volatility and risks inherent in the biotechnology industry.

Financial and Growth Prospects of Insmed

Insmed's financial health and growth prospects are areas of concern, with a Financial Strength rank of 2/10 and a Profitability Rank of 1/10. The company's GF Score of 47/100 indicates poor future performance potential, and its Piotroski F-Score of 4 suggests average financial health. These metrics, combined with a negative Altman Z score, underscore the speculative nature of this investment.

Biotechnology Sector and Industry Analysis

Vanguard's investment in Insmed Inc reflects its broader interest in the healthcare sector, which is one of its top investment areas. The biotechnology industry, where Insmed operates, is known for its high-risk, high-reward nature, and Vanguard's stake in the company indicates a calculated bet on the industry's future.

Comparative Positioning Among Major Investors

While Vanguard Group Inc has increased its holdings in Insmed Inc, it is essential to compare its position with other major investors. The largest guru holding shares in Insmed is Leucadia National, although specific share percentage data is not provided. Vanguard's 10.07% stake in Insmed places it as a significant investor, potentially influencing the company's strategic direction and reflecting Vanguard's confidence in Insmed's prospects.

In conclusion, Vanguard Group Inc's recent trade in Insmed Inc shares is a strategic addition to its portfolio, aligning with its investment philosophy and sector focus. While the financial and growth metrics of Insmed present a mixed picture, Vanguard's move may be seen as a long-term play in the biotechnology space, which is known for its potential for significant returns.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.