Vanguard Health Care Fund Buys Danaher, CVS Health, Adds to Allergan

- By Tiziano Frateschi

The Vanguard Health Care Fund (Trades, Portfolio) increased many holdings and established several other positions in the fourth quarter. The fund's nine largest trades are as follows:

Warning! GuruFocus has detected 4 Warning Sign with DHR. Click here to check it out.

The intrinsic value of DHR

The fund established a 3,798,100-share stake in Danaher Corp. (DHR), giving it 0.77% portfolio space.

The company, which manufactures industrial and consumer products, has a market cap of $70.55 billion and an enterprise value of $80.82 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity (ROE) of 9.93% and return on assets (ROA) of 5.33% are outperforming 67% of companies in the Global Diagnostics and Research industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.06 is below the industry median of 3.13.

The company's largest shareholder among the gurus is Dodge & Cox with 0.74% of outstanding shares, followed by Daniel Loeb (Trades, Portfolio) with 0.47%, Steven Cohen (Trades, Portfolio) with 0.37% and Chuck Akre (Trades, Portfolio) with 0.24%.

The fund increased its Allergan PLC (AGN) position by 16.57%, impacting the portfolio by 0.67%.

The specialty pharmaceutical company has a market cap of $59.95 billion and an enterprise value of $89.79 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The ROE of -9.71% and ROA of -5.63% are outperforming 74% of companies in the Global Drug Manufacturers - Specialty and Generic industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.18 is below the industry median of 2.89.

Seth Klarman (Trades, Portfolio) is another notable guru shareholder of the company with 0.89% of outstanding shares, followed by David Tepper (Trades, Portfolio) with 0.57% and Pioneer Investments (Trades, Portfolio) with 0.41%.

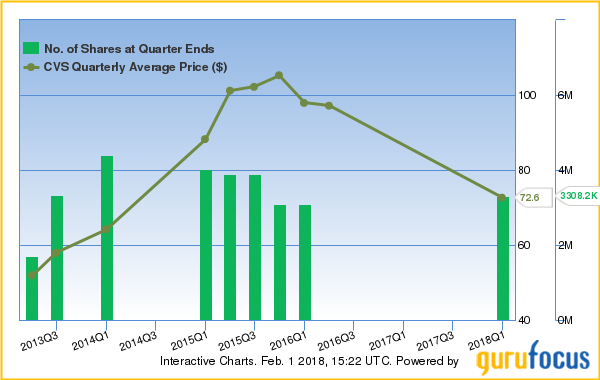

Vanguard bought 3,308,218 shares of CVS Health Corp. (CVS), expanding the portfolio 0.52%.

The drugstore chain has a market cap of $79.72 billion and an enterprise value of $102.95 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The ROA of 14.34% and ROA of 5.40% are outperforming 56% of companies in the Global Health Care Plans industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.10 is below the industry median of 1.51.

With 1.6% of outstanding shares, Barrow, Hanley, Mewhinney & Strauss is the company's largest guru shareholder, followed by Pioneer Investments with 0.57% and PRIMECAP Management (Trades, Portfolio) with 0.33%.

The fund established a position in IQVIA Holdings Inc. (IQV), buying 1,602,521 shares. The portfolio was expanded by 0.34%.

The information and technology-enabled health care service provider has a market cap of $21.25 billion and an enterprise value of $30.1 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The ROE of 0.90% and ROA of 0.30% are outperforming 54% of companies in the Global Diagnostics and Research industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.12 is below the industry median of 3.13.

Another notable guru shareholder of the company is Ken Fisher (Trades, Portfolio) with 0.07% of outstanding shares.

The fund boosted its stake in Tesaro Inc. (TSRO) by 88.94%. The trade had an impact of 0.25% on the portfolio.

The biopharmaceutical company has a market cap of $3.67 billion and an enterprise value of $3.29 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The ROE of -95.23% and ROA of -64% are underperforming 81% of companies in the Global Biotechnology industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 3.71 is below the industry median of 51.38.

Pioneer Investments is the company's largest guru shareholder with 0.19% of outstanding shares, followed by Jim Simons (Trades, Portfolio) with 0.11%.

The fund's holding of Eisai Co. Ltd. (TSE:4523), a Japanese drug manufacturer, was increased by 11.17%, expanding the portfolio by 0.21%.

The Teva Pharmaceutical Industries Ltd. (TEVA) position was increased by 15.34%, impacting the portfolio by 0.17%.

The Isreal-based pharmaceutical company has a market cap of $21.14 billion and an enterprise value of $59.3 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The ROE of -18.73% and ROA of -6.26% are underperforming 79% of companies in the Global Drug Manufacturers - Specialty and Generic industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.02 is below the industry median of 2.89.

Another notable guru shareholder is David Abrams (Trades, Portfolio) with 2.38% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 0.52%, John Paulson (Trades, Portfolio) with 9.27% and George Soros (Trades, Portfolio) with 0.13%.

The fund opened a position in Nektar Therapeutics Inc. (NKTR), giving it 0.17% portfolio space.

The biopharmaceutical company has a market cap of $14.17 billion and an enterprise value of $14.06 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The ROE of -344.32% and ROA of -20.36% are underperforming 100% of companies in the Global Biotechnology industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 1.43 is below the industry median 51.38.

With 14.7% of outstanding shares, PRIMECAP Management is the company's largest shareholder among the gurus, followed by Stanley Druckenmiller (Trades, Portfolio) with 0.74%.

The Health Care Fund established a 546,500-share position in Alexandria Real Estate Equities Inc. (ARE), expanding the portfolio by 0.16%.

The real estate investment trust has a market cap of $13.13 billion and an enterprise value of $18.39 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The ROE of 2.76% and ROA of 1.51% are underperforming 85% of companies in the Global REIT - Office industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.05 is below the industry median of 0.06.

The company's largest guru shareholder is Ron Baron (Trades, Portfolio) with 1.05% of outstanding shares, followed by Simons with 0.28% and Pioneer Investments with 0.23%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with DHR. Click here to check it out.

The intrinsic value of DHR