The Vanguard Health Care Fund's Top 5 Trades of the 4th Quarter

- By Graham Griffin

The Vanguard Health Care Fund (Trades, Portfolio) has released its portfolio for the fourth quarter. Major trades include selling out of Medtronic PLC (NYSE:MDT), Merck & Co Inc. (NYSE:MRK) and Roche Holding AG (XSWX:ROG). The quarter also saw the fund's position in Vertex Pharmaceuticals Inc. (NASDAQ:VRTX) boosted and the Bristol-Myers Squibb Co. (NYSE:BMY) holding reduced.

The fund seeks long-term capital appreciation by investing in health care stocks around the world. Stocks are picked based upon high-quality balance sheets, strong management teams and the implementation of new products that can generate high levels of revenue and earnings growth.

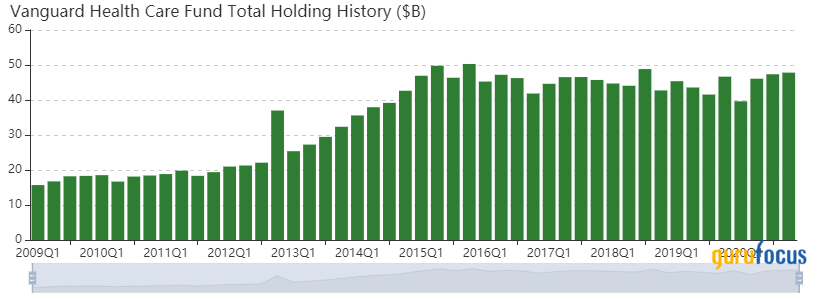

Portfolio overview

At the end of the fourth quarter, the fund's portfolio contained 94 stocks, with 12 new holdings. It was valued at $47.82 billion and has seen a turnover rate of 4%. Top holdings include UnitedHealth Group Inc. (NYSE:UNH), Pfizer Inc. (NYSE:PFE), AstraZeneca PLC (LSE:AZN), Eli Lilly and Co. (NYSE:LLY) and Novartis AG (XSWX:NOVN).

The fund is almost entirely invested in the health care sector (99.83%), which is accompanied by a small investment in the real estate (0.16%) sector.

Medtronic

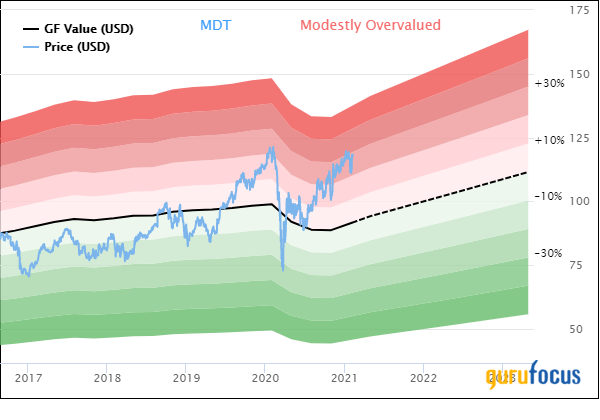

The fund's Medtronic (NYSE:MDT) holding lasted over a decade before being completely sold during the fourth quarter. The fund sold 6.04 million shares that traded at an average price of $110.21 during the quarter. Overall, the sale had an impact on the portfolio of -1.33% and GuruFocus estimates the fund gained 64.20% on the holding.

One of the largest medical device companies, Medtronic develops and manufactures therapeutic medical devices for chronic diseases. Its portfolio includes pacemakers, defibrillators, heart valves, stents, insulin pumps, spinal fixation devices, neurovascular products and surgical tools. The company markets its products to health care institutions and physicians in the United States and overseas. Foreign sales account for almost 50% of the company's total sales.

On Feb. 10, the stock was trading at $117.83 per share with a market cap of $158.53 billion. According to the GF Value Line, the stock is trading at a modestly overvalued rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 3 out of 10. There are currently two severe warning signs issued for a declining operating margin and a low Piotroski F-Score that implies poor business operations. Cash flows have recovered after struggling in 2018 to easily cover dividend payouts.

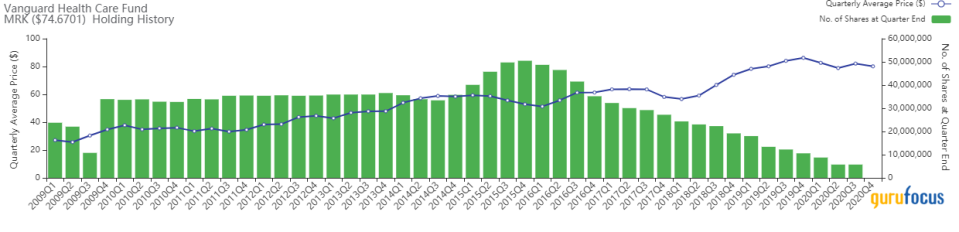

Merck

Vanguard's Merck & Co. (NYSE:MRK) holding was also sold out during the quarter. The 5.73 million shares that were sold traded at an average price of $80.13 during the quarter. GuruFocus estimates that Vanguard gained a total of 57.81% on the holding and the sale had an overall impact on the portfolio of -1%.

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent hepatitis B and pediatric diseases as well as HPV and shingles. Additionally, Merck sells animal health-related drugs. From a geographical perspective, close to 40% of the company's sales are generated in the United States.

As of Feb. 10, the stock was trading at $74.78 per share with a market cap of $189.07 billion. The GF Value Line shows the shares trading at a modestly undervalued rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 6 out of 10. There are currently no severe warning signs issued for the company. The strong profitability rank is propped up by operating and net margins that are better than 80% of the industry.

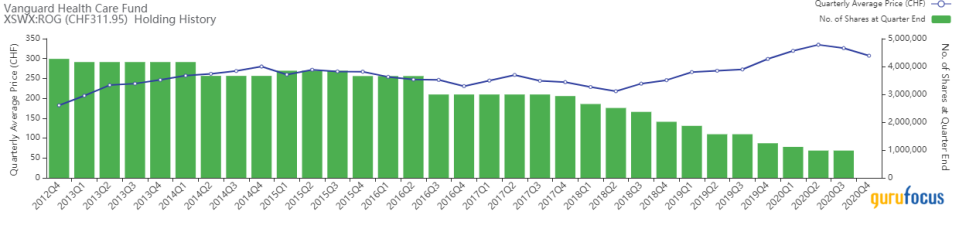

Roche Holding

Roche Holding AG (XSWX:ROG) was also cut from the fund's portfolio. The holding was consistently reduced over the last five years before the remaining 979,798 shares were sold. During the quarter, the shares traded at an average price of 307.16 swiss francs ($344.97). The sale impacted the portfolio by -0.71% and GuruFocus estimates the total gain at 45.29%.

The stock was trading at 311.95 swiss francs per share with a market cap of 266.98 billion swiss francs. The stock is trading at fair value according to the GF Value Line.

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 5 out of 10. There are currently no severe warning signs issued for the company. The company has a long-standing history of solid returns on invested capital that have allowed the company to increase value as it grows.

Vertex Pharmaceuticals

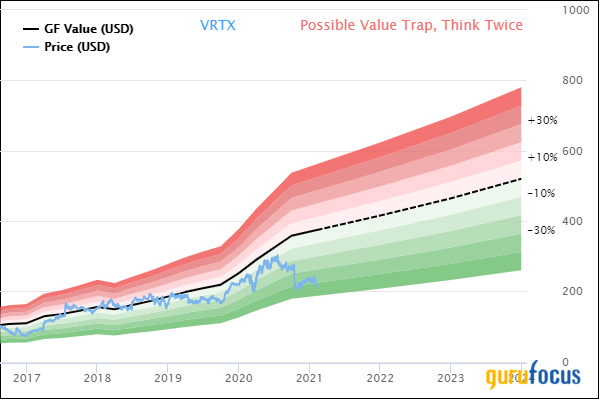

The largest addition to the portfolio came from Vertex Pharmaceuticals (NASDAQ:VRTX). The holding was boosted by 32.06% with the purchase of 1.01 million shares. During the quarter, the shares traded at an average price of $228.74. Overall, the purchase had an impact on the portfolio of 0.50% and GuruFocus estimates Vanguard had gained 107.64% on the holding.

Vertex Pharmaceuticals discovers and develops small-molecule drugs for the treatment of serious diseases. Its key drugs are Kalydeco, Orkambi, Symdeko and Trikafta for cystic fibrosis, where Vertex therapies remain the standard of care globally. Vertex's pipeline also includes therapies for cancer, pain, inflammatory diseases, influenza and other rare diseases.

On Feb. 10, the stock was trading at $212.12 with a market cap of $55.37 billion. According to the GF Value Line, the stock is a possible value trap and investors should think twice before purchasing shares.

GuruFocus gives the company a financial strength rating of 8 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 10 out of 10. There are currently no severe warning signs issued for the company. The company's Altman Z-Score of 12.54 shows the company well into the safe zone and the company's cash-to-debt ratio of 11.45 ranks it above 51.85% of the industry.

Bristol-Myers Squibb

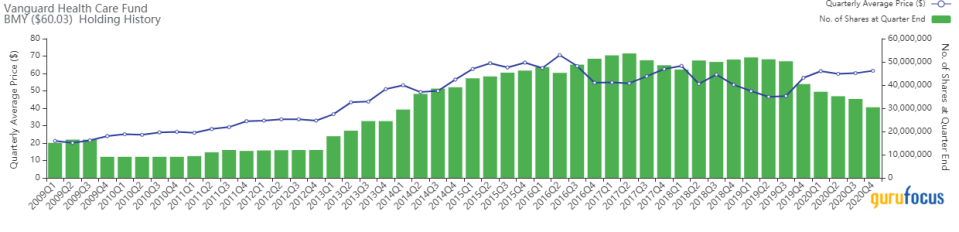

Rounding out the top five trades for the fund is the reduction of the holding in Bristol-Myers Squibb (NYSE:BMY). The holding was reduced by 10.53% with the sale of 3.58 million shares. The shares traded at an average price of $61.52 during the quarter. GuruFocus estimates the holding has gained 28.23% and the sale had an overall impact of -0.46%.

Bristol-Myers Squibb discovers, develops and markets drugs for various therapeutic areas, such as cardiovascular, oncology and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is leading in drug development. Unlike some of its more diversified peers, Bristol has exited several non pharmaceutical businesses to focus on branded specialty drugs, which tend to support strong pricing power.

As of Feb. 10, the stock was trading at $60 per share with a market cap of $125.59 billoin. The GF Value Line gives the stock a modestly undervalued rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 9 out of 10. There are currently four severe warning signs issued, including new long-term debt, assets growing faster than revenue and declining gross margin percentage. The company has consistently increased revenue since 2015, but revenue took a fall in 2020.

Disclosure: Author owns no stocks mentioned.

Read more here:

Primecap Management's Top Trades of the 4th Quarter

Mario Gabelli's Top Trades of the 4th Quarter

Larry Robbins' Firm Sells More Tenet Healthcare Shares

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.