Varex Imaging Corp Reports Mixed Q1 Results; Revenue Declines While Industrial Segment Grows

Revenue: $190 million, down 8% year-over-year.

GAAP Gross Margin: 30%, Non-GAAP Gross Margin: 31%.

GAAP Operating Margin: 2%, Non-GAAP Operating Margin: 5%.

GAAP Net Loss: $0.01 per diluted share, Non-GAAP Net Earnings: $0.06 per diluted share.

Cash Flow: Operations generated $10 million.

Outlook: Q2 revenues expected to be between $195 million and $215 million, with Non-GAAP EPS between $0.10 and $0.30.

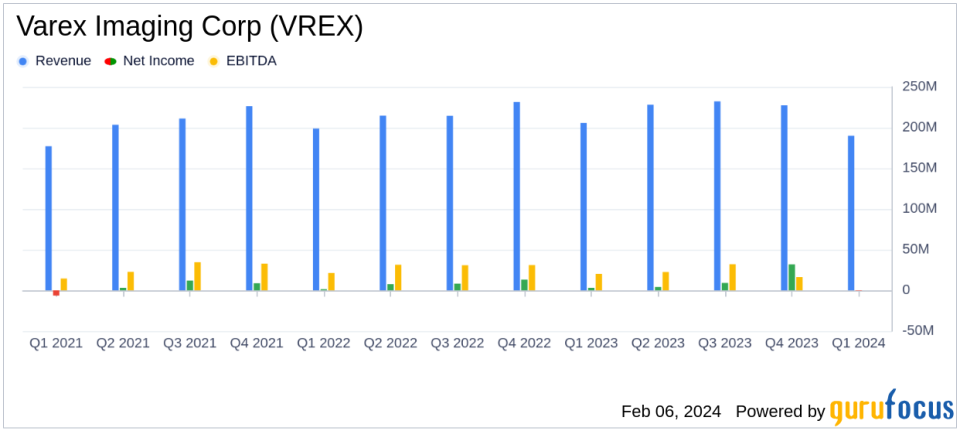

On February 6, 2024, Varex Imaging Corp (NASDAQ:VREX) released its 8-K filing, detailing the financial outcomes for the first quarter of the fiscal year 2024. The company, a prominent innovator in X-ray imaging components, experienced a revenue decrease to $190 million, which aligns with the mid-point of their guidance but represents an 8% decline from the previous year.

Performance Overview

The Medical segment, which is Varex's primary revenue source, saw a 13% decrease in revenue year-over-year, dropping to $140 million. Conversely, the Industrial segment displayed resilience with a 10% increase to $50 million. The company's GAAP gross margin stood at 30%, with a slight increase in the non-GAAP gross margin to 31%. Operating margins on a GAAP basis were at 2%, while non-GAAP margins were higher at 5%. The GAAP net loss per diluted share was reported at $0.01, with non-GAAP net earnings at $0.06 per diluted share, a significant decrease from $0.21 in the same quarter of the previous year.

Financial Health and Future Outlook

Varex's cash flow from operations was $10 million, attributed to stable working capital management. The company's cash reserves, including cash equivalents, marketable securities, and CDs, remained steady at $195 million. Looking ahead, Varex anticipates revenues for the second quarter of fiscal year 2024 to be between $195 million and $215 million, with non-GAAP net earnings per diluted share expected to range from $0.10 to $0.30.

The company's balance sheet reflects a slight decrease in total assets from $1,249.6 million to $1,242.3 million. Current assets decreased marginally, while long-term debt remained relatively stable. Varex's stockholders' equity saw a minor increase, indicating a stable financial position despite the challenges faced in the quarter.

"Revenue of $190 million in the first quarter of fiscal 2024, was at the mid-point of our guidance, however unfavorable mix in both the Medical and Industrial segments impacted profitability," said Sunny Sanyal, Chief Executive Officer of Varex.

The company's performance is crucial as it reflects the health of the Medical Devices & Instruments industry, which is sensitive to economic cycles, regulatory changes, and technological advancements. Varex's ability to navigate these challenges and capitalize on growth in the Industrial segment is vital for its long-term success.

Key Financial Metrics

Important metrics from the income statement include a net loss of $0.4 million, compared to a net income of $3.2 million in the previous year. The balance sheet shows a solid liquidity position with $141.3 million in cash and cash equivalents. The cash flow statement indicates a positive cash flow from operations, which is essential for sustaining operations and investing in future growth.

These metrics are important as they provide insights into the company's profitability, liquidity, and cash management, which are critical for investors and stakeholders in assessing the company's financial health and operational efficiency.

In conclusion, Varex Imaging Corp (NASDAQ:VREX) faces a challenging environment with a decline in revenue and profitability in its Medical segment, although the Industrial segment shows growth potential. The company's financial stability is maintained, and the outlook for the next quarter is cautiously optimistic. Investors and potential GuruFocus.com members should monitor Varex's performance closely, as it navigates through market fluctuations and strives for a rebound in profitability.

Explore the complete 8-K earnings release (here) from Varex Imaging Corp for further details.

This article first appeared on GuruFocus.