VAT Group (VTX:VACN) Is Paying Out A Larger Dividend Than Last Year

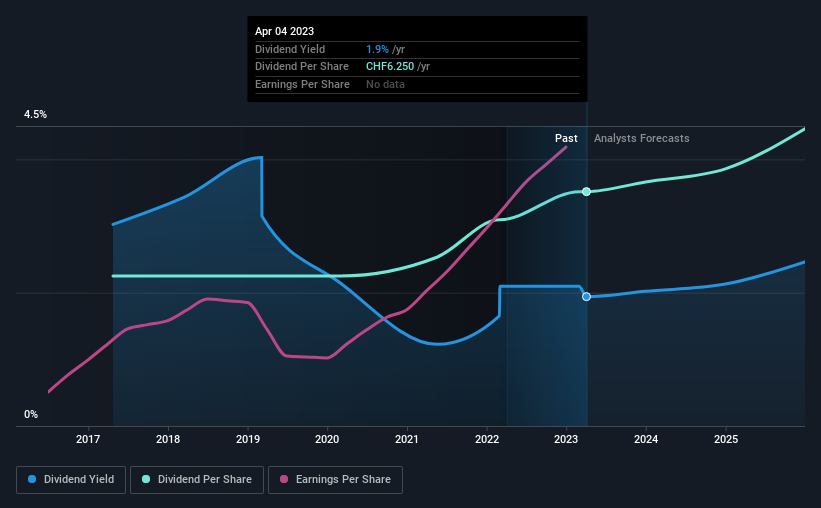

VAT Group AG (VTX:VACN) will increase its dividend from last year's comparable payment on the 24th of May to CHF6.25. The payment will take the dividend yield to 1.9%, which is in line with the average for the industry.

View our latest analysis for VAT Group

VAT Group's Payment Has Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last dividend was quite comfortably covered by VAT Group's earnings, but it was a bit tighter on the cash flow front. The company is clearly earning enough to pay this type of dividend, but it is definitely focused on returning cash to shareholders, rather than growing the business.

Over the next year, EPS is forecast to expand by 0.3%. If the dividend continues along recent trends, we estimate the payout ratio will be 65%, which is in the range that makes us comfortable with the sustainability of the dividend.

VAT Group Is Still Building Its Track Record

VAT Group's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2017, the annual payment back then was CHF4.00, compared to the most recent full-year payment of CHF6.25. This means that it has been growing its distributions at 7.7% per annum over that time. Investors will likely want to see a longer track record of growth before making decision to add this to their income portfolio.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see that VAT Group has been growing its earnings per share at 22% a year over the past five years. The company doesn't have any problems growing, despite returning a lot of capital to shareholders, which is a very nice combination for a dividend stock to have.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think VAT Group's payments are rock solid. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments VAT Group has been making. We don't think VAT Group is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for VAT Group that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here