Vector Group Ltd (VGR) Reports Mixed 2023 Financial Results Amid Market Challenges

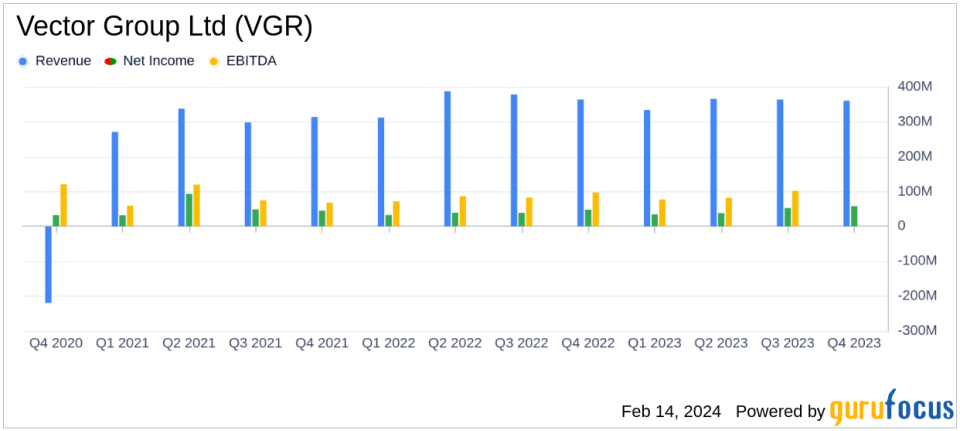

Consolidated Revenues: Slight decrease to $1.42 billion for the full year, down 1.2% from the previous year.

Operating Income: Increased to $91.6 million in Q4, up 2.6% year-over-year, but annual operating income fell 3.2%.

Net Income: Improved to $183.5 million for the year, representing a $1.16 per diluted share, an increase from $158.7 million in the prior year.

Adjusted EBITDA: Rose to $363.2 million for the year, a 3.1% increase from the previous year.

Tobacco Segment Market Share: Wholesale and retail market share increased to 5.5% and 5.8%, respectively, for the full year.

Dividends: Vector Group maintained its quarterly cash dividend, returning a total of $127.0 million to stockholders at $0.20 per common share.

Vector Group Ltd (NYSE:VGR) released its 8-K filing on February 14, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for its tobacco products and real estate investments through subsidiaries Liggett Group, Vector Tobacco, and New Valley, faced a slight revenue decline but showed resilience in its operating income and net income metrics.

Performance Overview

Vector Group's consolidated revenues for the full year 2023 were $1.42 billion, a modest decrease of 1.2% compared to the prior year. The tobacco segment, which contributes the majority of the company's revenue, saw a negligible decline of 0.1% in revenues, amounting to $1.42 billion. Despite the overall dip in revenues, Vector Group's operating income for Q4 2023 increased by 2.6% to $91.6 million, although the annual operating income saw a 3.2% decrease.

The company's net income for the year ended December 31, 2023, was $183.5 million, or $1.16 per diluted common share, an improvement from $158.7 million, or $1.01 per diluted common share, for the previous year. Adjusted EBITDA for the year also increased by 3.1% to $363.2 million, indicating a solid operational performance.

Strategic Highlights and Challenges

Vector Group's tobacco segment, particularly the Montego brand, strengthened its market position with an increase in both wholesale and retail market shares. The wholesale market share rose to 5.5% from 5.4%, and the retail market share increased to 5.8% from 5.5% in the prior year. This growth is significant in the competitive tobacco industry, where market share gains are crucial for long-term profitability.

However, the company faced challenges as tobacco segment wholesale shipments declined by 6.2% compared to the previous year, reflecting an industry-wide trend of declining cigarette shipments. Despite this, Vector Group's decline was less than the industry's overall decline, suggesting that the company is managing to navigate the challenging market conditions better than some of its competitors.

Financial Stability and Shareholder Returns

Vector Group maintained significant liquidity at the end of 2023, with cash and cash equivalents of $268.6 million. The company continued its tradition of returning value to shareholders, paying out a total of $127.0 million in dividends at a quarterly rate of $0.20 per common share.

"Vector Group delivered a solid performance in 2023 amid a dynamic operating environment, as the successful execution of our targeted investment strategy enabled Montegos continued growth as the largest discount brand in the United States," said Howard M. Lorber, President and Chief Executive Officer of Vector Group Ltd. "The Company is well positioned in 2024 and we are confident we have the right strategy and team in place to continue optimizing long-term profit and driving value for our stockholders."

Conclusion

Vector Group's mixed financial results for 2023 reflect the resilience of its tobacco segment in a challenging market, underscored by the growth of the Montego brand. The company's increased operating income and net income, along with its commitment to shareholder dividends, demonstrate its strategic focus on maintaining financial stability and delivering shareholder value. As Vector Group navigates the evolving landscape of the tobacco industry, its strategic investments and market positioning will be key factors in its continued success.

For a more detailed analysis of Vector Group Ltd's financial performance and to stay updated on the latest investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Vector Group Ltd for further details.

This article first appeared on GuruFocus.