Veeco Instruments Inc (VECO) Reports Solid Q4 and Fiscal Year 2023 Financial Results

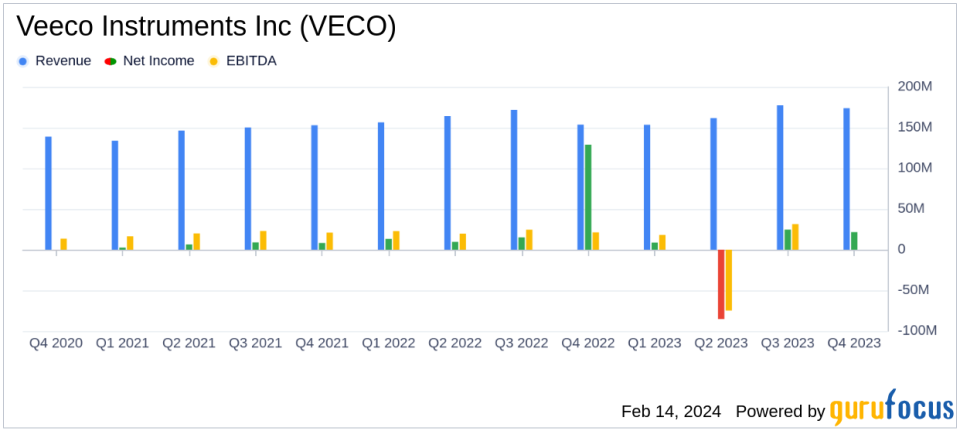

Revenue: Q4 revenue increased to $173.9 million from $153.8 million in Q4 2022.

Net Income: GAAP net income for Q4 stood at $21.6 million, a significant shift from the net loss of $(30.4) million for the full year.

Earnings Per Share (EPS): Q4 GAAP diluted EPS was $0.37, and Non-GAAP diluted EPS was $0.51.

Operating Income: Non-GAAP operating income for the full year increased to $109.6 million from $99.8 million in 2022.

Balance Sheet Strength: Cash, cash equivalents, and short-term investments totaled $305.4 million as of December 31, 2023.

Technological Milestones: Shipped evaluation systems for Nanosecond Annealing and Ion Beam Deposition technologies.

On February 14, 2024, Veeco Instruments Inc (NASDAQ:VECO) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the fiscal year ended December 31, 2023. The company, a key player in the semiconductor process equipment industry, reported a notable increase in revenue and a return to profitability in the fourth quarter, contrasting with the full-year net loss.

Veeco Instruments Inc is a United States-based company that designs, develops, and manufactures thin-film process equipment, which is essential for producing various electronic devices. The company's products are used across multiple markets, including lighting, display, and power electronics, which generate more than half of its revenue. Veeco operates globally, with significant sales coming from outside the United States.

Fiscal Performance and Strategic Achievements

The fourth quarter saw Veeco's revenue climb to $173.9 million, up from $153.8 million in the same quarter of the previous year. This increase reflects the company's strong position in the semiconductor industry, which continues to demand advanced manufacturing solutions. The full-year revenue also saw an uptick, reaching $666.4 million compared to $646.1 million in 2022.

Net income for the fourth quarter was reported at $21.6 million, a stark contrast to the full-year net loss of $(30.4) million. This turnaround can be attributed to the company's strategic focus on its Semiconductor business, which outperformed the overall Wafer Fabrication Equipment (WFE) growth for the third consecutive year. Non-GAAP operating income for the year improved to $109.6 million from $99.8 million in the prior year, indicating enhanced profitability and operational efficiency.

Veeco's CEO, Bill Miller, Ph.D., highlighted the company's technological advancements, including the shipment of evaluation systems for Nanosecond Annealing and Ion Beam Deposition technologies. These developments are critical for fabricating devices that offer higher performance and reduced power consumption, positioning Veeco at the forefront of semiconductor innovation.

"2023 was a critical year for Veeco, highlighted by our Semiconductor business outperforming WFE growth for the 3rd consecutive year," commented Bill Miller, Ph.D., Veecos Chief Executive Officer. "Im proud to say we successfully grew the business, improved profitability, and most importantly, laid the groundwork for future growth."

Financial Health and Outlook

The balance sheet reflects a strong financial position, with cash, cash equivalents, and short-term investments totaling $305.4 million as of December 31, 2023. This liquidity is crucial for Veeco's ongoing investments in research and development, which are essential for maintaining its competitive edge in the semiconductor equipment market.

Veeco's guidance for the first quarter of 2024 suggests a continued focus on growth and profitability. The company's strategic initiatives, including its transformation efforts and new product development, are expected to drive performance in the upcoming periods.

In summary, Veeco Instruments Inc (NASDAQ:VECO) has demonstrated a solid financial performance in the fourth quarter of 2023, with significant improvements in revenue and profitability. The company's strategic focus on technological innovation and operational efficiency has positioned it well for continued success in the dynamic semiconductor industry.

For a detailed analysis of Veeco's financial results and future outlook, investors and interested parties can access the full earnings call transcript and accompanying slide presentation on Veeco's investor relations website.

Explore the complete 8-K earnings release (here) from Veeco Instruments Inc for further details.

This article first appeared on GuruFocus.