Veeco Instruments (VECO): A Closer Look at Its Valuation Status

Veeco Instruments Inc (NASDAQ:VECO) has experienced a daily loss of -4.83% and a 3-month gain of 8.69%. With a current Earnings Per Share (EPS) of $0.83, this article delves into the question: is the stock modestly overvalued? This valuation analysis aims to provide clarity and insight into the intrinsic value of Veeco Instruments (NASDAQ:VECO).

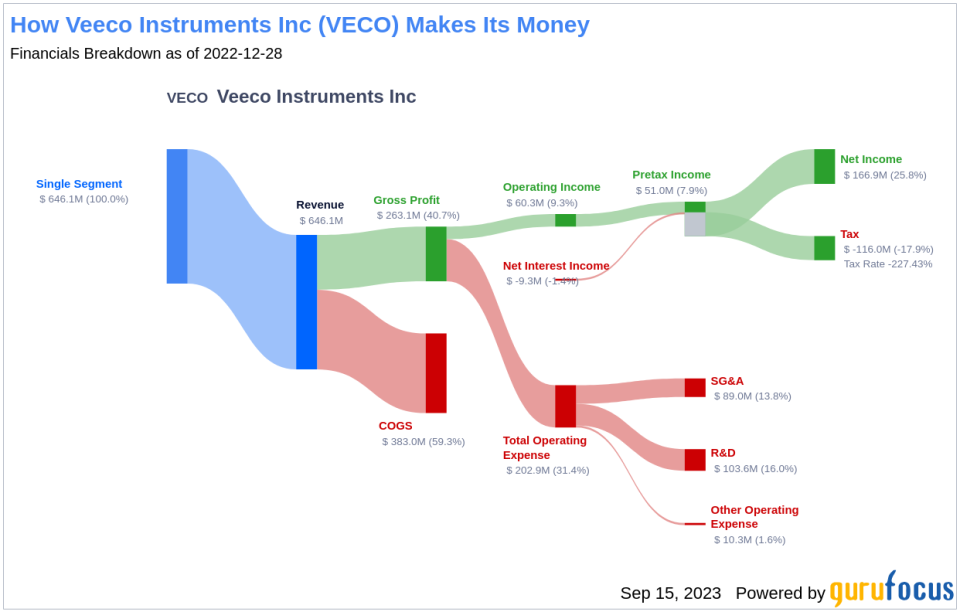

Company Overview

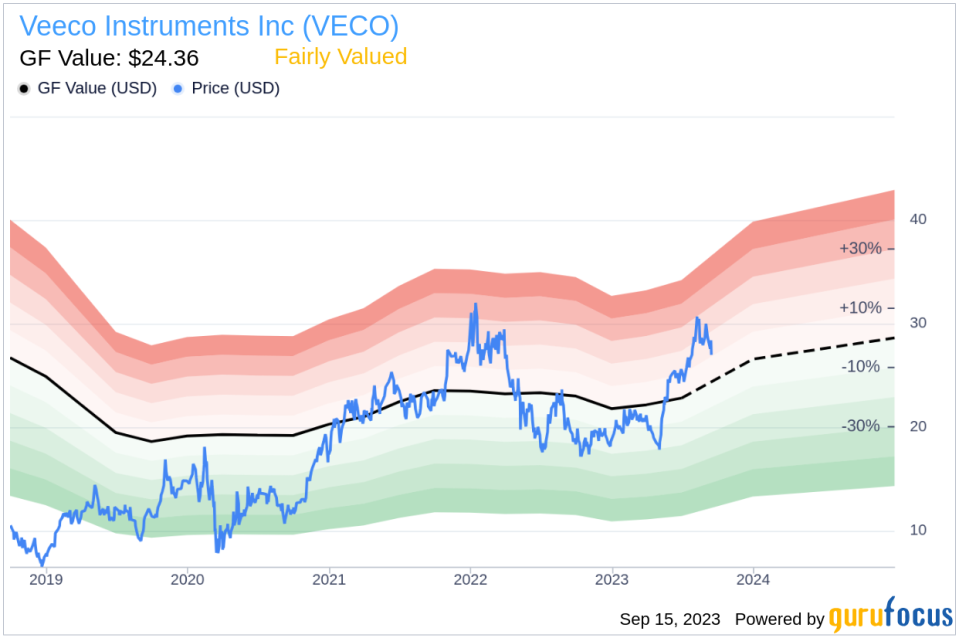

Veeco Instruments Inc is a U.S.-based company engaged in designing, developing, and manufacturing thin-film process equipment, mainly used to produce electronic devices. The company's products and services are offered in the United States, China, Europe, the Middle East, Africa, and the rest of the world, with overseas markets contributing the majority of total revenue. The company's stock price currently stands at $27, while the GF Value, an estimation of fair value, is $24.36. This discrepancy suggests that the stock might be modestly overvalued.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page provides a snapshot of the stock's ideal fair trading value.

According to our valuation method, the stock of Veeco Instruments (NASDAQ:VECO) is considered modestly overvalued. The long-term return of its stock is likely to be lower than its business growth due to its relative overvaluation.

Link: These companies may deliver higher future returns at reduced risk.

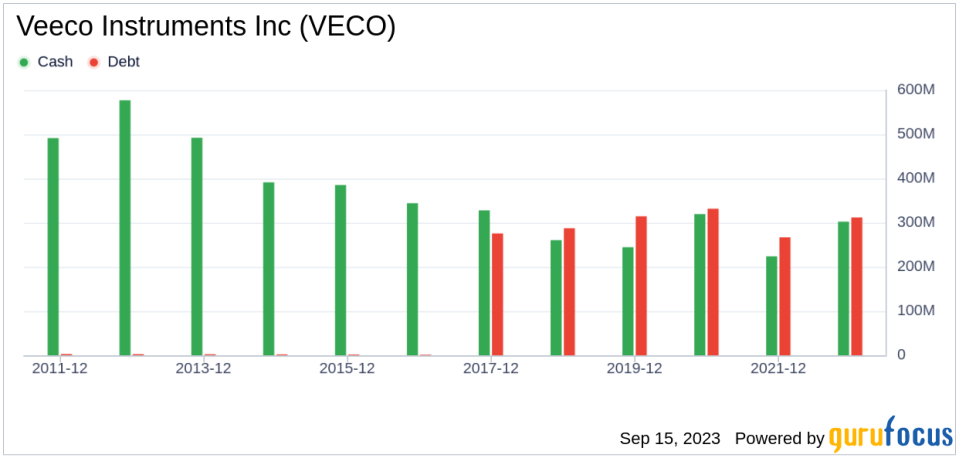

Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Therefore, it's crucial to carefully review a company's financial strength before deciding to buy its stock. Veeco Instruments has a cash-to-debt ratio of 0.92, which is lower than 67.44% of the companies in the Semiconductors industry. The overall financial strength of Veeco Instruments is ranked 6 out of 10, indicating fair financial strength.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. Veeco Instruments has been profitable 2 over the past 10 years. Over the past twelve months, the company had a revenue of $640.90 Mil and Earnings Per Share (EPS) of $0.83. Its operating margin is 8.5%, which ranks better than 55.08% of 944 companies in the Semiconductors industry. Overall, the profitability of Veeco Instruments is ranked 3 out of 10, indicating poor profitability.

One of the most important factors in the valuation of a company is growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of Veeco Instruments is 3.7%, which ranks worse than 70.31% of 869 companies in the Semiconductors industry. The 3-year average EBITDA growth is 0%, which ranks worse than 0% of 772 companies in the Semiconductors industry.

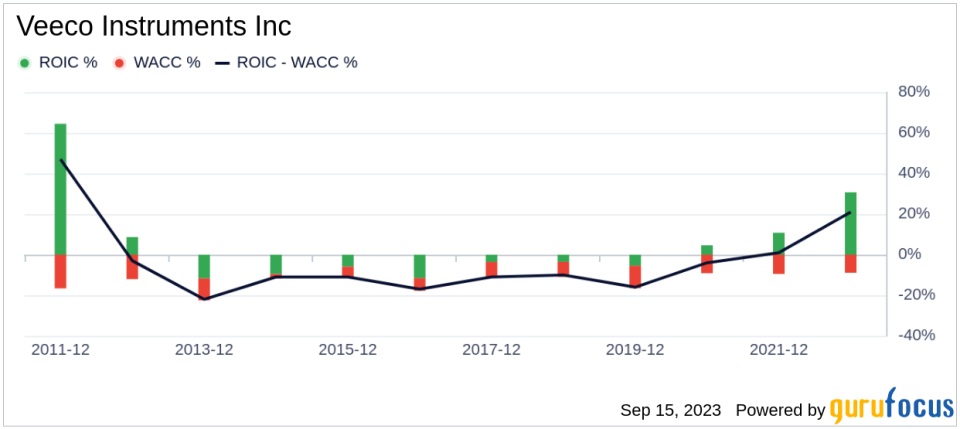

ROIC vs WACC

One can also evaluate a company's profitability by comparing its return on invested capital (ROIC) to its weighted average cost of capital (WACC). Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the return on invested capital exceeds the weighted average cost of capital, the company is likely creating value for its shareholders. During the past 12 months, Veeco Instruments's ROIC is -10.68 while its WACC came in at 9.87.

Conclusion

Overall, the stock of Veeco Instruments (NASDAQ:VECO) is believed to be modestly overvalued. The company's financial condition is fair, and its profitability is poor. Its growth ranks worse than 0% of 772 companies in the Semiconductors industry. To learn more about Veeco Instruments stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.