Veeva Systems (VEEV) Beats on Q3 Earnings, Revises FY24 Outlook

Veeva Systems, Inc. VEEV reported adjusted earnings per share (EPS) of $1.34 in the third quarter of fiscal 2024, reflecting an uptick of 18.6% from the year-ago EPS of $1.13. Adjusted EPS surpassed the Zacks Consensus Estimate by 4.7%.

GAAP EPS in the fiscal third quarter was 83 cents, up 23.9% from the year-ago period’s 67 cents.

Revenues

For the quarter, the company’s revenues totaled $616.5 million, outpacing the Zacks Consensus Estimate by 0.1%. On a year-over-year basis, the top line improved by 11.6%.

The fiscal third quarter top line was driven by Veeva Systems’ robust segmental performances.

Segmental Details

Veeva Systems derives revenues from two operating segments — Subscription services; and Professional services and other.

In the fiscal third quarter, Subscription services revenues improved 12.1% from the year-ago quarter to $494.9 million. Our projection for fiscal third-quarter revenues was $493.2 million.

Professional services and other revenues were up 9.8% year over year to $121.6 million, primarily resulting from continued strength in Research and Development (R&D) Solutions services and Veeva Business Consulting. Our projection for fiscal third-quarter revenues was $122.4 million.

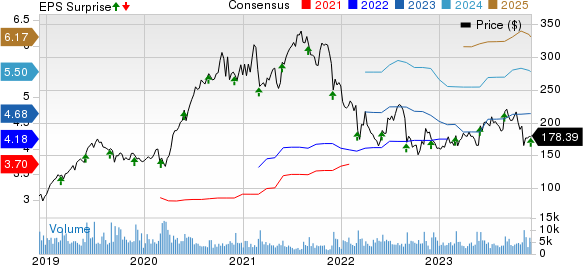

Veeva Systems Inc. Price, Consensus and EPS Surprise

Veeva Systems Inc. price-consensus-eps-surprise-chart | Veeva Systems Inc. Quote

Margin Details

In the quarter under review, Veeva Systems’ gross profit improved 12.6% to $448.8 million. The gross margin expanded 67 basis points (bps) to 72.8%.

We had projected 70.7% of gross margin for the fiscal third quarter.

Sales and marketing expenses rose 3% to $96.8 million. R&D expenses went up 23.8% year over year to $161.3 million, while general and administrative expenses climbed 17.8% year over year to $62.3 million. Total operating expenses of $320.3 million increased 15.6% year over year.

Operating profit totaled $128.5 million, which increased 5.8% from the prior-year quarter. However, the operating margin in the fiscal third quarter contracted 114 bps to 20.8%.

We had projected 18.5% of operating margin for the fiscal third quarter.

Financial Position

The company exited third-quarter fiscal 2024 with cash and cash equivalents and short-term investments of $3.94 billion compared with $3.87 billion at the fiscal second-quarter end.

Cumulative net cash provided by operating activities at the end of third-quarter fiscal 2024 was $853.6 million compared with $717.1 million in the year-ago period.

Guidance

Veeva Systems has revised its financial outlook for fiscal 2024 and provided its estimates for the fourth quarter of fiscal 2024.

For the fourth quarter of fiscal 2024, the company expects total revenues between $620 million and $622 million. The Zacks Consensus Estimate is currently pegged at $623 million.

Subscription revenues and Professional services and other revenues are estimated to be approximately $517 million and $103 million-$105 million, respectively, in the fiscal fourth quarter.

Adjusted EPS is projected to be $1.30. The Zacks Consensus Estimate is pegged at $1.26.

Veeva Systems now expects revenues for fiscal 2024 between $2,353 million and $2,355 million, lowered from the earlier outlook of $2,365 million and $2,370 million. The Zacks Consensus Estimate is currently pegged at $2.36 billion.

Subscription revenues are now expected to be $1,897 million, reflecting an uptick from the earlier projection of $1.895 million. This consists of Commercial Solutions’ subscription revenues of around $993 million (up from the prior projection of $985 million) and R&D Solutions’ subscription revenues of approximately $904 million (down from the prior projection of $910 million).

Professional services and other revenues for fiscal 2024 are now expected to be between $456 million and 458 million, lowered from the earlier outlook of $470 million and $475 million.

Adjusted EPS for the year is now expected to be $4.76, indicating an increase from the previous outlook of $4.68. The Zacks Consensus Estimate is pegged at $4.68.

Our Take

Veeva Systems exited the third quarter of fiscal 2024 with better-than-expected results. The uptick in the overall top and bottom lines and robust performances by both segments during the quarter were impressive. The company continues to benefit from its flagship Vault platform, which is encouraging. Veeva Systems’ continued strength in its Commercial Solutions with new customer additions and strong win rates in Veeva CRM looked promising.

Veeva Systems registered great traction in newer areas, including LIMS and Batch Release, which augurs well. The gross margin expansion bodes well.

On the flip side, the rising operating costs putting pressure on the operating margin during the quarter was concerning. On the earnings call, management sounded cautious about the overall macroeconomic environment as the industry continues to navigate inflation, higher interest rates, global conflicts and the Inflation Reduction Act. Management expects this to primarily impact the outlook for Veeva Systems’ Professional Services business. This raises our apprehension.

Zacks Rank and Key Picks

Veeva Systems currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are DaVita Inc. DVA, DexCom, Inc. DXCM and Integer Holdings Corporation ITGR.

DaVita, flaunting a Zacks Rank of 1 (Strong Buy), reported third-quarter 2023 adjusted EPS of $2.85, beating the Zacks Consensus Estimate by 48.4%. Revenues of $3.12 billion outpaced the consensus mark by 3.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has a long-term estimated growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.6%.

DexCom reported third-quarter 2023 adjusted EPS of 50 cents, beating the Zacks Consensus Estimate by 47.1%. Revenues of $975 million surpassed the Zacks Consensus Estimate by 4%. It currently carries a Zacks Rank #2 (Buy).

DexCom has a long-term estimated growth rate of 33.6%. DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%.

Integer Holdings reported third-quarter 2023 adjusted EPS of $1.27, beating the Zacks Consensus Estimate by 20.9%. Revenues of $404.7 million surpassed the Zacks Consensus Estimate by 8.7%. It currently sports a Zacks Rank #1.

Integer Holdings has a long-term estimated growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report