Veeva Systems' (VEEV) New Release to Address Supply-Chain Issues

Veeva Systems Inc. VEEV recently announced a new cloud application, Veeva Vault Batch Release. The latest application will likely enable faster and more confident Good Manufacturing Processes release and market-ship decisions.

Vault Batch Release will be part of Veeva Vault Quality and is planned for availability in the second half of 2024.

The latest application is expected to provide a significant boost to the Veeva Vault Quality Suite under the Veeva Development Cloud solutions. Notably, the Veeva Development Cloud solutions belong to the broader Life Sciences segment and will likely automate data aggregation, reviews and traceability for greater efficiency and accuracy.

Significance of the Availability

Vault Batch Release is expected to address increased manufacturing and supply-chain complexity by streamlining the aggregation and review of data and content while simplifying collaboration with external partners.

Vault Batch Release will likely bring together data and content across QMS, LIMS, ERP and regulatory systems for real-time visibility into batch release status. The application will be integrated with and require Veeva Vault QMS. It is also expected to offer flexibility for use with other third-party LIMS and regulatory solutions.

Per management, Veeva Vault Batch Release will likely offer an automated, end-to-end solution for an underserved, complex process with compliance and cost risks. Management also believes that a digitalized and automated batch-release solution will likely aid in delivering products to Veeva Systems’ customers consistently, speedily and efficiently.

Industry Prospects

Per a report by Future Market Insights, the global electronic batch records market is expected to exceed $2627 million in 2023 and reach $8786.4 million by 2033 at a CAGR of 12.8%. Factors like cost reduction, easier tracking of the automated batch and the possibility of adverse impacts resulting from manual record keeping are expected to drive the market.

Given the market potential, the latest application is expected to strengthen Veeva Systems’ position in the niche space globally.

Notable Developments

Last month, Veeva Systems announced its second-quarter fiscal 2024 results, wherein it registered an uptick in the overall top and bottom lines and robust performances by both segments during the quarter. On the earnings call, management confirmed that broad-based adoption across Veeva Development Cloud was observed during the reported quarter, and the company advanced several major partnership opportunities with the top 20 pharmas.

The same month, Veeva Systems announced that Civica Rx adopted Veeva Vault LIMS to optimize quality control.

Price Performance

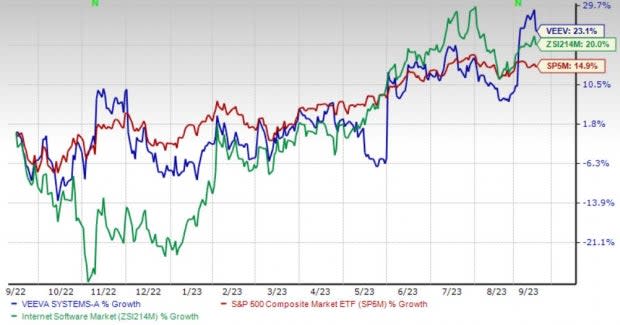

Shares of the company have gained 23.1% in the past year compared with the industry’s 19.9% rise and the S&P 500's 14.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Veeva Systems carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 9% against the industry’s 8.4% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 3.4% compared with the industry’s 12.6% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 30.3% against the industry’s 2.4% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report