Veeva (VEEV) Falls Nearly 3% on Morgan Stanley Downgrade

Veeva Systems VEEV witnessed a decline in its stock price on Wednesday, primarily driven by a recommendation downgrade. The stock was down 2.9% at the close in contrast to the relatively stable trajectory of the S&P 500 Index.

Analyst Craig Hettenbach from Morgan Stanley expressed a less optimistic view, citing potential competition from Salesforce CRM. Hettenbach downgraded Veeva to an underweight rating from its previous equalweight rating. He also set a price target of $181 per share, implying further decline of more than 7.5%.

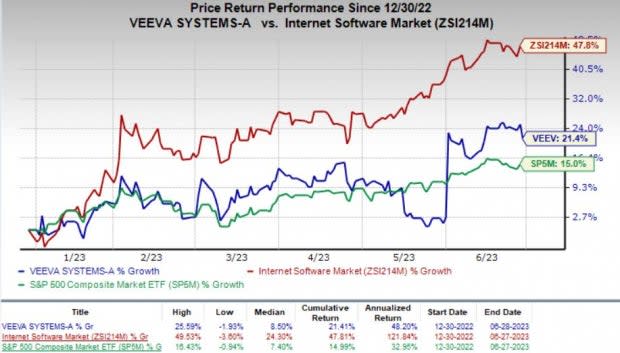

The company’s shares have risen 21.4% year to date compared with the industry’s growth of 47.8%. The S&P 500 Index has gained 15% in the same time frame.

Image Source: Zacks Investment Research

VEEV & Salesforce

Veeva is a cloud-computing service provider, specializing in healthcare companies. The company has demonstrated strong growth in recent years, owing to its presence in two rapidly growing industries.

Salesforce is a leading cloud-based customer relationship management platform, empowering businesses to build stronger customer connections. With its innovative solutions, Salesforce helps companies streamline sales, service, marketing and more, driving growth and enhancing customer experience.

Downgrade Analysis

In his analysis, Hettenbach expressed concerns regarding Veeva’s potential competition from a major participant in the customer relationship management industry. He indicated that the company’s strong hold in the Life Sciences customer relationship management market might experience a significant setback from Salesforce, presenting the most formidable threat to date.

Additionally, he emphasized the probable consequences of Salesforce's entry into the market, projecting a potential revenue decline of 5% or more for VEEV. This risk, he noted, is currently not reflected in the stock's premium valuation.

Other Opinions

Analysts' opinion on Veeva's prospects vary, as is common in the industry. In fact, there has been a trend of analysts becoming more bullish on the company's future rather than being less optimistic.

Following a solid first-quarter performance, wherein earnings surpassed estimates, several analysts have raised their price targets for VEEV stock, although the adjustments are relatively minor. For instance, Brian Peterson from Raymond James increased his price target to $210 per share from the previous $200, while maintaining a buy recommendation for the stock.

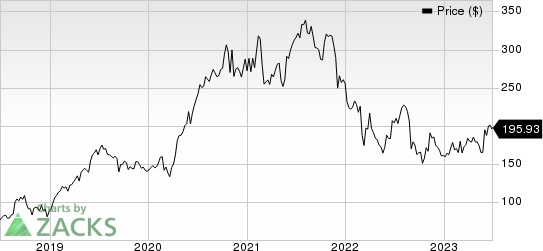

Veeva Systems Inc. Price

Veeva Systems Inc. price | Veeva Systems Inc. Quote

Zacks Rank & Stocks to Consider

Veeva currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the broader medical space are West Pharmaceutical Services WST and Dentsply Sirona XRAY, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

West Pharmaceutical Services has an estimated earnings growth rate of 13.2% for 2024. The company’s earnings surpassed estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 13.61%.

WST’s shares have risen 56.9% year to date compared with the industry’s 13% growth.

Dentsply Sirona has an estimated long-term growth rate of 9.1%. It delivered an average earnings surprise of 10.47% in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report