Veeva's Upside May Be Capped as Revenue Growth Slows

Veeva Systems Inc. (NYSE:VEEV) is the leading provider of industry cloud solutions for the global life sciences industry. The stock underperformed both the S&P 500 and the Nasdaq 100 in 2023. While the stock is up 16% year to date, I believe it has fully priced in future growth expectations, leaving little to no upside from its current levels.

The company has had a terrific history of operational excellence under the management of its co-founder and CEO, Peter Gassner, who has a deep industry background in life sciences and customer relationship management. This has enabled it to gain market share in an expanding total addressable market over the last three years. However, I believe there are headwinds facing the company that its share price does not fully reflect as revenue growth slows, margins stagnate and competition intensifies.

About Veeva

Veeva is a cloud-based software company that is targeted at customers in the life sciences industry. The company supports the research and development and commercial functions of life sciences and pharmaceutical companies via their two major product families.

Veeva Development Cloud: This includes application suites for clinical, regulatory, quality and safety functions of life science companies that enable customers to streamline their business processes.

Veeva Commercial Cloud: This comprises software and data solutions that are built specifically for life sciences companies so they can effectively commercialize their products.

In terms of its business model, the company derives its revenue from a combination of subscription-based pricing and professional services. According to the latest earnings report, Veeva generated 80% of its revenue from subscriptions, while the remaining 20% came from Professional Services.

Building the bull case

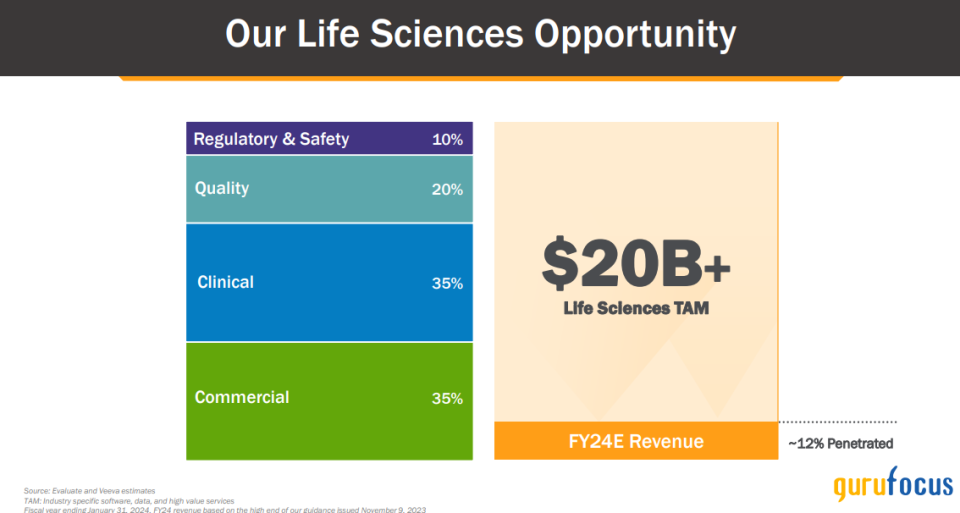

As per Veeva's 2023 investor presentation, the company estimates its total addressable market at $20 billion. The TAM is calculated by summing up the sizes of the following markets: Commercial at $7 billion, Clinical at $7 billion, Quality at $4 billion and Regulatory & Safety at $2 billion. Given management revenue guidance for 2024, Veeva should be able to penetrate 12% of the current TAM should it meet its revenue expectations.

Source: Veeva presentation.

While management has not provided its expectations on how the TAM will grow over the coming years, I found they estimated its TAM at $13 billion during its 2021 Investor Day presentation. This would mean the company has grown its TAM by a compounded annual growth rate of 15% over the last three years, while its revenue will have grown slightly faster at 17%, assuming Veeva meets its 2024 revenue guidance. This would mean the company's market share should have grown from 11% in 2021 to a projected 14% in 2024.

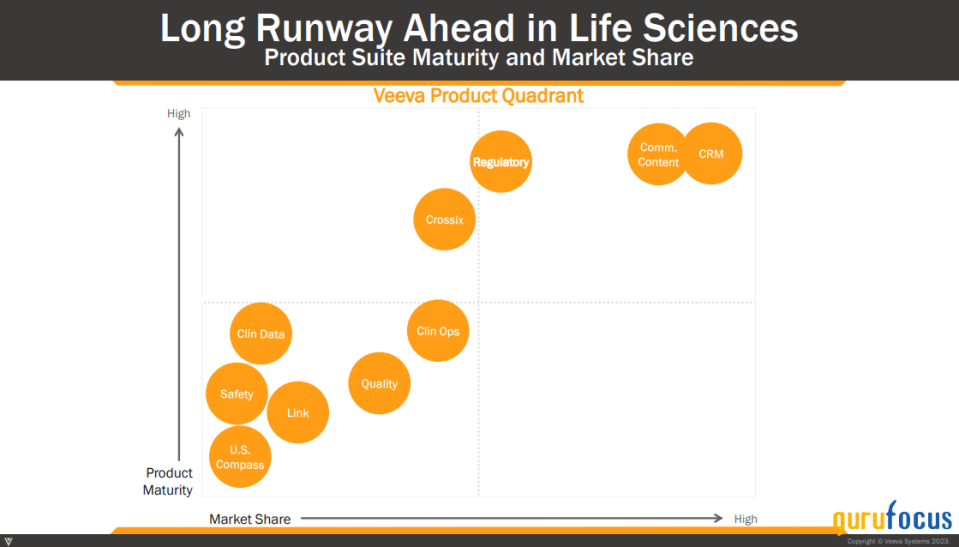

The expansion in TAM, coupled with an increase in market share over the last three years, was driven by a robust product roadmap. I have attached a slide from Veeva's recent investor day that maps the growth stage of all its products relative to implied market share. The left quadrant of the chart demonstrates the robust set of products that have recently been released to customers.

Source: Veeva presentation

While CRM solutions (part of the Veeva Commercial Cloud) are some of the more mature products that are driving the bulk of the revenue, the company is actively building solutions to penetrate emerging areas, such as clinical data, operations, safety and quality, that are faster growing segments in the TAM. I believe this should help position Veeva to drive deeper adoption of its product portfolio among its customer base over the coming years, which should further help it grow its market share and economies of scale.

Building the bear case

Slowing revenue growth amidst macroeconomic and platform migration uncertainty may be an issue, however. Veeva saw its revenue grow 12% year over year to $616.50 million. Out of that, subscription revenue contributed 80%, growing 12%, while professional services revenue contributed the remaining 20%, growing 10%.

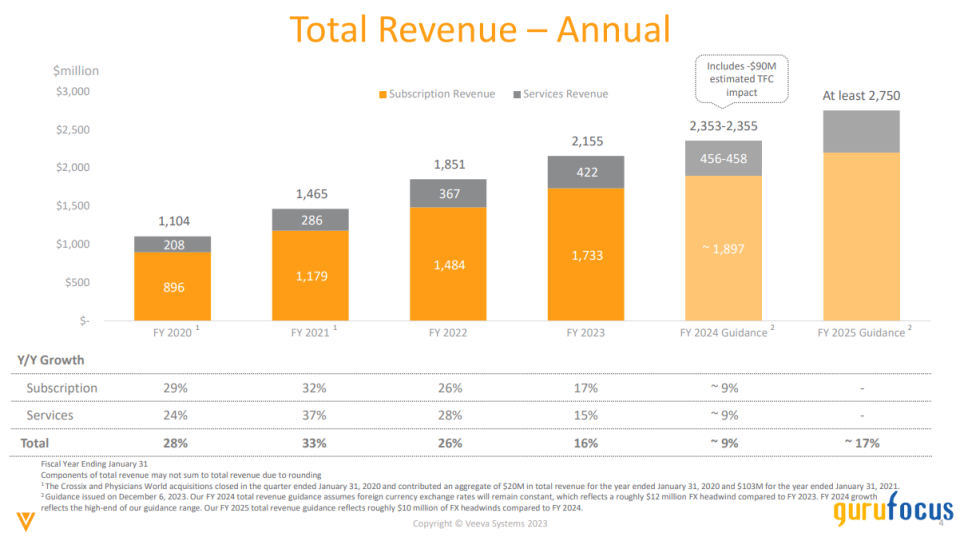

Looking ahead to 2024, Veeva's management is guiding for revenue of $2.35 billion, which represents a 9.20% year-over-year growth rate, but is slower than the 2023 growth rate of 16%. Taking into account the projected negative impact of $90 million on the top line as a result of the customer contracting change that standardized terminations for convenience rights in 2023, revenue for 2024 would have still grown at 13% year over year, a slower pace than in 2023. While revenue growth is expected to pick up in 2025 at 17% to $2.75 billion, this would mark the third consecutive year of sub-20% revenue growth despite a robust product roadmap.

Source: Veeva presentation

One of the contributing factors to the revenue slowdown could be the difficult macroeconomic conditions that have persisted since 2022, where it has become more cost-intensive for pharmaceutical companies to develop their pharma assets and go-to-market. During the third-quarter earnings call, Veeva's chief financial officer mentioned that his base case assumption was the macro conditions would continue to play out when asked about shrinking pharma research and development budgets. Moving forward, I believe this could continue to prove to be a headwind for top-line growth unless we see a material improvement in the overall direction of the macroeconomic environment.

Furthermore, Veeva announced in December 2022 that it would not be renewing its platform agreement with Salesforce (NYSE:CRM) after 2025. With the relationship set to expire in 2025, the company has to successfully migrate its customers over to its own platform. I believe there is a huge unknown as to the issues that customers may face during the migration phase until 2025 and their impact on renewals and retention rate. Given that Veeva has a small customer base where it leans heavily on a few large pharmaceutical giants, there is very little room for error.

Therefore, moving forward, I would not expect the company to return to its mid-to-high 20s range of revenue growth and instead expect revenues to normalize in the mid-teens over the next five years, assuming it is able to successfully execute on its customer migration with little impact to the top line, coupled with the existing pace of product innovation.

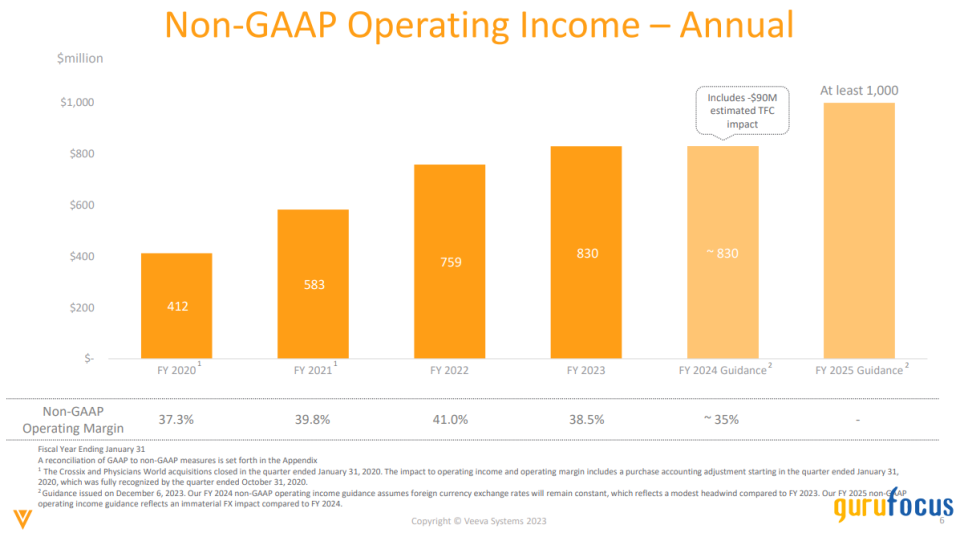

Turning to profitability, in the third quarter, its non-GAAP operating income grew slower than revenue at 7%, while its non-GAAP operating income margin dropped to 38% from 39.7% a year ago. While sales and marketing spend as a percentage of revenue remained steady on a year-over-year basis, the decline in non-GAAP operating margin was driven by a faster increase in research and development spend, which accounted for 26% of revenue compared to 23% in the previous year.

Looking ahead, management expects a non-GAAP operating income of $830 million in 2024, which would translate to a margin of 35%. For 2025, management expects the company to generate $1 billion of non-GAAP operating income, which represents a growth rate of 20% at a margin of 36.30%. Although this would be an improvement from 2024, I would like to point out the overall trend in the non-GAAP operating margin is worsening incrementally when compared to 2020, 2021 and 2022.

Source: Veeva presentation

Finally, the termination of Veeva's platform agreement with Salesforce has opened the door for other major players, such as Microsoft (NASDAQ:MSFT) and Alphabet's (GOO) Google, to enter the life sciences cloud space.

Salesforce has swiftly launched its own life sciences cloud now that the relationship with Veeva is terminated. Meanwhile, other hyperscalers, such as Microsoft and Google, already have their own life sciences cloud offerings. I believe the competition from large cloud companies with substantial resources poses a potential threat to Veeva's market share expansion ambitions.

Furthermore, during its third-quarter earnings call, the CEO pointed out what he perceives as anti-competitive behavior from IQVIA (NYSE:IQV), a clinical data and health care analytics company, particularly in creating barriers by not allowing third-party agreements. He said:

The anticompetitive behavior of IQVIA also creates significant barriers there because let's say the customer is using the IQVIA data for one data product, and we're selling one data product. And our services are necessary to mix those 2 data products together to provide a solution for the customer as well. IQVIA is not going to allow us to do that. They're not going to grant, let's call it a third-party agreement. So that's what slows things down.

Tying it together: Veeva's growth prospects are fully priced in

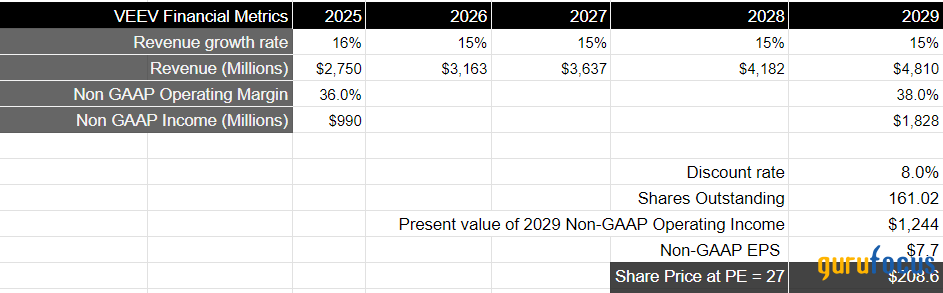

Finally, let's turn our attention to Veeva's valuation. While the company's management has guided revenue growth of 9% in 2024, followed by 17% in 2025 with a non-GAAP operating margin of 35%, I believe the current valuation has already priced in the growth prospects over a five-year investment horizon, leaving no upside from a risk-reward perspective.

Let me explain why. Assuming that Veeva continues to grow in the mid-teens range over the next five years, the company should be able to produce total revenue of $4.80 billion by 2029. Meanwhile, if I assume non-GAAP operating margins to stabilize and improve from current levels at 38%, we should expect Veeva to produce a non-GAAP operating income of close to $1.80 billion, which is equivalent to a present value of $1.18 billion when discounted at 9%.

Taking the S&P 500 as a proxy, where its companies have grown their earnings by an average of 8% over the last 10 years, as per Factset, with a forward price-earnings ratio in the range of 15 to 18, I believe Veeva should be trading at a forward multiple that is 1.50 times the S&P 500 in 2029, as the earnings growth trend is in line with the revenue growth rate in the low-teens region. This will result in a forward price-earnings multiple of 25 to 27, which would translate to a price target of $197 to $208, which is around 5% lower than the current stock price, leaving no room for substantial upside for long-term investors when looking at a five-year investment horizon.

Conclusion

While Veeva has successfully seen its TAM and market share expand as it heavily invests in its product innovation, I believe the company's upside is fully priced in at the moment.

At the same time, revenue growth has slowed substantially, and risks remain pertaining to the company's ability to drive renewals as it migrates its customers over to its own platform. Furthermore, given the challenging landscape of growing competition coupled with uncertain R&D budgets in a difficult macroeconomic environment, there is not an attractive entry point for the stock to drive substantial returns at current levels.

This article first appeared on GuruFocus.