Vehicle Retailer Stocks Q3 Highlights: CarMax (NYSE:KMX)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at CarMax (NYSE:KMX), and the best and worst performers in the vehicle retailer group.

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

The 4 vehicle retailer stocks we track reported a weak Q3; on average, revenues missed analyst consensus estimates by 5.8% Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but vehicle retailer stocks held their ground better than others, with the share prices up 3.2% on average since the previous earnings results.

CarMax (NYSE:KMX)

Known for its transparent, customer-centric approach and wide selection of vehicles, Carmax (NYSE:KMX) is the largest automotive retailer in the United States.

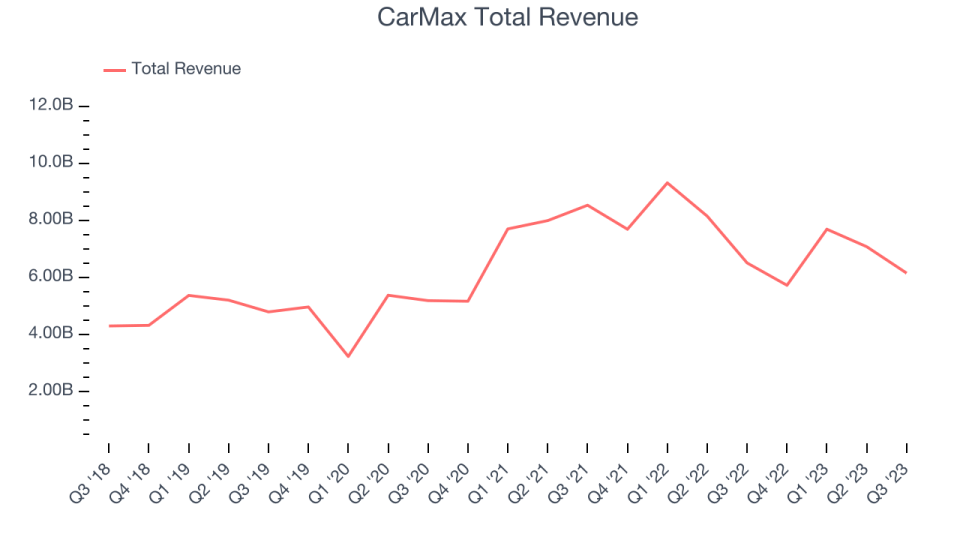

CarMax reported revenues of $6.15 billion, down 5.5% year on year, falling short of analyst expectations by 2.5%. It was a weaker quarter for the company, with a miss of analysts' revenue estimates.

“Our third quarter performance reflects the continued efforts of the team that have resulted in several quarters of sequential improvements across key components of our business, despite the persistent widespread pressures in the used car industry,” said Bill Nash, president and chief executive officer.

The stock is up 15.1% since the results and currently trades at $86.

Read our full report on CarMax here, it's free.

Best Q3: Camping World (NYSE:CWH)

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Camping World reported revenues of $1.11 billion, down 13.4% year on year, falling short of analyst expectations by 2.5%. It was a mixed quarter for the company, with an improvement in gross margin but a miss of analysts' revenue estimates.

Camping World delivered the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is down 2% since the results and currently trades at $24.61.

Is now the time to buy Camping World? Access our full analysis of the earnings results here, it's free.

Slowest Q3: America's Car-Mart (NASDAQ:CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

America's Car-Mart reported revenues of $299.6 million, down 7.9% year on year, falling short of analyst expectations by 14.6%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

America's Car-Mart had the weakest performance against analyst estimates in the group. The stock is up 0.4% since the results and currently trades at $62.52.

Read our full analysis of America's Car-Mart's results here.

Lithia (NYSE:LAD)

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

Lithia reported revenues of $7.67 billion, up 10.5% year on year, falling short of analyst expectations by 3.5%. It was a weaker quarter for the company, with a miss of analysts' revenue estimates. In addition, same store sales fell.

Lithia achieved the fastest revenue growth among its peers. The stock is down 0.5% since the results and currently trades at $297.18.

Read our full, actionable report on Lithia here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.