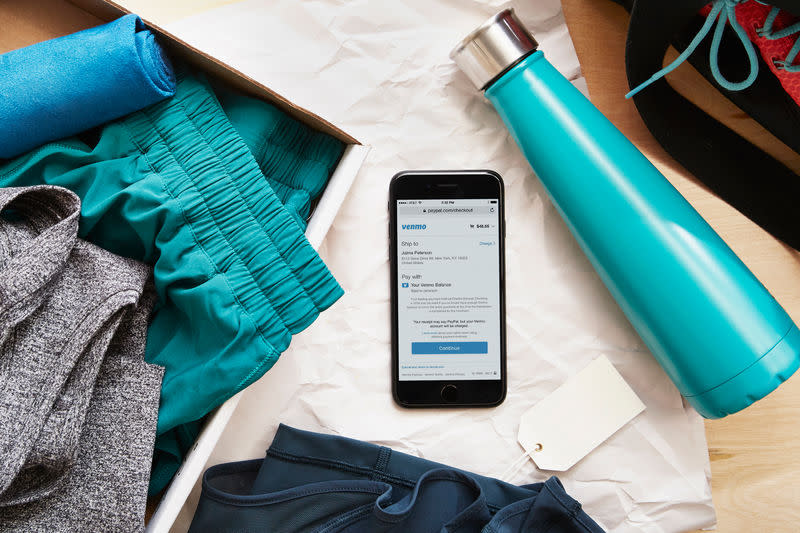

Venmo is one step closer to being a full-service digital wallet

Venmo, the popular peer-to-peer payment app favored by millennials to pay each other for rent, split a bill, or settle other expenses, is rolling out to 2 million merchants, finally allowing people to use the app to pay more than just friends and family.

“From the very beginning of Venmo we’ve tried to make it so you can use Venmo to really buy or pay for anything,” Ben Mills, Venmo’s head of product, told Yahoo Finance.

The service, owned by PayPal (PYPL), is leveraging its parent’s existing network to roll out the functionality making Venmo another option for paying online. “We’re going to get lots of interesting things as a result of that,” said Mills, citing PayPal’s purchase protection program, which will be available for Venmo purchases.

Effect on retailers

For millennials or others who may favor Venmo, the rollout means many retailers will have another means to facilitate transactions more quickly and smoothly. A simple touch of the screen is simpler than inputting credit card info, and with smooth transactions from retailers like Amazon (AMZN) becoming the norm, merchants are constantly looking to flatten speedbumps.

Retailers looking to take advantage of Venmo-fluent users will be able to do so without paying any extra, Mills said. The Venmo capabilities will be included with the standard fees merchants pay to allow customers to pay with PayPal.

A big change for peer-to-peer payments

In addition to expanding Venmo to businesses, the company also announced an almost-instant transfer feature so users can transfer money without waiting the standard few days for the payment to clear and settle, like a check.

Venmo will be charging $0.25 for the expedited transfer in lieu of taking a percent commission. “Most p2p companies are charging a 1% fee,” said Mills. For small amounts, that might not be much, but Mills noted that millennials frequently pay each other rent. So, for $1,000 a flat rate is much more favorable.

Venmo is shrewdly adopting this function as Zelle, the big banks’ overdue alternative to Venmo, has emerged, and marketing the new feature as an advantage.

Venmo could succeed where other phone payment services have failed

Mills told Yahoo Finance that “this is just one step to the path to use Venmo” in all situations. Though you can’t yet pay via Venmo at the store in-person, Mills hinted that this is the app’s future. Similarly, at this time, you can’t accept a payment from an individual other than friends and family like you can on PayPal for a 3% commission.

If and when (probably if) these steps are completed, Venmo will look like a full-service modern digital wallet. Digital wallets like Apple Pay haven’t hitherto been popular or widely used, but Venmo may be able to succeed where Apple hasn’t, given that “millions and millions” use the service. (Mills and spokesperson declined to share specifics on users.)

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: emann[at]oath[.com].

Read More:

Google’s Home recording scandal makes a case against being an early adopter

Consumer watchdog is killing ‘payday loans’ — here’s what will take their place

Equifax’s breach is an opportunity to fix a broken industry

ATM fees have shot up 55% in the past decade

Big bitcoin-friendly companies like Microsoft and Expedia hedge their bet

The real reason Mexico will never pay for the Trump’s wall: It’d be ‘treason’

How Waffle House’s hurricane response team prepares for disaster

Trump weighs slashing one of the most popular tax deductions

A robot lawyer can fight your parking tickets and much more

Consumer watchdog is making it easier for consumers to sue banks