Venus Concept (VERO) Expands Global Reach With New Partnerships

Venus Concept Inc. VERO, in its efforts to solidify its international reach, has inked two exclusive partnerships with Core Aesthetics Skin & Laser Limited in the United Kingdom and Spectra Medical Systems in India. Both regions are identified as high-growth markets for aesthetic technology, Venus Concept’s niche area.

The financial terms of the deals have been kept under wraps.

More on the News

The signing of these exclusive agreements reflects Venus Concept’s strategic vision to tap high-growth markets by leveraging local expertise. The partnerships with Core Aesthetics and Spectra are a significant step in the company's efforts to channel resources toward profitable direct markets, emphasizing a key aspect of its ongoing restructuring efforts.

Core Aesthetics, based in London, is led by former Venus Concept partner Michael Dodd, who helped facilitate the successful launch of Venus Viva and the distribution of Venus Legacy and Venus Versa in the United Kingdom. This company brings years of industry experience and a trusted reputation as a distributor. Per the new deal, Core Aesthetics is poised to cater to the comprehensive needs of U.K. clientele starting January 2024.

Spectra Medical Systems, on the other hand, is a prominent medical equipment distributor in India. It holds the exclusive rights to distribute Venus Concept's diverse portfolio throughout the country. With over 125 dedicated sales personnel and a strong presence in major cities, Spectra is well-positioned to provide extensive customer and technical support, ensuring the seamless operation of all commercial aspects, including sales, marketing, post-sale support and customer education.

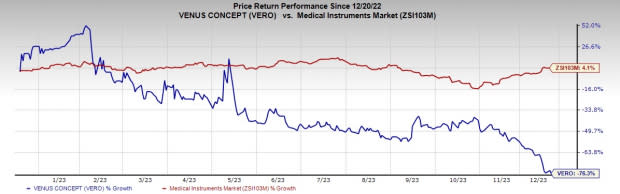

Image Source: Zacks Investment Research

Strategic Implications

Venus Concept expects these deals to fetch continued success in both the United Kingdom and India. The move aligns with Venus Concept’s commitment to excellence and dedication to providing advanced aesthetic solutions on a global scale. As Venus Concept continues to execute its strategic restructuring efforts, these exclusive partnerships set the stage for sustained international growth and success in the dynamic field of medical aesthetics.

Market Prospects

According to a Grand View Research report, the global aesthetic medicine market, valued at $112 billion in 2022, is projected to witness a 14.7% CAGR from 2023 to 2030. Advanced aesthetic devices, like non-invasive body contouring systems, are driving demand. Despite initial pandemic setbacks, remote work has intensified focus on appearance, boosting interest in cosmetic procedures, particularly non-invasive treatments. The surge in awareness, especially in developing countries like India and South Korea, positions the market for sustained high demand, with India ranking among the top five countries globally for non-surgical procedures in 2021, according to the International Society of Aesthetic Plastic Surgery.

Share Price Performance

Shares of VERO have plunged 76.3% over the past year against 4.1% rise of the industry.

Zacks Rank and Key Picks

Venus Concept carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. Insulet sports a Zacks Rank #1 (Strong Buy), while Haemonetics and DexCom presently carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have moved up from $1.90 to $1.91 in the past 30 days. Shares of the company have plunged 28.8% in the past year compared with the industry’s decline of 2.2%.

PODD’s earnings surpassed estimates in each ofthe trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Haemonetics’ stock has risen 10.8% in the past year. Earnings estimates for Haemonetics have increased from $3.86 to $3.89 for 2023 and from $4.11 to $4.15 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.43 to $1.44 in the past 30 days. Shares of the company have increased 7.4% in the past year compared with the industry’s rise of 2.2%.

DXCM’s earnings surpassed estimates in each ofthe trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Venus Concept Inc. (VERO) : Free Stock Analysis Report