Vera Bradley Inc (VRA) Returns to Profitability in Fiscal Year 2024

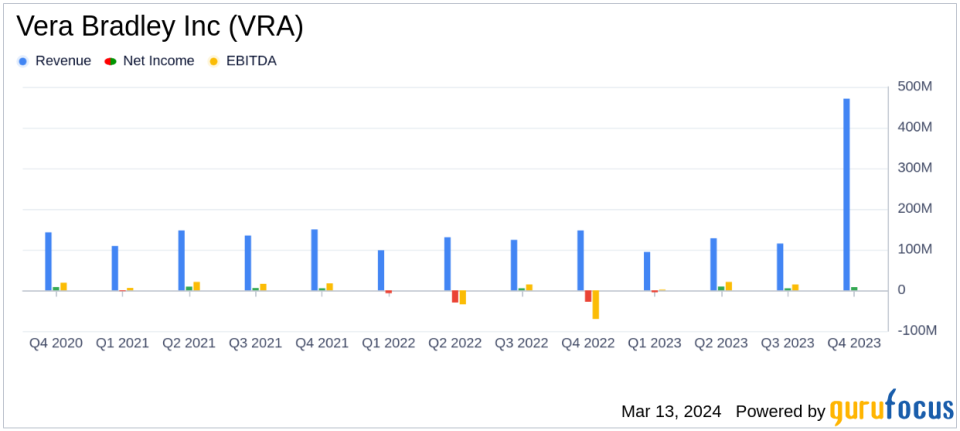

Net Revenue: $470.8 million for fiscal year 2024, down from $500.0 million the previous year.

Net Income: $7.8 million, or $0.25 per diluted share, compared to a net loss of ($59.7) million, or ($1.90) per diluted share, in the prior year.

Non-GAAP Net Income: $17.2 million, or $0.55 per diluted share, an improvement from a net loss of ($3.2) million, or ($0.10) per diluted share, last year.

Balance Sheet Strength: Cash and cash equivalents of $77.3 million, no debt, and inventories down nearly 17% year-over-year.

Guidance for Fiscal Year 2025: Management provides a revenue forecast of $460 to $480 million with a focus on profitability and strategic initiatives.

On March 13, 2024, Vera Bradley Inc (NASDAQ:VRA) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended February 3, 2024. The company, known for its design of women's handbags, travel items, and accessories, operates primarily in the United States and relies on third-party manufacturers in Asia. With a strong direct-to-consumer presence through retail stores and e-commerce, alongside a significant wholesale business, Vera Bradley has navigated a challenging economic landscape to return to profitability.

Financial Performance and Strategic Initiatives

CEO Jackie Ardrey highlighted the company's disciplined approach to gross margin management and cost control, which contributed to the year's profitability. Despite a decline in net revenues, the company's strategic efforts, including Project Restoration, are expected to stabilize and grow the sales base. The project focuses on branding, product assortments, and store environments, aiming to position Vera Bradley for long-term growth.

For the fourth quarter, Vera Bradley brand revenues fell by 6.1%, with direct channels experiencing soft sales and the impact of store closures. Pura Vida, another brand under the company's umbrella, saw a 21.6% decline in fourth-quarter sales, primarily due to decreases in e-commerce and wholesale revenues. However, the company managed to improve operating margins significantly for both the quarter and the full year.

Income Statement and Balance Sheet Highlights

The fiscal year's consolidated net revenues reached $470.8 million, a decrease from the previous year's $500.0 million. The GAAP net income was reported at $7.8 million, or $0.25 per diluted share, marking a significant turnaround from the previous year's net loss. The non-GAAP net income stood at $17.2 million, or $0.55 per diluted share, driven by improved gross margin performance and disciplined expense control.

The balance sheet reflects a strong financial position, with cash and cash equivalents totaling $77.3 million and no debt. Inventories were strategically reduced by nearly 17% compared to the previous year, demonstrating effective inventory management.

Forward-Looking Guidance

Looking ahead to fiscal 2025, management anticipates continued macroeconomic unpredictability but expects to leverage gross margin improvements and maintain a diligent expense structure. The company projects consolidated net revenues of $460 to $480 million and a consolidated gross profit percentage of 54.0% to 55.0%. SG&A expenses are expected to be relatively flat, with consolidated operating income forecasted between $21.0 to $24.5 million. Free cash flow is estimated at approximately $10 million, and the company anticipates a diluted EPS of $0.54 to $0.62.

Vera Bradley's return to profitability and strong balance sheet position it well for the implementation of its strategic initiatives. The company's focus on disciplined financial management and innovative strategies like Project Restoration are set to drive long-term growth and shareholder value.

For detailed financial tables and further information, investors and interested parties can review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Vera Bradley Inc for further details.

This article first appeared on GuruFocus.