Veracyte Inc (VCYT) Reports 22% Revenue Growth in 2023, Maintains Positive Cash Flow Outlook

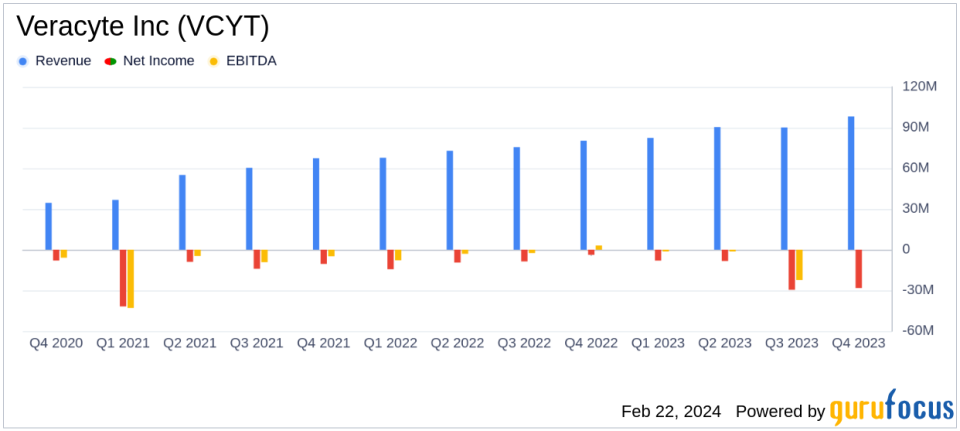

Revenue Growth: Veracyte Inc (NASDAQ:VCYT) reported a 22% increase in total revenue for 2023, reaching $361.1 million.

Test Volume Increase: The company saw a 24% increase in total test volume for the year, indicating strong demand for its diagnostic products.

Operational Cash Flow: Veracyte generated $44 million in cash from operations and ended the year with $216 million in cash and cash equivalents.

Net Loss: Despite revenue growth, the company recorded a net loss of $74.4 million for the year, including significant impairment charges.

2024 Outlook: Veracyte maintains its total revenue guidance for 2024, projecting between $394 million to $402 million.

On February 22, 2024, Veracyte Inc (NASDAQ:VCYT), a leading genomic diagnostics company, released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its genomic diagnostic products and services aimed at improving patient care for diseases such as thyroid cancer, lung cancer, and idiopathic pulmonary fibrosis, reported a robust 22% increase in total revenue for 2023, amounting to $361.1 million.

Veracyte's product portfolio, which includes Afirma analysis, Percepta, Envisia, and others, has been a significant revenue driver. The company's growth is particularly notable in its testing revenue, which saw a 30% increase compared to the previous year, primarily driven by the strong performance of its Decipher Prostate and Afirma tests. This growth in testing revenue underscores the importance of Veracyte's offerings in the biotechnology industry, where accurate and efficient diagnostics are critical for patient care and treatment decisions.

Financial Performance and Challenges

Veracyte's financial achievements in 2023 reflect the company's ability to scale its operations and innovate within the genomic diagnostics space. The company grew its total test volume by 24% for the full year, indicating a strong market demand for its diagnostic solutions. However, the company faced challenges as well, including a net loss of $74.4 million for the year, which includes impairment charges totaling $68.3 million. These charges were primarily associated with the impairment of HalioDx developed biopharmaceutical services technology, customer relationships, and customer backlog finite-lived intangible assets.

Despite these challenges, Veracyte's financial discipline and strategic investments have positioned the company to maintain a positive cash flow outlook. The company ended the year with a strong cash position of $216 million in cash and cash equivalents, which is crucial for funding ongoing research and development efforts and potential strategic initiatives.

Key Financial Metrics

Veracyte's income statement reveals a detailed picture of the company's financial health. The company's total gross margin improved to 64% in 2023 from 59% in the previous year, reflecting more efficient operations and cost management. Non-GAAP gross margin, which excludes certain expenses, was even higher at 69%. Operating expenses, excluding cost of revenue, increased by 46% to $315.5 million, reflecting the company's investment in growth and the aforementioned impairment charges.

On the balance sheet, Veracyte's total assets stood at $1.114 billion as of December 31, 2023, with a strong equity position of $1.044 billion. The company's liquidity is further evidenced by its cash flow statement, which shows a net cash provided by operating activities of $44.2 million, a significant increase from the previous year.

"We closed 2023 with another quarter of excellent results, driven by our Afirma and Decipher businesses," said Marc Stapley, Veracytes chief executive officer. "Looking to 2024 and beyond, we will leverage our Veracyte Diagnostics Platform to continue to drive near- and long-term revenue. With multiple growth catalysts over the coming years and with our strong financial discipline, we expect to achieve positive cash flow for the third consecutive year and going forward."

Veracyte's performance in 2023 demonstrates the company's resilience and adaptability in a competitive and rapidly evolving biotech industry. The company's focus on expanding its diagnostic capabilities, as evidenced by the acquisition of C2i Genomics and the agreement with Illumina to develop in vitro diagnostics, positions it well for future growth. However, investors will be watching closely to see how Veracyte manages its operating expenses and navigates the challenges ahead to maintain its growth trajectory and improve its bottom line.

For more detailed information and analysis on Veracyte Inc (NASDAQ:VCYT)'s financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Veracyte Inc for further details.

This article first appeared on GuruFocus.