Veris Residential Inc (VRE) Reports Solid Growth in Core FFO and NOI for FY 2023

Core FFO Growth: Core FFO per share increased by 20% year-over-year to $0.53.

NOI Expansion: Same Store NOI growth of 17.6% surpassed the upper end of guidance.

Operational Efficiency: Core G&A expenses reduced by 13% compared to 2022.

Dividend Policy: Quarterly dividend reinstated and raised by 5% in Q4.

Asset Sales: Over $700 million of non-strategic assets sold since the beginning of 2023.

Liquidity and Debt Management: Available liquidity of approximately $95 million with a weighted average debt rate of 4.5%.

ESG Recognition: Named a Leader in the Light by Nareit for superior sustainability efforts.

On February 21, 2024, Veris Residential Inc (NYSE:VRE), a forward-thinking multifamily real estate investment trust (REIT), announced its financial results for the fourth quarter and full year of 2023. The company released its 8-K filing, showcasing a year of operational outperformance and strategic transformation.

Veris Residential Inc is a fully-integrated, self-administered and self-managed REIT, owning and operating a portfolio predominantly of multifamily rental properties in the Northeast and Class A office properties. The company has successfully transitioned to a pure-play multifamily REIT, focusing on high-quality Class A properties and a vertically integrated operating platform.

Financial and Operational Highlights

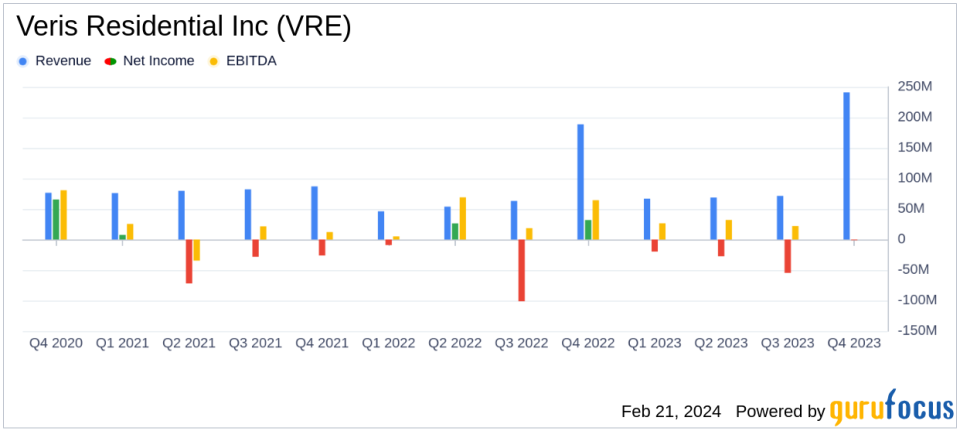

The company reported a Core FFO per diluted share of $0.12 for Q4 and $0.53 for the full year, marking a 20% increase compared to the previous year. This growth reflects the company's ability to drive revenue and effectively manage expenses. The Net Operating Income (NOI) margin improved to 64%, up from 62% in 2022, indicating enhanced operational efficiency. Despite a challenging environment, Veris Residential achieved a Same Store multifamily Blended Net Rental Growth Rate of 5.0% for the quarter and 9.3% for the year.

Veris Residential's commitment to cost control is evident in the 13% reduction in Core General & Administrative (G&A) expenses compared to 2022. The reinstatement and subsequent increase of the quarterly dividend demonstrate confidence in the company's financial stability and commitment to shareholder returns.

CEO Mahbod Nia commented on the company's transformation and potential for future growth, stating:

Over the past three years, we have successfully transformed Veris Residential from a complex company to a pure-play multifamily REIT underpinned by a high-quality portfolio of Class A properties and a vertically integrated, best-in-class operating platform. While we have built a strong foundation to date, the potential for continued value creation and relative outperformance as we mature as a multifamily company is tremendous."

Strategic Asset Management and Liquidity

The company's strategic disposition of non-strategic assets, totaling over $700 million, has streamlined its focus on multifamily properties. The sale of Harborside 5, the last office property, for $85 million, further solidifies this focus. Veris Residential has also managed its debt profile effectively, refinancing $400 million of debt and reducing overall indebtedness by $50 million.

As of February 20, 2024, Veris Residential reported approximately $95 million in available liquidity, with nearly all of its debt portfolio hedged or fixed. The weighted average interest rate stands at 4.5%, with a maturity of 3.7 years, reflecting a strong debt management strategy.

Environmental, Social, and Governance (ESG) Achievements

Veris Residential's ESG efforts have been recognized with several awards, including the Leader in the Light by Nareit for superior sustainability efforts in the residential sector. These accolades underscore the company's commitment to sustainability and corporate responsibility.

Looking Ahead

The company's operational guidance for 2024 reflects confidence in its ability to maintain positive growth momentum. With a solid foundation and strategic focus, Veris Residential is poised for continued success in the multifamily REIT sector.

For a more detailed analysis of Veris Residential Inc's financial performance and strategic initiatives, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Veris Residential Inc for further details.

This article first appeared on GuruFocus.