VeriSign (VRSN) Q3 Domain Name Registrations Rise 2.4% Y/Y

VeriSign VRSN announced that domain name registrations increased 8.5 million or 2.4% year over year across all top-level domains (TLDs) in the third quarter of 2023. Sequentially, domain name registrations were up 0.8% to 359.3 million.

The company continues to benefit from healthy growth across .com and .net domain name registrations. For 2023, the company expects the domain name base growth rate to fall 0.4% to rise 0.4% due to continued uncertainty and weakness related to China.

In the third quarter, the .com and .net TLDs decreased 0.2 million domain name registrations, or 0.1% year over year to 173.9 million. Also, the .com and .net domain name bases totaled 160.8 million and 13.2 million domain name registrations, respectively, for the quarter that ended on Sep 30, 2023.

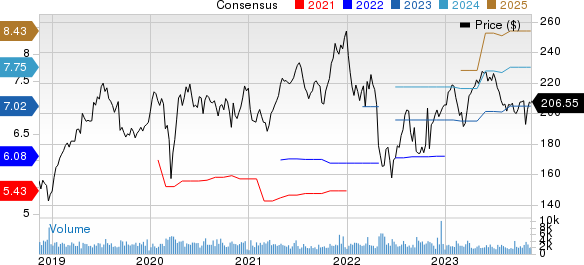

VeriSign, Inc. Price and Consensus

VeriSign, Inc. price-consensus-chart | VeriSign, Inc. Quote

The company processed 9.9 million new domain name registrations for .com and .net, which remained the same in the year-ago quarter.

In the third quarter, the final .com and .net renewal rates for second-quarter 2023 were 73.4% compared with 73.8% in the year-ago quarter. Management expects the renewal rate for third-quarter 2023 to be around 73.4% compared with 73.7% in the year-ago quarter.

VeriSign marginally lowered the higher end of its revenue guidance. Management now expects 2023 revenues between $1.49 billion and $1.495 billion compared with the earlier guided range of $1.49-$1.50 billion.

VeriSign provides Internet infrastructure services that include domain name registry services and infrastructure assurance services. The company continues to expand its critical infrastructure to tap the growing demand for DNS navigation services in industries like commerce, education and healthcare.

The company announced that from Feb 1, 2024, it will increase the annual registry-level wholesale price for .net domain names by 99 cents to $10.91 from $9.92.

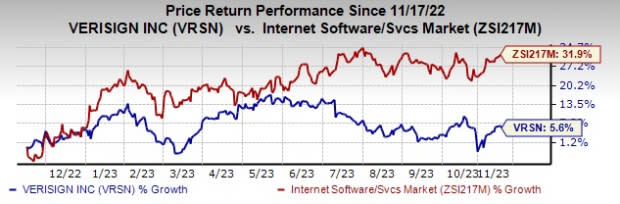

VeriSign currently carries a Zacks Rank #3 (Hold). Shares of VRSN have gained 5.6% compared with the sub-industry’s growth of 31.9% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Guidewire Software GWRE, Flex FLEX and Badger Meter BMI. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Guidewire Software’s fiscal 2024 EPS has increased 10.5% in the past 60 days to 74 cents. Shares of GWRE have soared 47.1% in the past year.

The Zacks Consensus Estimate for Flex’s fiscal 2024 EPS has gained 3.6% in the past 60 days to $2.56. Flex’s long-term earnings growth rate is 12.4%. Shares of FLEX have gained 29.5% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has improved 7.3% in the past 60 days to $3.07.

Badger Meter’s earnings outpaced the Zacks Consensus Estimate in all the last four quarters, the average surprise being 10.3%. Shares of BMI have rallied 24.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report