VeriSign (VRSN) Q3 Earnings & Revenues Beat Estimates, Up Y/Y

VeriSign VRSN reported third-quarter 2023 adjusted earnings per share (EPS) of $1.83, which beat the Zacks Consensus Estimate by 5.2%. The company had reported EPS of $1.58 in the prior-year quarter.

Revenues jumped 5.4% year over year to $376.3 million and surpassed the Zacks Consensus Estimate by 0.7%.

VeriSign marginally narrowed the upper end of its revenue guidance. Management now expects 2023 revenues between $1.490 billion and $1.495 billion compared with the earlier guided range of $1.490-$1.50 billion. VRSN’s domain name base’s growth is now expected to fall 0.4% to rise 0.4% due to continued economic uncertainty. Earlier, the domain name base’s growth was projected to stay flat or rise 1%.

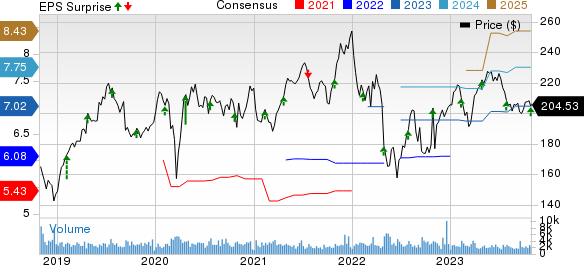

VeriSign, Inc. Price, Consensus and EPS Surprise

VeriSign, Inc. price-consensus-eps-surprise-chart | VeriSign, Inc. Quote

Quarter in Details

VRSN ended the reported quarter with 173.9 million .com and .net domain name registrations, down 0.1% year over year. Our estimate for .com and .net domain name registrations was 175.6 million.

The company processed 9.9 million new domain name registrations for .com and .net, which remained the same in the year-ago quarter. Our estimate for new domain name registrations for .com and .net was 9.6 million.

The final .com and .net renewal rates for second-quarter 2023 were 73.4% compared with 73.8% in the year-ago quarter. Renewal rates are not fully measurable until 45 days after the end of the quarter.

Management expects the renewal rate for third-quarter 2023 to be around 73.4% compared with 73.7% in the year-ago quarter.

VeriSign’s research and development expenses increased 3.3% from the year-ago quarter to $21.7 million.

Selling, general and administrative (SG&A) expenses increased 5.3% year over year to $51.7 million. As a percentage of revenues, SG&A expenses contracted 18 basis points (bps) on a year-over-year basis to 13.7%.

Operating income was $254.3 million, up 7.4% year over year. Operating margin expanded 123 bps to 67.6%.

Balance Sheet & Cash Flow

As of Sep 30, 2023, VRSN’s cash and cash equivalents (including marketable securities) were $943 million compared with $935.6 million as of Jun 30.

Cash flow from operating activities was $245 million in the third quarter compared with $262 million in the year-ago quarter. Free cash flow was $217 million in the reported quarter.

In the third quarter, Verisign repurchased 1.1 million shares for $220 million. The available amount under Verisign's share repurchase program is $1.34 billion.

2023 Guidance

GAAP operating income is now expected to be between $0.995 billion and $1.00 billion compared with the previous guidance of $0.990 billion and $1.005 billion. Capital expenditures are anticipated to be in the range of $45-$55 million.

Zacks Rank & Stocks to Consider

VeriSign currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and Wix.com WIX. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 55.9% in the past year.

The Zacks Consensus Estimate for Synopsys’ 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have surged 62.7% in the past year.

The Zacks Consensus Estimate for Wix’s 2023 EPS has remained unchanged in the past 60 days to $3.35.

Wix’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 319.3%. Shares of WIX have rallied 5.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report