Verisk Analytics Inc (VRSK) Reports Solid Growth Amidst Strategic Changes in Q4 and Full-Year 2023

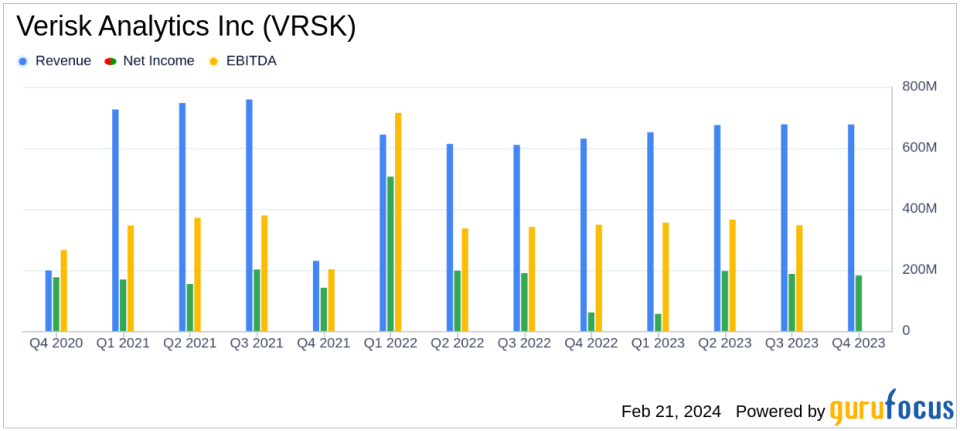

Revenue Growth: Q4 revenue increased by 7.4% to $677.2 million; full-year revenue up 7.4% to $2,681.4 million.

Income Fluctuations: Q4 income from continuing operations decreased by 15.5% to $182.3 million; full-year income down 26.3% to $768.4 million.

Adjusted EBITDA: Q4 adjusted EBITDA grew by 9.0% to $362.0 million; full-year adjusted EBITDA up 11.6% to $1,433.5 million.

Earnings Per Share: Q4 diluted EPS decreased by 8.8% to $1.25; full-year diluted EPS down 20.3% to $5.22.

Free Cash Flow: Q4 free cash flow increased by 15.8% to $196.1 million; full-year free cash flow up 5.9% to $830.7 million.

Dividends and Share Repurchases: A dividend increase to 39 cents per share and a new $1.0 billion share repurchase authorization announced.

2024 Outlook: Revenue guidance set between $2,840 million and $2,900 million with adjusted EBITDA margin expected between 54.0% and 55.0%.

On February 21, 2024, Verisk Analytics Inc (NASDAQ:VRSK) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The company, a leading provider of data analytics and technology for the insurance industry, has reported a solid performance, with revenue and adjusted EBITDA growth surpassing its long-term targets. This achievement comes amidst a period of strategic, organizational, and cultural changes, highlighting the company's resilience and adaptability.

Financial Performance and Challenges

Verisk's fourth-quarter revenue rose to $677.2 million, a 7.4% increase year-over-year, driven by solid growth in underwriting and moderate growth in claims. The full-year revenue also saw a 7.4% increase, reaching $2,681.4 million. However, income from continuing operations saw a decline, with a 15.5% decrease in the fourth quarter and a 26.3% drop for the full year, primarily due to litigation reserve expenses, a one-time tax benefit in the previous year, and higher depreciation expenses.

Adjusted EBITDA for the fourth quarter grew by 9.0% to $362.0 million, and for the full year, it increased by 11.6% to $1,433.5 million. The growth in adjusted EBITDA reflects strong revenue performance coupled with disciplined cost management. Despite these positive results, challenges such as the absence of storm-related revenue compared to the previous year and ongoing inquiries related to the former Financial Services segment have impacted the company's financials.

Segment Performance and Financial Metrics

The Insurance segment, which is the core of Verisk's business, exhibited a 7.4% revenue growth in the fourth quarter and a 10.0% increase for the full year. The segment's adjusted EBITDA margins remained robust, demonstrating the company's ability to maintain profitability despite external pressures.

Diluted EPS for Verisk decreased by 8.8% to $1.25 in the fourth quarter, while the full-year diluted EPS was down by 20.3% to $5.22. The decrease was attributed to a lower tax expense in the prior year and higher depreciation expenses. Conversely, diluted adjusted EPS saw a slight decrease of 2.1% in the fourth quarter but increased by 14.0% for the full year, indicating a strong underlying operational performance.

Free cash flow, an important indicator of financial health, showed a significant increase, with a 15.8% rise in the fourth quarter and a 5.9% increase for the full year, demonstrating Verisk's ability to generate cash and fund its operations effectively.

Strategic Moves and Future Outlook

Verisk has been proactive in its capital allocation, as evidenced by the dividend increase to 39 cents per share and the authorization of an additional $1.0 billion for share repurchases. These moves reflect the company's commitment to delivering value to shareholders and its confidence in the ongoing strength of the business.

Looking ahead to fiscal 2024, Verisk has provided guidance that anticipates continued revenue growth and margin expansion. The company expects revenue to be between $2,840 million and $2,900 million, with an adjusted EBITDA margin between 54.0% and 55.0%. This outlook underscores Verisk's focus on consistent and predictable growth, as well as its strategic investments in innovation and technology to support the insurance industry.

Verisk Analytics Inc (NASDAQ:VRSK) remains a key player in the data analytics and technology space, with a clear strategy for growth and a strong financial foundation. As the company navigates through its strategic changes, it continues to demonstrate its capacity to adapt and thrive in a dynamic industry landscape.

Explore the complete 8-K earnings release (here) from Verisk Analytics Inc for further details.

This article first appeared on GuruFocus.