Verisk's (VRSK) Q4 Earnings Miss Estimates, Decrease Y/Y

Verisk Analytics Inc. VRSK reported mixed fourth-quarter 2023 results, wherein earnings missed the Zacks Consensus Estimate but revenues beat the same.

Adjusted earnings were $1.4 per share, missing the Zacks Consensus Estimate by 1.4% and decreasing 2.1% year over year. The decline in adjusted EPS was due to a one-time tax benefit of around $30.3 million in the fourth quarter of 2022 and increased depreciation expense.

Total revenues of $677.2 million surpassed the consensus estimate by 1% and increased 7.4% year over year on a reported basis and 6% on an organic constant currency (OCC) basis.

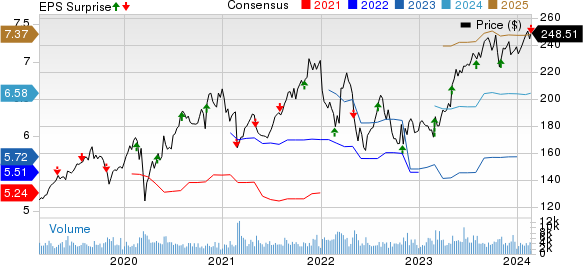

Verisk Analytics, Inc. Price, Consensus and EPS Surprise

Verisk Analytics, Inc. price-consensus-eps-surprise-chart | Verisk Analytics, Inc. Quote

Quarter Details

Underwriting and Rating revenues saw an uptick of 7.8% year over year on a reported basis and 7.3% at OCC to $479 million, beating our estimate of $465.6 million. Claim revenues increased 6.6% on a reported basis and 2.8% at OCC to $198.2 million and surpassed our estimate of $189.9 million.

Adjusted EBITDA grew 9% year over year on a reported basis and 6.5% at OCC to $362 million, beating our estimate by 2.1%. The adjusted EBITDA margin was 53.4%, increasing 70 basis points from the year-ago figure but fell short of our estimated 54.5%.

The company exited the quarter with cash and cash equivalents of $302.7 million compared with $416.8 million held at the end of the previous quarter. Long-term debt was $2.9 billion, flat with the prior quarter's tally.

Net cash generated from operating activities was $252.4 million. Free cash flow generated during the quarter was $196.1 million. The company repurchased shares of $250 million in the quarter and returned $48.9 million as dividends to shareholders.

2024 Guidance

The company expects revenues to be in the range of $2.84-$2.90 billion. The midpoint ($2.87) of the guided range matches the current Zacks Consensus Estimate. Adjusted EBITDA is expected to be in the band of $1.54-$1.60 billion. The expected adjusted EBITDA margin is in the band of 54-55%. Adjusted EPS expectation is between $6.3 and $6.6. The midpoint ($6.45) of the guided range is below the current Zacks Consensus Estimate of $6.58.

Verisk currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Earnings Snapshots

Robert Half RHI reported better-than-expected fourth-quarter 2023 results.

Quarterly earnings of 83 cents per share beat the consensus mark by 1.2% but declined 39.4% year over year. RHI’s revenues of $1.5 billion beat the consensus mark by a slight margin but decreased 14.7% year over year.

Aptiv APTV reported mixed fourth-quarter 2023 results, with earnings beating the Zacks Consensus Estimate but revenues missing the same.

Adjusted earnings of $1.4 per share beat the Zacks Consensus Estimate by 8.5% and increased 10.2% year over year. APTV’s revenues of $4.9 billion missed the Zacks Consensus Estimate by 0.5% but increased 6% year over year.

S&P Global SPGI reported mixed fourth-quarter results, wherein earnings missed the Zacks Consensus Estimate but revenues beat the same.

Adjusted EPS of $3.13 missed the Zacks Consensus Estimate by 0.6% but increased 23.2% year over. Revenues of $3.2 billion surpassed the consensus estimate by 0.5% and improved 7.3% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Robert Half Inc. (RHI) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report