Veritone Inc (VERI) Faces Headwinds Despite Revenue of $127.6 Million in Fiscal Year 2023

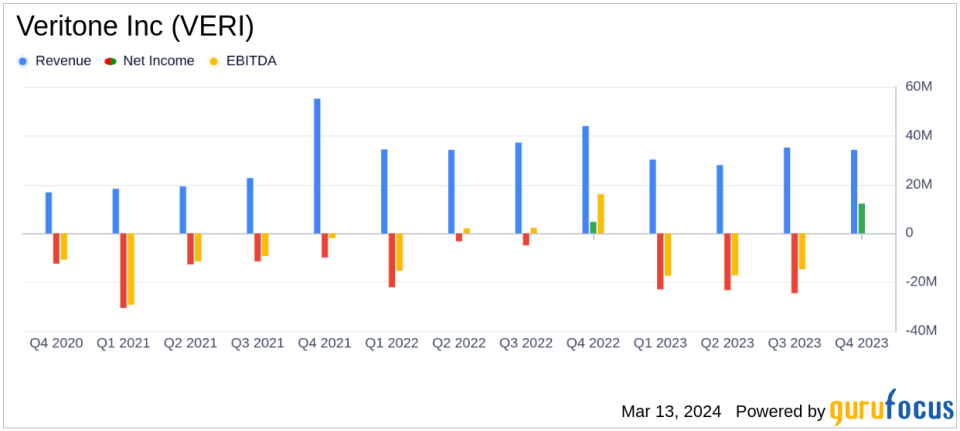

Revenue: Fiscal Year 2023 revenue reported at $127.6 million, a 14.8% decrease year-over-year.

Net Loss: GAAP net loss widened to $58.6 million, compared to $25.2 million in the previous year.

Software Revenue: Software Products and Services revenue declined by 19.1% year-over-year to $68.4 million.

Cost-Saving Measures: Announced restructuring expected to save over 15% in operating expenses, aiming for profitability in H2 2024.

Liquidity Position: Ended the year with $79.4 million in cash and cash equivalents.

On March 12, 2024, Veritone Inc (NASDAQ:VERI) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year of 2023. The company, known for its artificial intelligence (AI) computing solutions and services, faced a challenging year with a significant decrease in revenue and an increased net loss compared to the previous fiscal year.

Fiscal Year 2023 Performance

Veritone reported a total revenue of $127.6 million for the fiscal year 2023, marking a 14.8% decrease from the previous year. The loss from operations grew substantially to $92.3 million, up from $38.0 million in 2022. The non-GAAP gross profit also saw a downturn, decreasing by 18.8% to $99.3 million. The net loss on a GAAP basis increased to $58.6 million, up by $33.0 million year over year. Non-GAAP net loss worsened, standing at $37.3 million compared to $15.9 million in fiscal year 2022.

Fourth Quarter Insights

The fourth quarter of 2023 saw revenues of $34.2 million, a 22.1% decrease from the same period in 2022. Software Products and Services revenues fell by 27.2% to $19.8 million, while Managed Services revenue dropped by 13.8% to $14.4 million. The company's loss from operations for the quarter was $17.5 million, compared to a loss of $10.0 million in the fourth quarter of 2022. However, GAAP net income was $12.2 million, an improvement from $5.0 million in Q4 2022, primarily due to gains from repurchases of convertible notes.

Strategic Moves and Outlook

Veritone's management has taken significant steps to realign the organization and reduce costs. The company announced a restructuring plan in Q1 2024, which is expected to result in annualized savings of over 15% in operating expenses. This move is part of a strategy to accelerate profitability into the second half of 2024. Additionally, Veritone closed a $77.5 million four-year Senior Secured Term Debt facility, using part of the proceeds to repurchase $50.0 million of its November 2026 Convertible notes.

For the first quarter of 2024, Veritone anticipates revenue to be between $30.5 million and $31.5 million, with a non-GAAP net loss in the range of $7.0 million to $8.0 million. Looking at the full year 2024, the company expects revenue to be between $134.0 million and $142.0 million, with a non-GAAP net loss projected to be between $11.0 million and $15.0 million.

Conclusion

While Veritone Inc (NASDAQ:VERI) faces headwinds, the company's restructuring efforts and focus on cost savings may pave the way for a more stable financial future. Investors and stakeholders will be watching closely to see if these strategic initiatives can steer the company back to profitability in the competitive AI market.

For a more detailed analysis of Veritone Inc's financials and strategic direction, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Veritone Inc for further details.

This article first appeared on GuruFocus.