Verizon (VZ) Q1 Earnings In Sync, Shares Fall on Muted Outlook

Verizon Communications Inc. VZ reported relatively healthy first-quarter 2022 results, wherein the bottom line matched the Zacks Consensus Estimate and the top line beat the same. The telecom giant is witnessing significant 5G adoption and fixed wireless broadband momentum. It currently covers nearly 113 million people in the country with 5G Ultra Wideband. However, a muted outlook for 2022 dragged the shares down in pre-market trading as investors probably expected a solid growth momentum.

Net Income

On a GAAP basis, net income in the quarter was $4,711 million or $1.09 per share compared with $5,378 million or $1.27 per share in the prior-year quarter. The year-over-year decrease despite top-line growth was primarily attributable to higher operating expenses. Quarterly adjusted earnings per share were $1.35 compared with $1.36 in the prior-year quarter. The bottom line was in line with the Zacks Consensus Estimate.

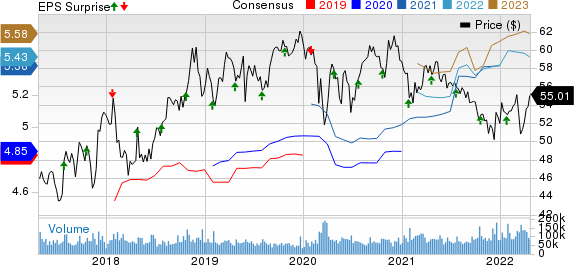

Verizon Communications Inc. Price, Consensus and EPS Surprise

Verizon Communications Inc. price-consensus-eps-surprise-chart | Verizon Communications Inc. Quote

Revenues

Quarterly total operating revenues improved 2.1% year over year to $33,554 million. Strong wireless service revenues, record demand for fixed wireless broadband and strength in 5G mobility driven by solid 5G Ultra Wideband network expansion triggered the revenue growth. The top line beat the consensus estimate of $33,383 million.

Quarterly Segment Results

Consumer: Total revenues from this segment increased 10.9% year over year to $25,292 million, driven by strong demand for higher-tier premium mobility and broadband offerings and first full quarter of TracFone integration. Strong wireless service revenue momentum, healthy profitability and significant Fios revenue growth were witnessed in the quarter.

Service revenues were up 9.4% to $18,126 million, while wireless equipment revenues jumped 28.2% to $5,374 million, led by higher work-from-home-driven customer activities. Other revenues totaled $1,792 million, down 12% year over year.

Verizon recorded 292,000 wireless retail postpaid net loss in the quarter due to competitive offerings from rivals. Wireless retail postpaid churn was 0.95%, while retail postpaid phone churn was 0.77%. The company recorded 55,000 Fios Internet net additions as high demand for reliable fiber optic broadband was spurred by increasing work-from-home trend. Fixed wireless broadband net additions were 112,000 for the quarter. However, Verizon registered 78,000 Fios Video net losses in the quarter, reflecting the ongoing shift from traditional linear video to over-the-top offerings.

The segment’s operating income declined 2.7% to $7,319 million with a margin of 28.9%, down from 33% in the year-ago quarter. EBITDA increased 1% to $10,481 million with a margin of 41.4% compared with 45.5% in the prior-year quarter.

Business: The segment revenues were down 0.9% to $7,709 million due to a decline in legacy wireline. Verizon had 395,000 wireless retail postpaid net additions in the quarter, including 256,000 phone net additions. Operating income declined to $673 million from $899 million in the year-ago quarter with respective margins of 8.7% and 11.6%. EBITDA was down 9.3% to $1,734 million for a margin of 22.5% compared with 24.6% in the year-earlier quarter.

Other Quarterly Details

Total operating expenses increased 2.6% year over year to $25,758 million, while operating income was relatively flat at $7,796 million. Consolidated adjusted EBITDA declined to $12,032 million from $12,167 million for respective margins of 35.9% and 37%.

Cash Flow & Liquidity

In first-quarter 2022, Verizon generated $6,821 million of net cash from operating activities compared with $9,694 million in the year-ago quarter. The reduction was primarily induced by working capital impacts as the increase in activation volumes affected receivable levels, and inventory levels increased as part of supply chain management. Free cash flow was $1,000 million compared with $5,200 million.

As of Mar 31, 2022, the company had $1,661 million in cash and cash equivalents with $139,961 million of long-term debt. Capital expenditure for the quarter totaled $5,821 million, up from $4,494 million in prior-year period, driven by expenses of $1.5 billion related to C-Band deployment. The continued build out of OneFiber and C-Band spectrum expansion will expand the reach and capacity of its 5G Ultra Wideband network and will likely enable it to serve an additional 40 million people in the near term.

2022 Guidance Updated

Verizon has updated its earlier guidance for 2022 and currently expects organic service and other revenue growth to be flat year over year. Reported wireless service revenue growth is expected at the lower end of its previously guided range of 9-10%. Adjusted EBITDA is likely to be at the lower end of the earlier range of 2% and 3%. The company expects adjusted earnings at the lower end of the previously guided range of $5.40 to $5.55 per share. Capital expenditure, excluding C-Band, is estimated between $16.5 billion and $17.5 billion.

Zacks Rank & Stock to Consider

Verizon currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Sell) stocks here.

A better-ranked stock in the broader industry is Sierra Wireless, Inc. SWIR, carrying a Zacks Rank #2 (Buy). It has a long-term earnings growth expectation of 12.5% and delivered an earnings surprise of 58%, on average, in the trailing four quarters.

Over the past year, Sierra Wireless has gained 18.3%. Earnings estimates for the current year for the stock have moved up 68.8% since April 2021. The company continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Nokia Corporation NOK, carrying a Zacks Rank #2, is another solid pick for investors. Earnings estimates for the current year for the stock have moved up 40% since April 2021.

Nokia pulled off a trailing four-quarter earnings surprise of 205.2%, on average. It has moved up 28.1% in the past year. Nokia is well-positioned for the ongoing technology cycle given the strength of its end-to-end portfolio. The company’s deal win rate is encouraging with notable successes in the key 5G markets of the United States and China.

Viasat, Inc. VSAT, carrying a Zacks Rank #2, is another key pick. It pulled off a trailing four-quarter earnings surprise of 129.9%, on average. The company attracts millions of U.S. consumers and enterprises by its high-quality broadband service.

Viasat’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. Viasat has a competitive advantage in bandwidth economics, global coverage, flexibility and bandwidth allocation, which makes it believe that mobile broadband will act as a profit churner.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

Viasat Inc. (VSAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research