Vertex Energy Inc (VTNR) Faces Net Loss in Q4 and Full Year 2023 Amid Renewables Segment Challenges

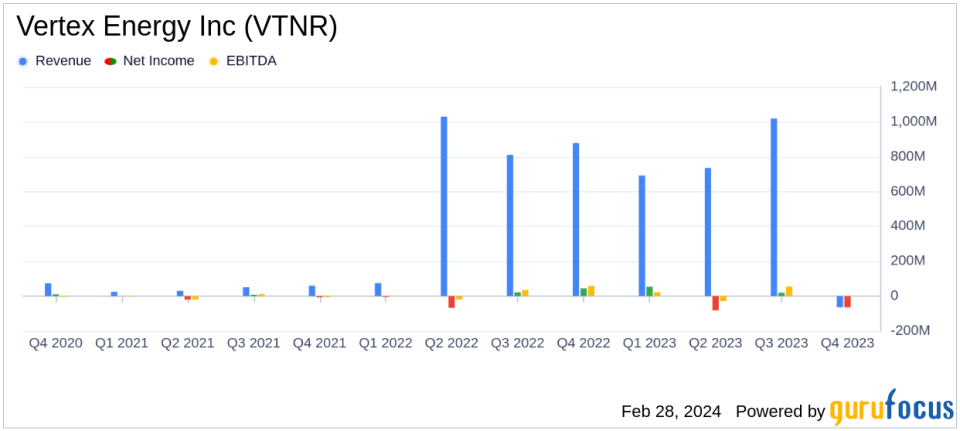

Net Loss: Vertex Energy Inc (NASDAQ:VTNR) reported a Q4 2023 net loss of $63.9 million, a stark contrast to the net income of $44.4 million in Q4 2022.

Adjusted EBITDA: Q4 Adjusted EBITDA plummeted to ($35.1) million from $75.2 million in the same period last year.

Full-Year Performance: The full-year 2023 net loss stood at ($71.5) million compared to ($4.8) million in 2022, with Adjusted EBITDA at $17.1 million versus $161.0 million.

Renewables Segment: Elevated costs for RBD soybean oil feedstock and increased corporate expenses for business expansion impacted the Renewables segment.

Liquidity Position: As of December 31, 2023, VTNR had a net debt position of $205.5 million with a net debt to trailing twelve-month Adjusted EBITDA ratio of 12.0 times.

On February 28, 2024, Vertex Energy Inc (NASDAQ:VTNR), a leading environmental services company specializing in the recycling of industrial waste streams and off-specification commercial chemical products, released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company operates primarily through its Refining and Marketing, and Recovery segments, with the former being the major revenue generator.

Financial Performance Overview

VTNR's fourth quarter saw a significant downturn, with a net loss attributable to the company of ($63.9) million, or ($0.84) per fully-diluted share, compared to a net income of $44.4 million, or $0.07 per fully-diluted share in the fourth quarter of 2022. The full-year figures also reflected a downturn, with a net loss of ($71.5) million, a substantial decline from the ($4.8) million loss in 2022. Adjusted EBITDA for the full year was $17.1 million, a decrease from $161.0 million in the previous year.

Operational Highlights and Challenges

The company's Renewables segment faced challenges due to elevated costs for RBD soybean oil feedstock and increased corporate expenses to support business expansion. Despite these challenges, VTNR's management remains focused on establishing new lines of business, expanding capabilities, and positioning for growth into new markets. The launch of Vertex Renewables and optimization of feedstocks are expected to create margin opportunities post-2024.

Strategic and Financial Developments

VTNR's CEO, Benjamin P. Cowart, highlighted the company's strategic initiatives, including the launch of Vertex Renewables and the Marine Fuels and Logistics business. These efforts are aimed at leveraging strategic integration opportunities and enhancing product value. The company's priorities moving into 2024 include increasing cash position, reducing operating costs, and improving margins.

"In 2023, we focused on establishing new lines of business, expanding our capabilities, and positioning ourselves for growth into new markets," said Mr. Cowart. "As we move into 2024, our priorities are to increase our cash position, reduce our operating costs, and improve margins."

Balance Sheet and Liquidity

As of December 31, 2023, VTNR's total debt stood at $286 million, with cash and equivalents of $80.6 million, resulting in a net debt position of $205.5 million. The company has taken steps to modify its term loan agreement, providing an additional $50.0 million in borrowings, reflected in the year-end cash position.

Looking Forward

VTNR is undergoing a strategic evaluation process that may enhance liquidity options. The company's management believes it has adequate financial flexibility to meet its needs based on the total liquidity position. Additionally, VTNR has entered into hedge positions to manage commodity price risk, covering approximately 38% of planned diesel and distillate production for the first quarter of 2024.

Vertex Energy is committed to being a leading energy transition company, producing high-quality renewable and conventional fuels. The company's innovative solutions aim to enhance performance and sustainability, shaping the future of the energy industry.

For more detailed financial information and reconciliations of non-GAAP financial measures, please refer to the full 8-K filing.

Investors and analysts are encouraged to review Vertex Energy's financial results and projections, and to attend the conference call scheduled for today at 8:30 A.M. Eastern Time.

Explore the complete 8-K earnings release (here) from Vertex Energy Inc for further details.

This article first appeared on GuruFocus.