Vertex Pharmaceuticals Will Use $100 Million to Tank Its Own Market Share. Here's Why That's a Smart Move.

Hot off the approval of its gene therapy for a pair of rare hereditary blood disorders, Vertex Pharmaceuticals (NASDAQ: VRTX) will soon have another therapy up for approval, and the financial implications are massive. But they're not massive just because it stands to crank out billions in additional revenue. Instead, the plan is to shell out the equivalent of $100 million so that the potential new drug can compete for the market share of one of its already commercialized medicines as soon as possible.

What's going on here? It's time to dig in and figure it out so that investors can decide what to do.

Is this good news actually bad news for shareholders?

Per the results of a phase 3 clinical trial reported Feb. 5, Vertex's latest candidate for treating cystic fibrosis (CF), a rare and serious genetic disease of the lung, is both safe and effective. The medicine is currently called "vanza triple" because it combines the molecule vanzacaftor and two other drugs. One of the three compounds, tezacaftor, is already in one of the company's medicines on the market, though the others aren't.

In the clinical trial, the vanza triple combo performed at least as well as Trikafta, the biopharma's best-selling product for CF. By one metric -- how much the therapy reduced the level of detectable chloride in patients' sweat -- the combo was superior, and its side effect burden comparable. That poses an interesting problem.

In 2023, Trikafta was responsible for roughly $9 billion in sales from a top line of roughly $10 billion. If the new medicine gets approval from regulators at the Food and Drug Administration (FDA), which management plans to petition for by mid-2024, Vertex will have two products in direct competition with each other on the market simultaneously. There is likely not any opportunity for patients to take both therapies at once, and it is unclear whether there is a chance that a large group of patients will respond better to the older combination than the new one.

Therefore, the probability of the vanza triple combination cannibalizing Trikafta's market share is very high. Investors may balk at any decision to proceed and go for the approval as they would rather continue milking revenue from sales of Trikafta for years and years, transitioning to a new product only when generic competitors start to encroach.

And they might balk even harder at the management-endorsed idea of expending an asset worth in the ballpark of $100 million to start the cannibalization process even faster. The asset in question is what's called a priority review voucher (PRV), which is a government-issued piece of paper that entitles the bearer to get (you guessed it) a privileged regulatory status in the review stages of the drug approval process, thereby cutting the time it takes to go from submitting the paperwork to getting a decision on commercialization by a handful of months. In recent times, many biopharmas have traded PRVs to each other, preferring to get cash rather than save time, and $100 million is the value of a typical sale.

Investors are likely to wonder why management seems to be in such a hurry to torpedo the company's most successful product.

One critical detail explains everything

Vertex isn't being impatient, nor is the decision to use the PRV a poor one. In fact, the move was carefully calculated and will likely turn out for the best for patients and shareholders alike. Here's why.

Per management, a smaller proportion of revenue from sales of the vanza triple drug will be siphoned off to pay out royalties to external parties than with its existing portfolio of CF medicines. So, by commercializing the vanza combination, the business will fatten its profit margin, even if it does not dramatically increase its revenue, because it will pay fewer royalties.

Using the PRV thus implies that management sees the earnings benefit of getting the drug to market a bit faster as being larger than the sale price of the voucher. That perspective is all the more credible when taking the royalty issue into account, as it significantly changes the economic benefit of each month the medicine spends on the market.

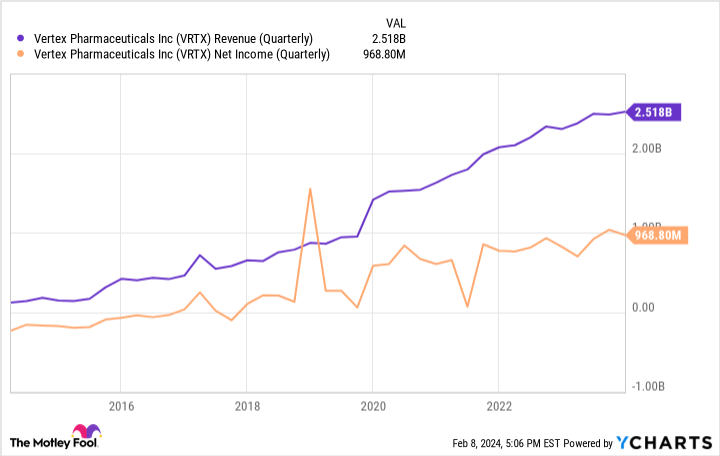

Furthermore, it's important to recognize that this isn't Vertex's first rodeo when it comes to gracefully replacing one of its older products with a shinier newer version that works a bit better. If anything, the company is an expert at cannibalizing its CF market share again and again while still growing, having commercialized four different but overlapping drugs in succession over the years. Just look at this chart:

As you can see, the previous shakeups of its CF products didn't leave shareholders in the poorhouse, and this time won't either. If anything, this is a bullish setup for the stock. After all, it'll soon be raking in even more money by serving the same core market, and patients will get better treatment, too.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Vertex Pharmaceuticals made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of February 12, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.

Vertex Pharmaceuticals Will Use $100 Million to Tank Its Own Market Share. Here's Why That's a Smart Move. was originally published by The Motley Fool