Vertex Pharmaceuticals: Shares are Under Heavy Accumulation

Vertex Pharmaceuticals Shares are a Big Money Favorite

Want an edge in investing? Follow the Big Money.

Volumes precede price. And when it comes to top-ranking stocks, institutional investors can send stocks soaring.

Fund managers are always on the lookout for the next outlier stocks…the best in class. They spend countless hours sizing up industries, reading reports, speaking to analysts…and more. When they find a company firing on all cylinders, they pounce in a big way.

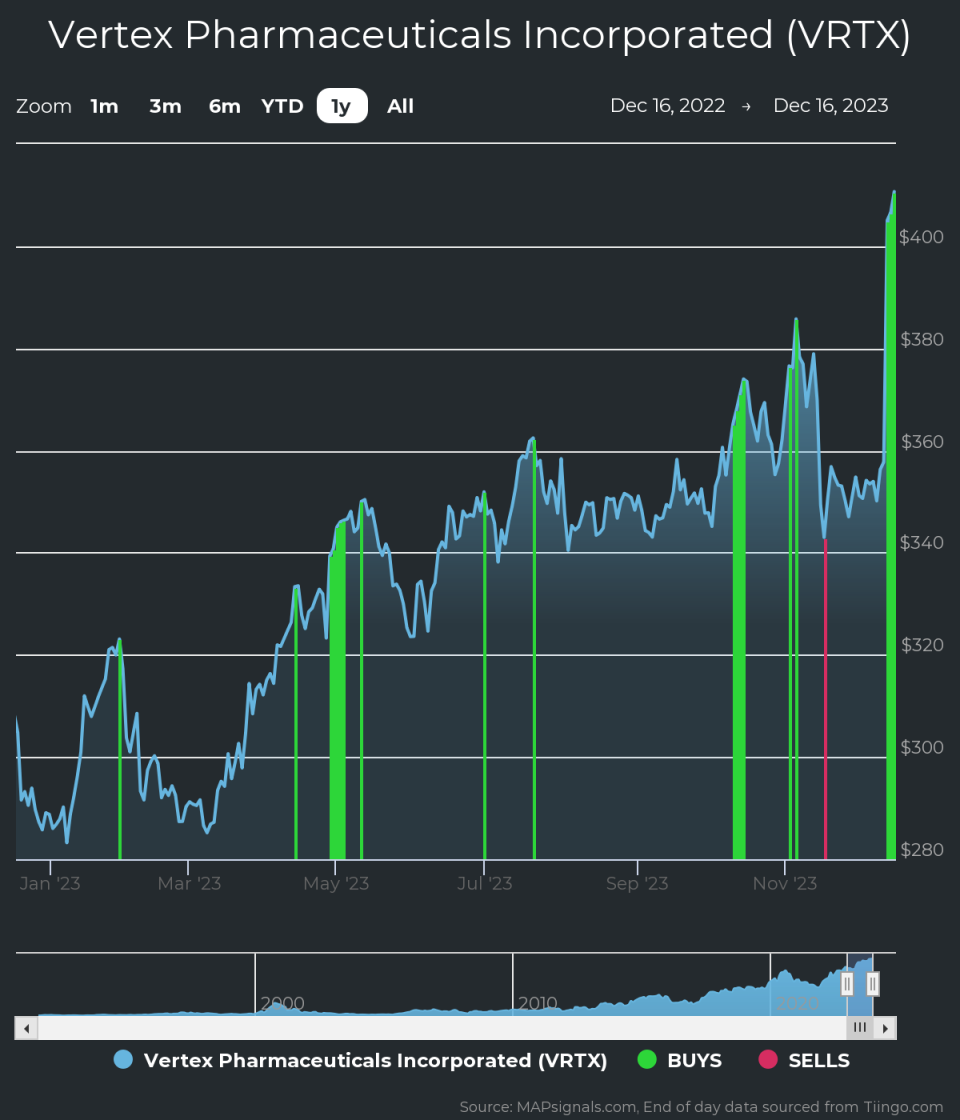

The 1-year action tells the story. Each green bar signals unusual increasing volumes in VRTX shares, pushing the stock higher. The evidence points to healthy institutional demand:

Few stocks have charts this strong. Recent green bars suggest healthy demand. Now, let’s check the fundamental story.

Vertex Pharmaceuticals Fundamental Analysis

Institutional support coupled with a healthy fundamental backdrop makes this company interesting. As you can see, VRTX has had positive sales & earnings growth in recent years:

3-year sales growth rate (+29.3%)

3-year EPS growth rate (+52.5%)

Source: FactSet

Now it makes sense why the stock has been powering higher. VRTX is an earnings powerhouse.

Marrying great fundamentals with our proprietary Big Money software has found some big winning stocks over the long-term.

Check this out. Vertex has been a top-rated stock at MAPsignals. That means the stock has had unusual buy pressure and growing fundamentals. We have a ranking process that showcases stocks like this on a weekly basis.

It’s made the rare Top 20 report many times. The blue bars below shows when VRTX was a top pick:

Tracking unusual volumes reveals the power of the MAPsignals process.

Don’t fight the Big Money!

Vertex Pharmaceuticals Price Prediction

The VRTX rally has been in place all year. Big Money buying in the shares is signaling to take notice. Given the historical gains in share price and strong fundamentals, this stock could be worth a spot in a diversified portfolio.

Disclosure: the author holds no position in VRTX at the time of publication.

If you want to take your investing to the next level, learn more about the MAPsignals process here.

This article was originally posted on FX Empire