Vertex (VRTX) Q3 Earnings Beat, Revenues Lag Estimates

Vertex Pharmaceuticals Incorporated VRTX delivered third-quarter 2019 earnings per share of $1.23, beating the Zacks Consensus Estimate of $1.14. Moreover, earnings rose 13% year over year. Strong cystic fibrosis (CF) product revenues led to higher profits in the reported quarter.

However, Vertex’s revenues of $949.8 million missed the Zacks Consensus Estimate of $952 million. But the company’s sales increased 21.1% year over year, driven by the rapid uptake of its newest CF medicine Symdeko in the United States. Symdeko is marketed under the trade name Symkevi in the EU.

Shares of Vertex have rallied 20.2% so far this year against the industry’s decline of 0.9%.

Quarter in Detail

Vertex’s third-quarter top line comprised only CF product revenues of $949.8 million. The company markets three CF medicines, namely Kalydeco (ivacaftor), Orkambi (lumacaftor-ivacaftor) and Symdeko (a combination of tezacaftor and ivacaftor). The company did not record any collaborative and royalty revenues during the reported quarter.

Symdeko/ Symkevi generated sales of $404 million in the reported quarter, reflecting a surge of 58.4% year over year. Symdeko sales growth was mainly driven by strong demand trends and the drug’s U.S. label expansion approval to treat pediatric CF patients.

Notably, in June, the FDA approved Symdeko to treat children with CF aged from six to 11 years with certain mutations in the CFTR gene. Vertex plans to submit a marketing application in Europe in the second half of 2019 to get a nod for the given patient population.

Meanwhile, Kalydeco, Vertex’s first CF medicine, generated sales of $249 million in the reported quarter, reflecting an increase of 1.2% year over year.

Vertex’s second CF medicine Orkambi generated sales of $297 million in the reported quarter, reflecting an increase of 5.3% year over year. The company also received a reimbursement approval for Orkambi in England, Spain, Australia and Scotland.

Adjusted research and development (R&D) expenses rose 5.8% to $290 million in the third quarter.

Adjusted selling, general and administrative (SG&A) expenses escalated 20.9% to $127 million in the reported quarter.

2019 Revenue Guidance

Vertex maintained its 2019 outlook for sales from CF products and the combined operating costs.

The company expects total revenues for CF products in the range of $3.70-3.75 billion, unchanged from prior expectations.

We remind investors that last week, when Trikafta received the FDA approval, the company updated and provided CF revenue guidance of $3.70-3.75 billion compared with $3.60-3.70 billion issued during the second quarter of 2019.

Moreover, combined adjusted research and development (R&D) plus selling, general and administrative (SG&A) expenses in 2019 are anticipated in the band of $1.65-$1.70 billion, unchanged from the previous view.

Recent Developments

In October 2019, the FDA approved Vertex’s tripel combo regimen Trikafta (elexacaftor/tezacaftor/ivacaftor and ivacaftor) for the treatment of CF in patients aged12 years and above with at least one copy of the F508del mutation in their CFTR gene. The FDA approval came five months ahead of the scheduled PDUFA date in March 2020. With the approval of the triple-combo regime, Vertex can address a significantly larger CF patient population — almost 90% of patients with CF — in the future. Trikafta is Vertex's fourth medicine to be approved by the FDA to treat the underlying cause of CF.

A regulatory application in the EU seeking approval of elexacaftor/tezacaftor/ivacaftor combination regimen was filed in the quarter. On Oct 31, 2019, the European Medicines Agency (EMA) validated the marketing authorization for the same application.

On third-quarter conference call, management stated that the first patient was already prescribed Trikafta by the physicians. Notably, a large proportion of patients currently on Kalydeco, Orkambi or Symdeko will switch to Trikafta over time, underscoring a strong interest in the medicine.

Meanwhile, phase III studies are underway to evaluate VX-445 triple combination regimens in six to 11-yearold children with CF for F508del/Min as well as to address F508del homozygous patients.

In October 2019, Vertex acquired the privately-held biotech Semma Therapeutics for an all-cash deal worth $950 million. This acquisition added pre-clinical cell-based treatment candidates for type I diabetes to Vertex’s pipeline.

Other Pipeline Updates

Vertex’s non-CF pipeline, though in early stage, looks interesting with treatments being developed for beta thalassemia, sickle cell disease, alpha-1 antitrypsin deficiency (AAT), APOL1-mediated kidney diseases and pain.

Notably, Vertex has a partnership with CRISPR Therapeutics CRSP to evaluate an investigational gene editing treatment, CTX001, for the two devastating diseases, namely sickle cell disease and thalassemia. Enrollment is currently ongoing in phase I/II studies on CTX001 for beta thalassemia and sickle cell disease. Both companies plan to provide the first clinical data from these studies in the fourth quarter of 2019.

Vertex plans to begin a phase II proof-of-concept study on its first oral small molecule corrector VX-814 for the treatment of alpha-1 antitrypsin (AAT) deficiency. The study will enroll around 50 patients with AAT deficiency, who have two Z mutations. The company plans to announce data from the same in 2020. The company also has a second AAT corrector, VX-864, currently in phase I development for the treatment of AAT deficiency.

Vertex is conducting a phase I study on VX-961, a NaV1.8 inhibitor, to address various pain indications.

Another phase I study is evaluating Vertex’s investigational candidate VX-147 in healthy volunteers for the treatment of APOL1-mediated focal segmental glomerulosclerosis (FSGS) and other serious kidney diseases. If successful, the company plans to initiate a phase II proof-of-concept study on the candidate in 2020.

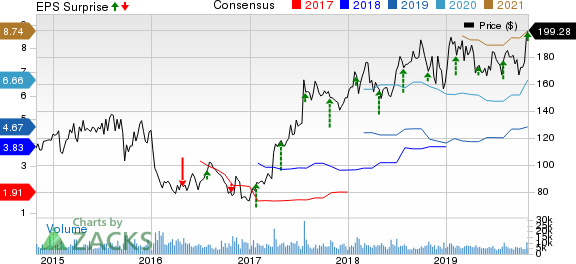

Vertex Pharmaceuticals Incorporated Price, Consensus and EPS Surprise

Vertex Pharmaceuticals Incorporated price-consensus-eps-surprise-chart | Vertex Pharmaceuticals Incorporated Quote

Zacks Rank & Other Stocks to Consider

Vertex currently sports a Zacks Rank #1 (Strong Buy). Other top-ranked stocks from the healthcare sector include Acorda Therapeutics, Inc. ACOR and Anika Therapeutics Inc. ANIK, both flaunting a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Acorda’s loss per share estimates have been narrowed 20.4% for 2019 and 43% for 2020 over the past 60 days.

Anika’s earnings estimates have been revised 16% upward for 2019 and 19.1% for 2020 over the past 60 days. The stock has skyrocketed 107.3% year to date.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Acorda Therapeutics, Inc. (ACOR) : Free Stock Analysis Report

Anika Therapeutics Inc. (ANIK) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research