VF Corp (NYSE:VFC) Misses Q3 Revenue Estimates, Stock Drops

Lifestyle clothing conglomerate VF Corp (NYSE:VFC) fell short of analysts' expectations in Q3 FY2024, with revenue down 16.2% year on year to $2.96 billion. It made a non-GAAP profit of $0.57 per share, down from its profit of $1.12 per share in the same quarter last year.

Is now the time to buy VF Corp? Find out by accessing our full research report, it's free.

VF Corp (VFC) Q3 FY2024 Highlights:

Revenue: $2.96 billion vs analyst estimates of $3.25 billion (8.9% miss)

EPS (non-GAAP): $0.57 vs analyst expectations of $0.78 (27.1% miss)

Free Cash Flow of $1.10 billion is up from -$217.4 million in the previous quarter

Gross Margin (GAAP): 55.1%, in line with the same quarter last year

Market Capitalization: $6.43 billion

Bracken Darrell, President and CEO, said: "Our third quarter top-line performance was disappointing. However, we are confident the actions we are implementing as part of Reinvent will enable VF to stabilize and then grow revenue and improve operational performance across brands and regions. We have already begun to see the impact of our efforts to right-size the company’s cost structure and improve its inventory position, resulting in stronger than expected cash flow and expanded gross margin in the quarter. This quarter marked the beginning of the next phase of our transformation plan: resetting the marketplace for Vans, reviewing our brand portfolio and continuing to build the organization of the future. As we approach the end of this fiscal year, my confidence in VF’s future is rising. "

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE:VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

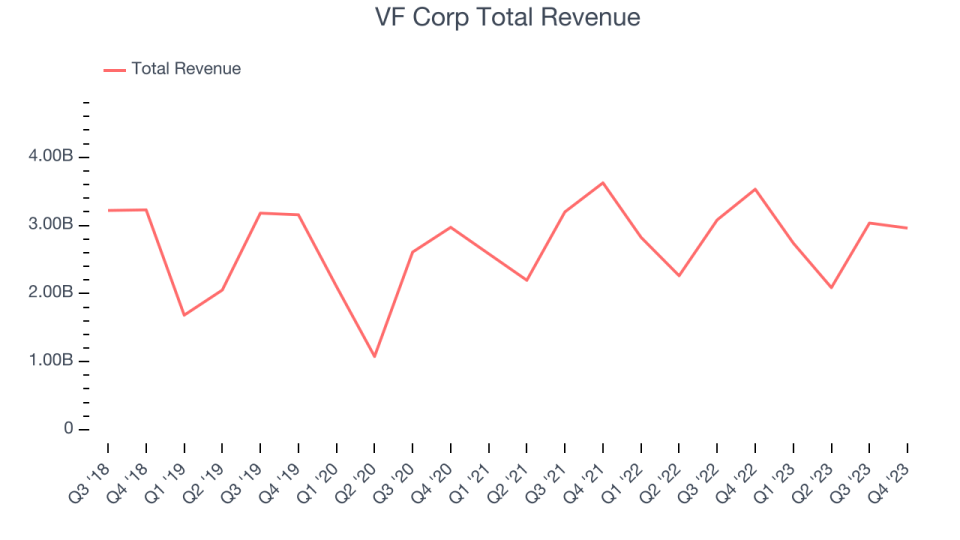

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. VF Corp's revenue was flat over the last 5 years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. VF Corp's recent history shows a reversal from its 5-year trend, as its revenue has shown annualized declines of 3.4% over the last 2 years.

VF Corp also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last 2 years, its constant currency sales were flat. Because this number is higher than its revenue growth during the same period, we can see that macroeconomic challenges hindered VF Corp's top-line performance.

This quarter, VF Corp missed Wall Street's estimates and reported a rather uninspiring 16.2% year-on-year revenue decline, generating $2.96 billion of revenue. Looking ahead, Wall Street expects sales to grow 2.9% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

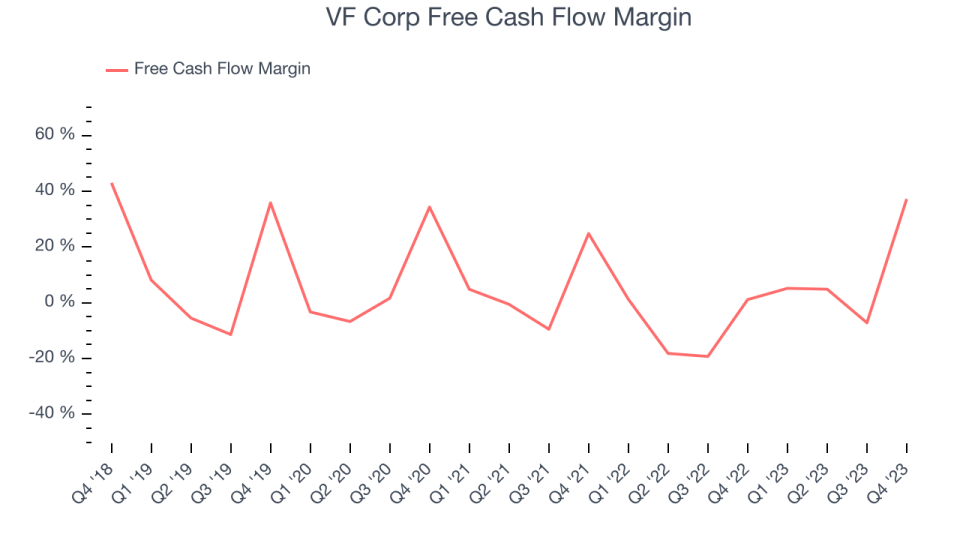

Over the last two years, VF Corp broke even from a free cash flow perspective, subpar for a consumer discretionary business.

VF Corp's free cash flow came in at $1.10 billion in Q3 equivalent to a 37.2% margin, up 2,639% year on year. The gain was so large because VF Corp is a seasonal business, and during 2023, it was in a slump.

Key Takeaways from VF Corp's Q3 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS unfortunately missed analysts' expectations. This underperformance was driven by declines at The North Face ($1.2 billion of revenue vs estimates of $1.3 billion) and Vans ($668 million of revenue vs estimates of $720 million). Overall, the results could have been better. The company is down 6.1% on the results and currently trades at $15.93 per share.

VF Corp may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.