Viasat (VSAT) Offers Business Update, Affirms FY24 & FY25 View

Viasat, Inc. VSAT recently offered an update on key operational metrics and reiterated its guidance for fiscal 2024 and fiscal 2025. With the realization of synergistic benefits from the successful integration of Inmarsat over the next fiscal year, the company expects to reach the inflection point of sustainable positive free cash flow in the first half of 2025 rather than the second half, as anticipated earlier. Such positive feelers seemed to have hit the right investor chords, as share prices were up nearly 7.5% to close at $16.20 as of Oct 12, 2023.

In fiscal 2025, Viasat expects to record synergies to the tune of $80 million in annual operating expenses and around $110 million in annual capital expenditures from the Inmarsat buyout. The company will fully realize these benefits in fiscal 2025, contrary to earlier expectations of a three-year window.

The company further revealed that despite a mechanical deployment issue on the ViaSat-3 F1 satellite, the payload was fully functional. However, the company expects to recover less than 10% of the planned throughput on ViaSat-3 F1. Nevertheless, management believes that improved flexibility and agility of its integrated satellite fleet, the addition of the next two ViaSat-3 generation satellites, ground network mitigations and third-party bandwidth commitments will enable the company to fulfill the current and future needs of its mobility customers.

In addition, the company projected capital expenditures in fiscal 2025 to decrease year over year in the range of $1.4-$1.5 billion, owing to lower outlays on the ViaSat-3 constellation. As of Sep 30, 2023, Viasat had a liquid balance of $3 billion, including approximately $2.0 billion of cash, cash equivalents and short-term investments with no near-term debt maturities.

Viasat’s Satellite Services business is progressing well with key metrics, including ARPU (average revenue per user) and revenues, showing impressive growth. ARPU is growing on the back of a solid retail distribution network, which accounts for a rising proportion of high-value and high-bandwidth subscriber base. Furthermore, the growing adoption of in-flight Wi-Fi services in commercial aircraft is proving conducive to business growth.

Viasat’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. It has a competitive advantage in bandwidth economics, global coverage, flexibility and bandwidth allocation, which makes it believe that mobile broadband will act as a profit churner with a significant improvement in in-flight connectivity (IFC) revenues.

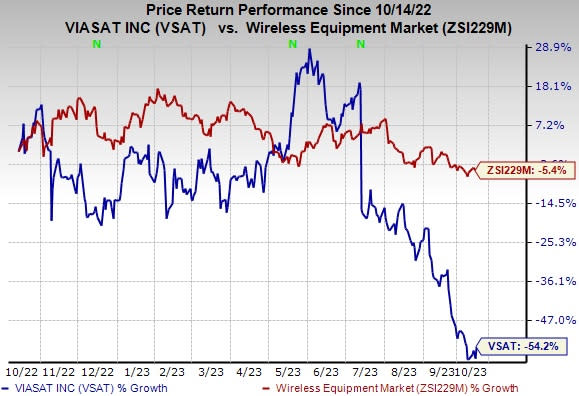

The stock has lost 54.2% over the past year compared with the industry fall of 5.4%.

Image Source: Zacks Investment Research

Viasat currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Ubiquiti Inc. UI, carrying a Zacks Rank #2, is another key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices.

Ubiquiti boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2, delivered an earnings surprise of 5.62%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 5.58%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Viasat Inc. (VSAT) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report