Viasat (VSAT) to Power IFE Connectivity in Malaysia Airlines

Viasat Inc. VSAT has secured a prime contract for Ka-band satellite in-flight entertainment (IFE) solutions from Malaysia Airlines for an undisclosed amount. The IFE services will aim to offer enhanced Internet capabilities with best-in-class in-flight entertainment options and likely contribute to the uptrend in leisure air travel demand.

Per the deal, Malaysia Airlines — the national carrier of Malaysia — will use Viasat’s Ka-band IFE solutions in its new Boeing 737-8 fleet. The solutions will enable high-quality, high-speed Internet and video streaming services on the personal electronic device of users to make air travel more digitally accessible and seamless. Passengers will gain access to more than 500 on-demand entertainment options and personalized shopping experiences.

Viasat’s Ka-band solutions enable business jet customers to enjoy high-speed Internet connectivity from takeoff to touchdown. It empowers aviation clients to reinforce their IFC investments and helps customers stay connected with smooth web browsing and streaming services. Equipped with unrivaled speed and quality, Viasat’s Ka-band service has been specifically designed to meet accretive demand for data backed by next-gen business applications. The Ka-band leverages global bandwidth to provide avant-garde Internet service with best-in-market pricing to boost the competitiveness of the business jet market.

The surging popularity of high-engagement IFE solutions has compelled leading airline companies to scout for new ways to utilize Viasat’s high-capacity satellite solutions to maximize passenger satisfaction. The company’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. With an advanced level of Internet connectivity, Malaysia Airlines will offer customers an opportunity to stream all types of video content and seamlessly access Wi-Fi aboard. In addition, it is likely to sow the seeds for future entertainment enhancements and personalization on customer seatback screens.

Viasat’s Satellite Services business is progressing well, with key metrics including steady growth of average revenue per user (ARPU) and revenues showing impressive growth. ARPU is growing on the back of a solid retail distribution network, accounting for a rising proportion of high-value and high bandwidth subscriber base. Further, the growing adoption of in-flight Wi-Fi services in commercial aircraft like Malaysia Airlines is benefiting the business.

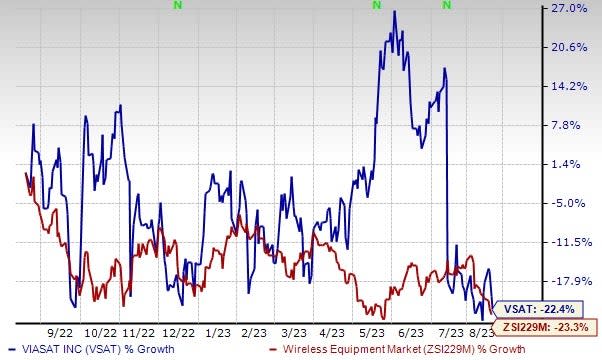

The stock has lost 22.4% in the past year compared with the industry's decline of 23.3% in the same period. Nevertheless, we are impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

T-Mobile US, Inc. TMUS, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 8.8% in the last reported quarter. It has a VGM Score of B.

Headquartered in Bellevue, WA, T-Mobile is a national wireless service provider. The company offers services under the T-Mobile, Metro by T-Mobile and Sprint brands. T-Mobile, through its subsidiaries, provides wireless services for branded postpaid and prepaid, and wholesale customers.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Keysight Technologies, Inc. KEYS is a Zacks Rank #2 stock. It has a long-term earnings growth expectation of 7.7% and delivered an earnings surprise of 9.6%, on average, in the trailing four quarters.

Based in Santa Rosa, CA, Keysight is a provider of electronic design and test instrumentation systems. The company is witnessing solid adoption of its electronic design and test solutions. Strong demand for its solutions has been a key catalyst behind robust top-line growth. Apart from strength in 5G domain, Keysight’s efforts in other emerging growth markets like Internet of Things and high-speed data centers bode well for the top line.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Viasat Inc. (VSAT) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report