Viasat (VSAT) Secures Long-Term Contract With U.S. Air Force

Viasat Inc. VSAT recently inked a multi-year agreement with the U.S. Air Force (“USAF”) to foster technology innovation and expedite the testing and integration of new technologies into air force operations.

The company is a significant part of the multi-vendor contract, which is valued at $900 million, enforceable for an initial period of around five years and extendable for an additional five years. This is the first major deal win for Viasat following its acquisition of Inmarsat earlier this year.

Given the vital importance of robust communication and security measures for defense forces, the USAF is ramping up efforts in software and hardware development to keep pace with industry advancements. VSAT’s experts will collaborate with Air Force research, development and operational communities throughout this initiative.

In a detailed breakdown, Viasat will oversee three key categories within the scope of this venture. Through the Development Planning phase, VSAT experts will chalk out a streamlined process for the rapid transition of technology into operational use. The Systems Development phase will see the testing of technologies in operational situations and the smooth incorporation of the emerging software and hardware into existing systems. The third category, Synthetic Environment Development, will involve the creation of advanced models and simulations based on real-world situations.

VSAT’s industry-leading communication portfolio that includes satellite services from its Ka-band, S-band and L-band networks will play an essential role in this endeavor as well. In summary, the company will prototype and validate a wide range of cutting-edge hardware, software and cybersecurity solutions to augment multi-domain capabilities across the Air Force, facilitating the swift deployment of these technologies.

Viasat’s Satellite Services business is progressing well with key metrics, including average revenue per user (ARPU) and revenues showing impressive growth. ARPU is growing on the back of a solid retail distribution network, which accounts for a rising proportion of high-value and high-bandwidth subscriber base. Furthermore, the growing adoption of in-flight Wi-Fi services in commercial aircraft is proving conducive to business growth.

VSAT’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. It has a competitive advantage in bandwidth economics, global coverage, flexibility and bandwidth allocation, which makes it believe that mobile broadband will act as a profit churner with a significant improvement in in-flight connectivity revenues.

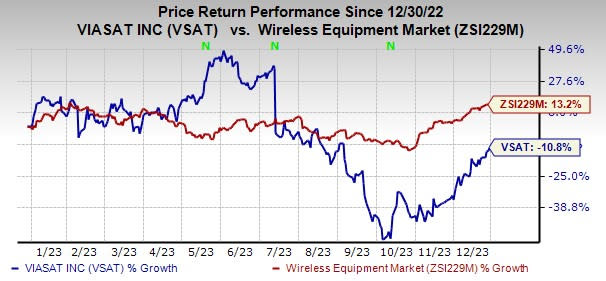

The stock has lost 10.8% over the past year against the industry's rise of 13.2%.

Image Source: Zacks Investment Research

Viasat currently has a Zacks Rank #3 (Hold).

Stocks to Consider

Model N Inc MODN, carrying a Zacks Rank #2 (Buy) at present, delivered a trailing four-quarter average earnings surprise of 20.78%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MODN provides revenue management solutions for life sciences and technology companies, including applications for configuration, price, quote, rebate management and regulatory compliance. In the last reported quarter, it delivered an earnings surprise of 3.33%.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven and data-centric approach to help customers build cloud architecture and enhance their cloud experience. Arista delivered a trailing four-quarter average earnings surprise of 12%.

ANET holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is gaining market traction in 200 and 400-gigabit high-performance switching products and is well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

NVIDIA Corporation NVDA, currently carrying a Zacks Rank #2, delivered a trailing four-quarter average earnings surprise of 18.99%. In the last reported quarter, it delivered an earnings surprise of 19.64%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Viasat Inc. (VSAT) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report