Viasat (VSAT) Secures UK Regulator Nod for Inmarsat Buyout

Viasat Inc. VSAT has secured provisional approval from Britain's competition regulator CMA for its proposed acquisition of Inmarsat, paving the way for the likely closure of the deal. The transaction, inked in November 2021, is valued at $7.3 billion comprising $850 million in cash, approximately 46.36 million Viasat shares valued at $3.1 billion (based on the closing price as of Nov 5, 2021) and the assumption of $3.4 billion of net debt.

With more than 40 years of experience, Inmarsat operates a diverse portfolio of mobile telecommunications satellite networks, boasting a multi-layered global spectrum spanning L-band, Ka-band and S-band airwaves. It has established itself as a key player in the mobility segment and has achieved an edge in network design with its multi-dimensional mesh network.

The buyout will create a leading communications service provider with complementary assets and enhanced scale for offering affordable, secure and reliable connectivity.

The combined company intends to integrate the spectrum, satellite and terrestrial assets of both firms to create a framework incorporating multi-band, multi-orbit satellites and terrestrial air-to-ground systems that can deliver higher speeds and greater density of bandwidth at high-demand locations like airport and shipping hubs and low latency at a lower cost.

In particular, the merged entity will boast a broad portfolio of spectrum licenses across the Ka-, L- and S-bands and a fleet of 19 satellites in service with an additional 10 spacecraft under construction and slated for launch within the next three years. The global Ka-band footprint will support bandwidth-intensive applications driven by L-band assets that support all-weather resilience and highly reliable, narrowband and IoT connectivity. It will help unlock greater value by incorporating Viasat’s state-of-the-art beamforming, end-user terminal and payload technologies and its hybrid multi-orbit space-terrestrial networking capabilities.

Viasat’s Ka-band solutions enable business jet customers to enjoy high-speed Internet connectivity from takeoff to touchdown. It empowers aviation clients to reinforce their in-flight connectivity (IFC) investments and helps customers stay connected with smooth web browsing and streaming services. Boasting unrivaled speed and quality, Viasat’s Ka-band service has been specifically designed to meet the accretive demands of data backed by next-gen business applications. The Ka-band leverages global bandwidth to provide avant-garde Internet service with best-in-market pricing to boost the competitiveness of the business jet market.

The surging popularity of high-engagement IFC solutions has forced leading airline companies to scout for new ways to utilize Viasat’s high-capacity satellite solutions to maximize passenger satisfaction. The company’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. With an advanced level of Internet connectivity, airline carriers will offer customers an opportunity to stream all types of video content and seamlessly access free Wi-Fi aboard on air. In addition, it is likely to sow the seeds for future entertainment enhancements and personalization on customer seatback screens.

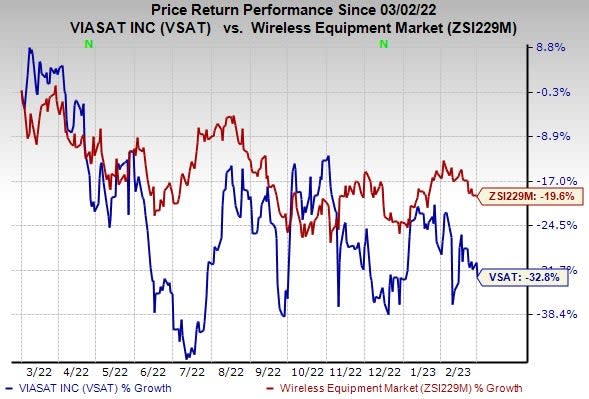

The stock has lost 32.8% over the past year compared with the industry's fall of 19.6%.

Image Source: Zacks Investment Research

Viasat currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is likely to benefit from the strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 17.5% and delivered an earnings surprise of 12.7%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

United States Cellular Corporation USM carries a Zacks Rank #2 (Buy). Headquartered in Chicago, IL, U.S. Cellular is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve efficiency of government operations.

U.S. Cellular has taken concrete steps to accelerate subscriber additions and improve churn management. The company aims to offer the best wireless experience to customers by providing superior quality network and national coverage. It is well-positioned to support the investment required for network enhancements, including the deployment of 5G technology. The company is well-positioned for continued demand for broadband services.

Viavi Solutions Inc. VIAV, carrying a Zacks Rank #2, is another key pick. Headquartered in Scottsdale, AZ, Viavi is a leading provider of network test, monitoring and service enablement solutions to diverse sectors across the globe. The product portfolio of the company offers end-to-end network visibility and analytics that help build, test, certify, maintain, and optimize complex physical and virtual networks.

Viavi also offers high-performance thin film optical coatings for light-management solutions used in anti-counterfeiting, 3D sensing, electronics, automotive, defense and instrumentation markets. It delivered an earnings surprise of 9.1%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Viasat Inc. (VSAT) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Viavi Solutions Inc. (VIAV) : Free Stock Analysis Report