Viatris Inc (VTRS) Meets 2023 Financial Targets and Sets Course for Continued Growth in 2024

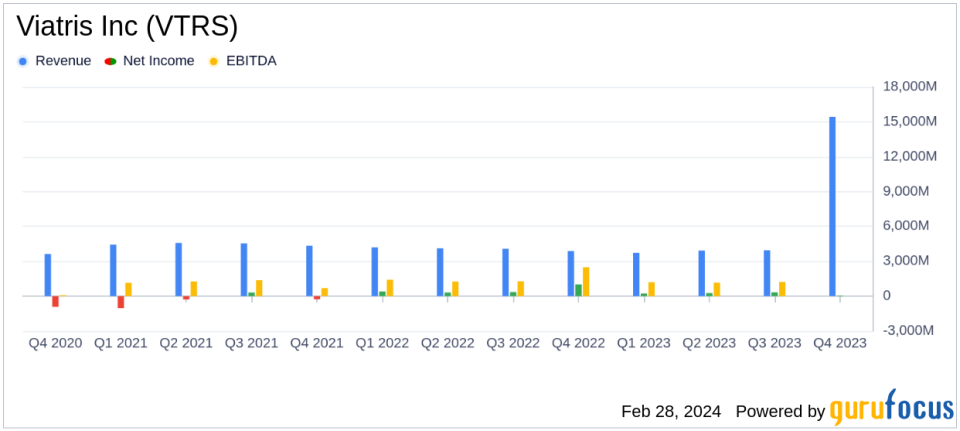

Total Revenues: Reported 2023 total revenues of $15.4 billion, meeting the adjusted guidance range.

Net Earnings: U.S. GAAP net earnings stood at $54.7 million for the year.

Adjusted EBITDA: Achieved $5.1 billion, within the adjusted guidance range.

Free Cash Flow: Generated a robust $2.4 billion in free cash flow.

Operational Revenue Growth: Recorded third consecutive quarter of operational revenue growth on a divestiture-adjusted basis.

Share Repurchases: Completed $250 million in share repurchases with an additional $1 billion authorized by the Board.

Dividend Policy: Maintained at 48 cents per share for 2024 with a first-quarter dividend declared at 12 cents per share.

On February 28, 2024, Viatris Inc (NASDAQ:VTRS) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, a global healthcare giant formed through the merger of Mylan and Upjohn, a Pfizer subsidiary, reported meeting its 2023 guidance for total revenues, adjusted EBITDA, and free cash flow. Viatris, which operates in over 165 countries, is known for its large portfolio of generic and specialty drugs, including well-known products like Lipitor, Norvasc, Lyrica, and Viagra.

Financial Performance and Strategic Developments

Viatris CEO Scott A. Smith highlighted the company's strong operational results and the successful execution of its strategy, leading to the third consecutive quarter of operational revenue growth. The company's financial position was further bolstered by strategic collaborations, such as the one with Idorsia, which added two Phase 3 assets with blockbuster potential. CFO Sanjeev Narula emphasized the company's solid financial year, with substantial cash flow enabling commitments in debt paydown, business development, and capital return.

The company's financial achievements are particularly significant given the competitive nature of the Drug Manufacturers industry. Viatris' ability to meet its financial guidance demonstrates operational efficiency and strategic foresight in a market characterized by intense competition and regulatory challenges.

Income Statement and Balance Sheet Highlights

Viatris reported a total revenue of $15.4 billion for 2023, aligning with its adjusted guidance range. The U.S. GAAP net earnings were $54.7 million, with an adjusted EBITDA of $5.1 billion. The company's operational activities generated a U.S. GAAP net cash provided by operating activities of $2.8 billion and a free cash flow of $2.4 billion.

These metrics are crucial for Viatris as they reflect the company's profitability, operational efficiency, and ability to generate cash to fund operations, pay down debt, and return capital to shareholders. The reported growth in operational revenue on a divestiture-adjusted basis also indicates the company's core business strength, despite divestitures.

"2023 was an outstanding year for Viatris in which we delivered strong operational results, streamlined the Company and finished the year with our third consecutive quarter of operational revenue growth," said Viatris CEO Scott A. Smith.

"The Company had another solid year, we met our financial guidance and continued to generate strong and durable cash flow," added Viatris CFO Sanjeev Narula.

Looking Ahead

For 2024, Viatris projects total revenues to range between $15.25 billion and $15.75 billion, with an adjusted EBITDA of $4.8 billion to $5.1 billion, and free cash flow expectations set at $2.3 billion to $2.7 billion. The company's adjusted EPS is forecasted to be between $2.70 and $2.85. These projections are based on key exchange rates and do not include potential costs related to pending divestitures or acquired IPR&D.

Viatris' guidance for the upcoming year reflects a cautious yet optimistic outlook, considering the dynamic nature of the pharmaceutical industry and the company's strategic initiatives. The focus on returning capital to shareholders through dividends and share repurchases, while investing in growth opportunities, underscores Viatris' commitment to creating value for its stakeholders.

In conclusion, Viatris Inc (NASDAQ:VTRS) has demonstrated financial resilience and strategic agility in its 2023 performance. With a solid foundation and a clear vision for the future, the company is well-positioned to navigate the complexities of the pharmaceutical industry and continue its growth trajectory in 2024 and beyond.

Explore the complete 8-K earnings release (here) from Viatris Inc for further details.

This article first appeared on GuruFocus.