Viatris (VTRS) Wins in Court Against AstraZeneca's Symbicort

Viatris Inc. VTRS announced that the company and partner Kindeva Drug Delivery L.P. have won a court decision that invalidates AstraZeneca's AZN patent for Symbicort.

The U.S. District Court for the Northern District of West Virginia found that AstraZeneca's Symbicort patent, U.S. Patent No. 10,166,247, is invalid on two separate grounds — lack of written description and lack of enablement.

With the court’s decision, Viatris gets a chance to launch its generic version of the same drug.

We note that Mylan Pharmaceuticals Inc., a Viatris subsidiary, received approval from the FDA for its abbreviated new drug application for Breyna (budesonide and formoterol fumarate dihydrate inhalation aerosol), the first approved generic version of AstraZeneca's Symbicort.

Breyna, a drug-device combination product, is indicated for certain patients with asthma or chronic obstructive pulmonary disease and will be available in 160 mcg/4.5 mcg and 80 mcg/4.5 mcg dosage strengths.

The latest court decision marks the fourth Symbicort patent to be found either not infringed or invalid. In May, after Viatris and Kindeva won an appeal, AstraZeneca stipulated that budesonide/formoterol fumarate dihydrate products would not infringe U.S. Patent Nos. 7,759,328, 8,143,239, and 8,575,137.

Viatris recently reported mixed results for the third quarter, with revenues missing expectations due to the negative impact of the foreign exchange rate.

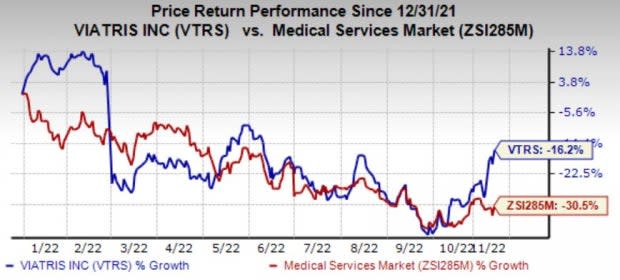

Viatris’ stock has lost 16.2% in the year so far compared with the industry’s decline of 32.8%.

Image Source: Zacks Investment Research

Nevertheless, shares surged on Nov 7 after the company announced that it intends to create an ophthalmology franchise by acquiring Oyster Point Pharma and Famy Life Sciences for an aggregate of $700-$750 million in cash.

Per the terms, Viatris has agreed to acquire Oyster Point for $11 per share in cash upfront through a tender offer.

Viatris expects to close this acquisition by the first quarter of 2023. Concurrently, Viatris also expects to acquire Famy Life Sciences, which has a complementary ophthalmology portfolio.

Viatris anticipates the acquisitions to add at least $1 billion in net sales by 2028.

Viatris currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the biotech space include Syndax Pharmaceuticals SNDX and Puma Biotechnology PBYI. While Syndax sports a Zacks Rank #1 (Strong Buy), Puma carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, loss estimates for Syndax have narrowed to $2.59 from $2.68. Syndax also surpassed estimates in each of the trailing four quarters, with the average being 95.39%.

Over the past 60 days, loss estimates for Puma have narrowed to 6 cents from 16 cents. Puma also surpassed estimates in three of the trailing four quarters, with the average being 201.37%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

Viatris Inc. (VTRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research