Viavi Solutions Inc (VIAV) Reports Mixed Fiscal Q2 2024 Results Amid Market Challenges

Net Revenue: $254.5 million, a decrease of 10.5% year-over-year.

GAAP Operating Margin: Increased to 8.8%, up from 8.0% in the same quarter last year.

Non-GAAP Operating Margin: Declined to 13.2%, down from 16.2% year-over-year.

GAAP EPS: Rose to $0.05, marking a 25.0% increase compared to the same period last year.

Non-GAAP EPS: Decreased to $0.11, a 21.4% drop year-over-year.

Cash Flow: Generated $20.4 million of cash flows from operations during the quarter.

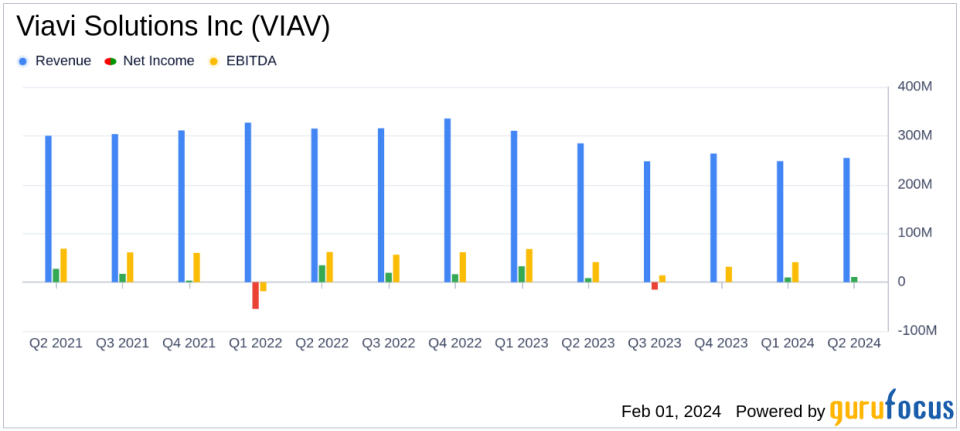

On February 1, 2024, Viavi Solutions Inc (NASDAQ:VIAV) released its 8-K filing, detailing the financial results for its second fiscal quarter ended December 30, 2023. The company, a global provider of network test, monitoring, and assurance solutions, reported a net revenue of $254.5 million, which represents a 10.5% decrease from the $284.5 million reported in the same quarter of the previous fiscal year. Despite the revenue decline, GAAP operating margin improved slightly by 80 basis points year-over-year to 8.8%, while non-GAAP operating margin decreased by 300 basis points to 13.2%.

Viavi Solutions Inc's GAAP diluted earnings per share (EPS) increased by 25.0% year-over-year to $0.05, while non-GAAP diluted EPS saw a decrease of 21.4% to $0.11. The company's President and CEO, Oleg Khaykin, commented on the results, stating, "The December quarter came in stronger than expected... In the near term, we expect stronger demand in the above segments to help offset continued weakness in Service Provider spend."

Financial Performance Overview

Viavi Solutions Inc's performance in the second quarter of fiscal 2024 reflects the challenges faced by the hardware industry, including market consolidation and shifts in technology demand. The company's revenue from its Network Enablement segment was $155.5 million, a 15.2% decrease year-over-year, while the Service Enablement segment saw a slight increase of 1.3% to $24.1 million. The Optical Security and Performance Products segment also experienced a decline of 3.2% to $74.9 million.

Geographically, the Americas, Asia-Pacific, and EMEA regions contributed 40.5%, 31.2%, and 28.3%, respectively, to the total net revenue for the quarter. As of December 30, 2023, Viavi Solutions Inc held $571.8 million in total cash, short-term investments, and short-term restricted cash, and had a total net carrying value of debt at $729.1 million.

The company's balance sheet remains robust with $965.3 million in total current assets and a total stockholders' equity of $728.0 million. For the upcoming third quarter of fiscal 2024, Viavi Solutions Inc expects net revenue to be between $245 million to $253 million and non-GAAP EPS to be between $0.05 to $0.09.

Analysis and Outlook

Viavi Solutions Inc's mixed financial results highlight the company's resilience in a challenging market environment. The increase in GAAP operating margin suggests improved operational efficiency, while the decline in non-GAAP operating margin and EPS reflects the ongoing market pressures and competitive landscape. The company's focus on high-demand segments such as 400G/800G Fiber, Mil/Aero, and SE products may provide a buffer against the weakness in Service Provider spending.

Value investors may find Viavi Solutions Inc's strong cash position and positive cash flow generation appealing, as these factors indicate the company's ability to navigate market volatility and invest in growth opportunities. The expected revenue range for the next quarter suggests cautious optimism, as the company continues to adapt to market dynamics.

For detailed insights into Viavi Solutions Inc's financial performance and strategic direction, investors and potential GuruFocus.com members are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Viavi Solutions Inc for further details.

This article first appeared on GuruFocus.