Vice President and CFO Gail Sasaki Sells 3,292 Shares of Netlist Inc

On September 6, 2023, Gail Sasaki, Vice President and CFO of Netlist Inc (NLST), sold 3,292 shares of the company. This move is part of a series of insider transactions that have been taking place over the past year.

Gail Sasaki has been with Netlist Inc for several years, serving in various roles before becoming the Vice President and CFO. Her experience and knowledge of the company's operations and financials make her trades particularly noteworthy for investors.

Netlist Inc is a leading provider of high-performance modular memory subsystems serving customers in diverse industries that require superior memory performance to empower critical business decisions. The company's solutions are used in various applications, including cloud computing, storage systems, and various server applications.

Over the past year, the insider has sold a total of 287,237 shares and purchased 0 shares. This recent sale of 3,292 shares is part of this larger trend.

The insider transaction history for Netlist Inc shows a total of 13 insider sells over the past year, with no insider buys. This could indicate a bearish sentiment among insiders, which could potentially impact the stock's performance.

On the day of the insider's recent sale, shares of Netlist Inc were trading for $1.91 apiece, giving the stock a market cap of $430.356 million.

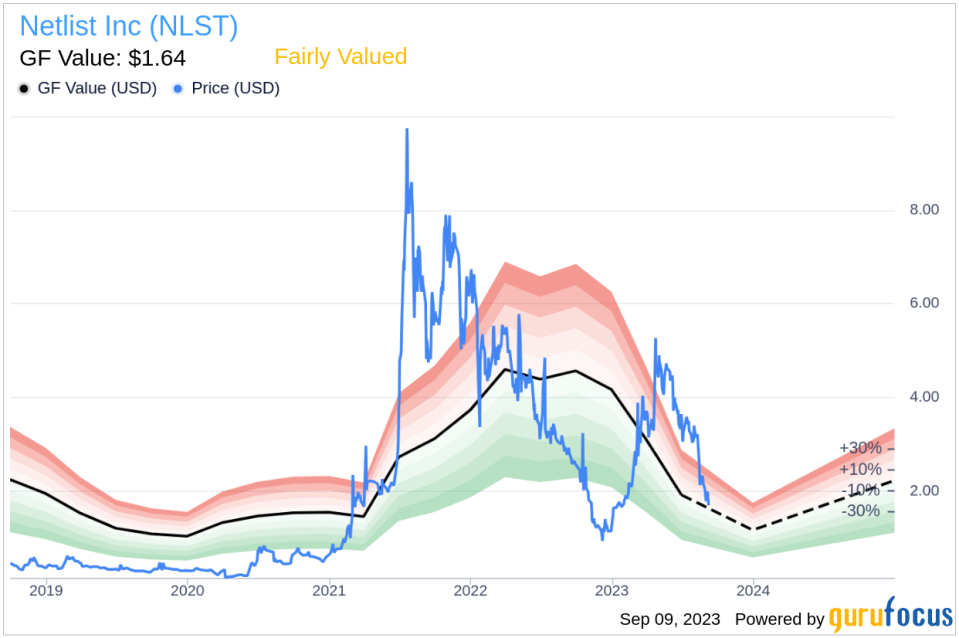

With a price of $1.91 and a GuruFocus Value of $1.64, Netlist Inc has a price-to-GF-Value ratio of 1.16. This suggests that the stock is fairly valued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The relationship between insider sell/buy activities and the stock price is complex. While a high volume of insider selling could indicate a lack of confidence in the company's future prospects, it could also be driven by personal financial planning or other non-company related factors. Therefore, while the insider's recent sale of shares is noteworthy, it should not be the sole factor considered when making investment decisions.

Investors should continue to monitor insider transactions alongside other key financial indicators and market news to make informed investment decisions.

This article first appeared on GuruFocus.