Vice President Daniel Menold Sells 21,497 Shares of CymaBay Therapeutics Inc (CBAY)

In a recent transaction on December 15, 2023, Daniel Menold, the Vice President of Finance at CymaBay Therapeutics Inc, sold 21,497 shares of the company's stock. This sale has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's financial health and future prospects.

Who is Daniel Menold of CymaBay Therapeutics Inc?

Daniel Menold serves as the Vice President of Finance at CymaBay Therapeutics Inc, a role that places him in a critical position to oversee the company's financial operations and strategy. His insights into the company's financial matters are invaluable, and his trading activities are closely monitored by investors for clues about the company's performance and outlook.

CymaBay Therapeutics Inc's Business Description

CymaBay Therapeutics Inc is a clinical-stage biopharmaceutical company focused on developing and providing access to innovative therapies for patients with liver and other chronic diseases. The company's pipeline includes advanced drug candidates that aim to improve the lives of those with severe and debilitating conditions. With a commitment to research and development, CymaBay Therapeutics Inc is at the forefront of addressing unmet medical needs in the healthcare sector.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

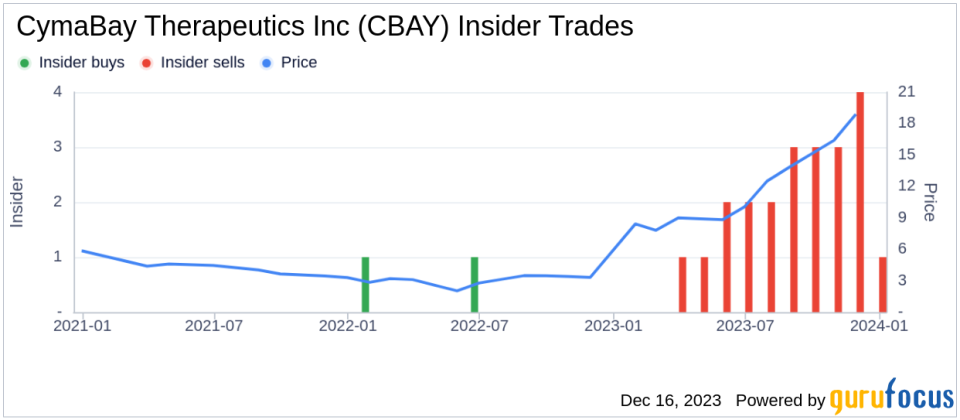

The recent sale by Daniel Menold of 21,497 shares is part of a larger pattern observed over the past year. According to the data, Menold has sold a total of 42,442 shares and has not made any purchases. This one-sided transaction history could suggest a lack of confidence in the company's short-term growth potential or simply a personal financial decision by the insider.The absence of insider buys over the past year, coupled with 22 insider sells, may raise questions among investors. Insider selling can sometimes be interpreted as a lack of confidence in the company's future prospects, although it is important to consider that insiders might sell shares for various reasons, including personal financial planning, diversification, and others that may not necessarily reflect their outlook on the company's future.On the day of Menold's recent sale, CymaBay Therapeutics Inc's shares were trading at $21.99, valuing the company at a market cap of $2.497 billion. The stock price and market cap provide a snapshot of the company's value at a specific point in time and can be influenced by a multitude of factors, including insider trading activity.

The insider trend image above illustrates the pattern of insider transactions over a period of time. This visual representation can help investors discern whether there is a trend in insider behavior that could potentially impact the stock price.

Conclusion

The sale of 21,497 shares by Vice President Daniel Menold is a significant transaction that warrants attention from CymaBay Therapeutics Inc's investors and potential investors. While insider selling can be a red flag for some, it is crucial to consider the broader context, including the company's performance, market conditions, and the insider's personal circumstances.Investors should also take into account the company's strong focus on developing treatments for liver and other chronic diseases, which could lead to long-term growth and success. As with any investment decision, it is recommended to look at a comprehensive analysis that includes, but is not limited to, insider trading activity.The relationship between insider transactions and stock price is complex and multifaceted. While Daniel Menold's recent sale may influence some investors' perceptions, it is just one piece of the puzzle. A thorough evaluation of CymaBay Therapeutics Inc's financial health, market position, and growth potential is essential for making informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.