Vicor Corp (VICR) Faces Revenue Decline in Q4; Annual Net Income Rises

Revenue: Q4 revenue fell to $92.7 million, a 12.2% decrease year-over-year.

Gross Margin: Improved to 51.1% in Q4 from 46.6% in the same period last year.

Net Income: Q4 net income increased slightly to $8.7 million from $8.1 million year-over-year.

Annual Performance: 2023 net income rose to $53.6 million, a significant increase from $25.4 million in the prior year.

Cash Flow: Operations generated $22.1 million in Q4, up from $0.9 million year-over-year.

Backlog: Decreased to $160.8 million in Q4, down 47.2% from the same period last year.

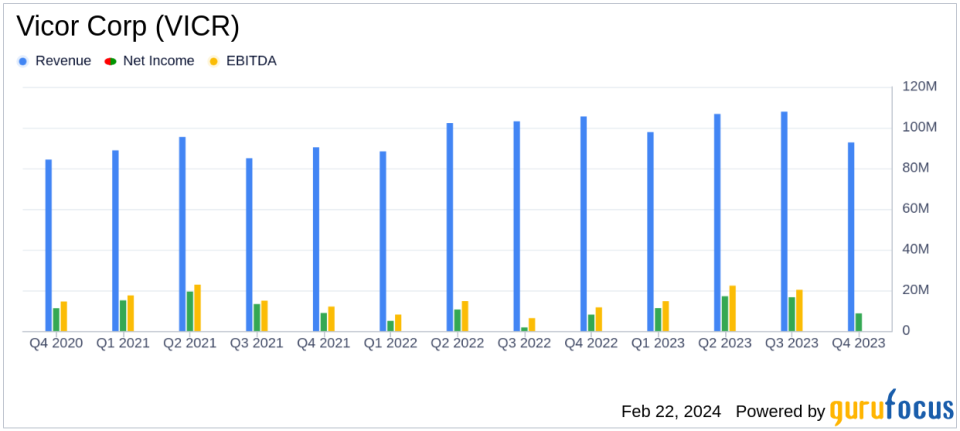

On February 22, 2024, Vicor Corp (NASDAQ:VICR) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. Vicor Corp, a leading provider of modular power components and complete power systems, reported a decrease in quarterly revenue but an increase in annual net income, reflecting both the challenges and resilience of the company.

Quarterly Financial Highlights

The fourth quarter saw a decline in revenue by 12.2% to $92.7 million compared to the same period in the previous year. This decrease was also reflected sequentially from the third quarter of 2023, which had a revenue of $107.8 million. Despite the revenue downturn, gross margin as a percentage of revenue increased to 51.1% in the fourth quarter, up from 46.6% year-over-year, although it saw a slight decrease from 51.8% in the previous quarter. Net income for the fourth quarter was $8.7 million, or $0.19 per diluted share, a marginal increase from $8.1 million, or $0.18 per diluted share, in the same period last year.

Annual Financial Achievements

For the full year of 2023, Vicor Corp achieved a 1.5% increase in revenue, totaling $405.1 million, and a significant rise in net income to $53.6 million, or $1.19 per diluted share, which is a substantial improvement from $25.4 million, or $0.57 per diluted share, in the prior year. The gross margin as a percentage of revenue also increased to 50.6% for the year. These improvements underscore the company's ability to enhance profitability despite market fluctuations.

Operational Cash Flow and Capital Expenditures

Cash flow from operations was robust in the fourth quarter, totaling $22.1 million, compared to just $0.9 million in the same period a year ago. Capital expenditures for the quarter were $7.7 million, showing consistent investment in the company's growth. Vicor's cash and cash equivalents stood at approximately $242.2 million as of December 31, 2023, marking a 6.3% sequential increase.

Backlog and Future Outlook

The company's backlog at the end of the fourth quarter was $160.8 million, a significant decrease from the previous year's $304.4 million. This reduction could signal future revenue challenges. However, CEO Dr. Patrizio Vinciarelli remains optimistic, citing strategic decisions to focus on long-term goals and the company's strong position in AI power system requirements.

"As our products and applications pipeline create demand to fill our vertically integrated foundry, we have turned down deals that would have been inconsistent with our long term strategy," said Dr. Vinciarelli.

"Our 5G product line and ChiP foundry put us well ahead of AI power system requirements, providing superior performance and scalable capacity to expand the market opportunity," he added.

Vicor's commitment to protecting its intellectual property and its strategic focus on high-performance computing, industrial equipment, and other advanced markets, positions the company to navigate the competitive landscape effectively.

Conclusion

While Vicor Corp (NASDAQ:VICR) faced a challenging fourth quarter in terms of revenue and backlog, the company's annual performance demonstrates resilience and a strong foundation for future growth. With a clear strategic direction and a focus on innovation and market leadership, Vicor is poised to continue its trajectory in the power systems industry.

For more detailed information and to participate in the earnings conference call, investors and analysts are encouraged to visit Vicor's website and register for the event.

Explore the complete 8-K earnings release (here) from Vicor Corp for further details.

This article first appeared on GuruFocus.