Victoria's Secret & Co. Reports Encouraging Q4 Results Amid Market Challenges

Net Income: Q4 net income reached $181 million, with EPS at $2.29, compared to $173 million and $2.10 in the prior year.

Net Sales: Q4 net sales increased by 3% to $2.082 billion, with an estimated $80 million attributed to an extra week in the quarter.

Gross Margin: Improved gross margin rate, driven by disciplined inventory management and supply chain modernization.

International Growth: International sales surged by 24% in Q4, highlighting the brand's global expansion success.

Share Repurchase: A new $250 million share repurchase program has been authorized, replacing the previous program.

Outlook: Fiscal year 2024 net sales are projected to be around $6.0 billion, with adjusted operating income expected between $250 million to $275 million.

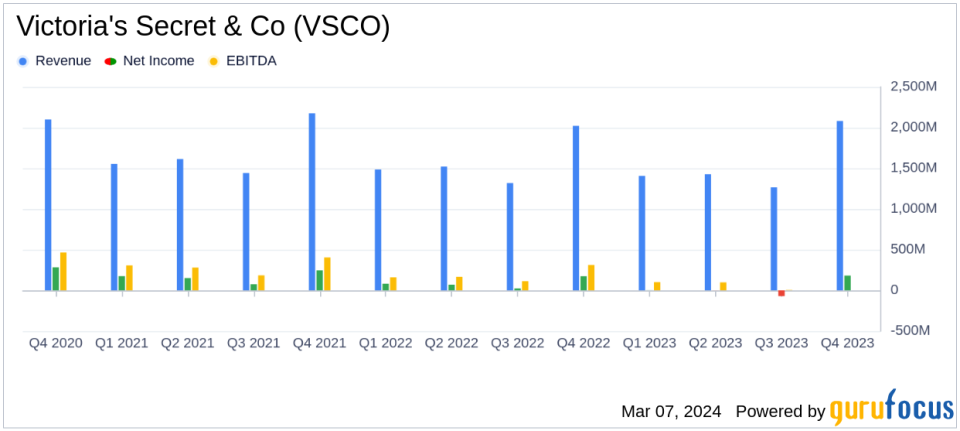

On March 6, 2024, Victoria's Secret & Co (NYSE:VSCO) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended February 3, 2024. The company, a renowned specialty retailer of lingerie, pajamas, and beauty products, reported a net income of $181 million, or $2.29 per diluted share for the fourth quarter, which was an improvement from the $173 million, or $2.10 per diluted share reported in the same period last year.

Financial Performance and Strategic Initiatives

Victoria's Secret & Co's adjusted operating income and adjusted diluted EPS were at the high end of the guidance range, indicating a strong performance in the critical holiday quarter. CEO Martin Waters praised the team's execution of strategies and customer engagement, which led to solid financial results despite volatile weekly sales trends. The company's international business continued to thrive, with a 24% increase in sales compared to the previous year, underscoring the brand's aggressive global expansion plans.

Waters emphasized the company's commitment to strategic priorities, including accelerating the core business, igniting growth, and transforming the foundation. Despite a downturn in the broader North American intimates market, Victoria's Secret & Co is focused on growth-driving initiatives such as a multi-tender loyalty program, digital customer experience enhancements, and product launches.

Financial Achievements and Challenges

Victoria's Secret & Co's financial achievements in the fourth quarter were significant, with a gross margin rate that exceeded expectations, largely due to disciplined inventory management and cost reductions from supply chain modernization. These improvements are crucial for a retailer in the cyclical industry, where margins can be heavily impacted by inventory and supply chain efficiencies.

However, the company faces challenges, including a consecutive four-quarter decline in the North American intimates market. This has led to a conservative near-term business planning approach, balancing the need for fiscal prudence with the pursuit of growth opportunities.

Income Statement and Balance Sheet Highlights

For the fourth quarter, Victoria's Secret & Co reported net sales of $2.082 billion, a 3% increase from the previous year. The company also generated $589 million in operating cash flow and reduced its debt by over $150 million year-over-year. The balance sheet reflects a strong liquidity position, ending the fiscal year with a cash balance of $270 million and a significantly reduced debt load.

Adjusted net income for the full fiscal year was $178 million, or $2.27 per diluted share, with adjusted operating income at $327 million. These figures represent a decrease from the previous year, highlighting the ongoing challenges in the retail sector.

Outlook and Share Repurchase Program

Looking ahead to fiscal year 2024, Victoria's Secret & Co forecasts net sales of approximately $6.0 billion, with adjusted operating income expected to be between $250 million and $275 million. The company also announced a new share repurchase program, authorizing the repurchase of up to $250 million of its common stock, which underscores the confidence in its long-term growth potential and commitment to delivering shareholder value.

The company's performance, strategic initiatives, and financial discipline position it to navigate the current market challenges while pursuing growth opportunities. Investors and stakeholders can expect Victoria's Secret & Co to continue leveraging its brand strength and operational improvements to drive future success.

For a more detailed analysis of Victoria's Secret & Co's financial results and strategic outlook, interested parties can join the earnings call scheduled for March 7, 2024, or visit the Investors section of the company's website.

Value investors and potential GuruFocus.com members seeking more information on Victoria's Secret & Co's financial performance can access the full earnings report and additional company insights at GuruFocus.com.

Explore the complete 8-K earnings release (here) from Victoria's Secret & Co for further details.

This article first appeared on GuruFocus.