Victory Capital Holdings Inc (VCTR) Reports Solid Q4 and Full-Year 2023 Earnings

Total Assets Under Management (AUM): Grew to $166.6 billion, marking an 8.5% increase from the previous quarter.

Adjusted EBITDA Margin: Improved to 52.3% in Q4, reflecting a 130 basis point rise for the full year to 50.9%.

GAAP Net Income: Reported at $0.82 per diluted share for Q4 and $3.12 for the full year.

Adjusted Net Income with Tax Benefit: Reached $1.15 per diluted share in Q4 and $4.51 for the full year.

Shareholder Returns: The company returned $243 million to shareholders in 2023, including a 5% increase in the regular quarterly cash dividend to $0.335 per share.

Strategic Growth: Victory Capital continued to invest in new products, capabilities, and technology, while also actively pursuing M&A opportunities.

Investment Performance: A significant portion of AUM outperformed benchmarks across various time periods, with high ratings for mutual funds and ETFs by Morningstar.

On February 8, 2024, Victory Capital Holdings Inc (NASDAQ:VCTR) released its 8-K filing, detailing its financial results for the fourth quarter and the full year ended December 31, 2023. The independent investment management firm, which operates through franchises and solutions platforms, reported a robust set of financials, underlining the strength and resilience of its business model.

Financial Highlights and Performance

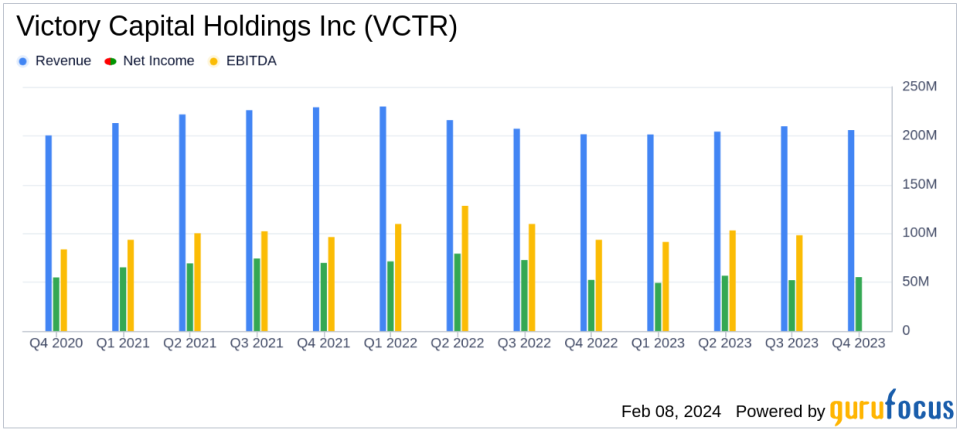

Victory Capital's AUM saw a notable increase to $166.6 billion, driven by positive market action and despite experiencing net outflows. The company's strategic growth initiatives throughout the year, including the launch of new products and technology enhancements, have contributed to its solid financial position. Adjusted EBITDA margin for the year expanded by 130 basis points to 50.9%, reflecting the company's ability to scale efficiently and manage costs effectively.

GAAP net income for the fourth quarter stood at $0.82 per diluted share, with an adjusted net income with tax benefit of $1.15 per diluted share. These figures underscore the company's profitability and its ability to generate value for shareholders, who saw a 21% increase in returns over the previous year, including a 5% hike in the quarterly dividend.

Challenges and Market Position

Despite the positive results, Victory Capital faced challenges in the form of long-term net outflows of $1.1 billion in the fourth quarter. However, the company's franchises continued to deliver strong investment performance, with a significant portion of AUM outperforming benchmarks over 3-, 5-, and 10-year periods. This performance is crucial for maintaining client trust and attracting new investments in the competitive asset management industry.

Capital Management and Future Outlook

The company ended the year with a strong balance sheet, including $124 million in cash and a total debt of approximately $1,002 million. Victory Capital's proactive capital management, as evidenced by share repurchases and dividend payments, reflects its commitment to delivering shareholder value. Looking ahead, the company remains optimistic about executing transactions aligned with its strategic growth objectives, indicating a forward-thinking approach to expansion and market positioning.

For more detailed financial information and commentary from the management, investors and interested parties are encouraged to review the full 8-K filing.

Victory Capital's earnings report highlights the company's robust financial health and strategic positioning for continued growth. For value investors and potential GuruFocus.com members, these results offer a promising outlook on the company's future performance and investment potential.

For further insights and analysis, visit GuruFocus.com, where we provide in-depth coverage of financial news and market trends.

Explore the complete 8-K earnings release (here) from Victory Capital Holdings Inc for further details.

This article first appeared on GuruFocus.