Victory Capital (VCTR) July AUM Increases 2.6% to $165.9B

Victory Capital Holdings VCTR reported assets under management (AUM) of $165.9 billion for July 2023. This reflects a 2.6% increase from $161.6 billion reported as of Jun 30, 2023.

By asset classes, at the end of July, VCTR’s U.S. Mid Cap Equity AUM rose 3.4% from the June level to $31 billion. The U.S. Small Cap Equity AUM of $16.4 billion increased 4.5%. Further, the U.S. Large Cap Equity AUM increased 2.2% to $12.4 billion. The Global/Non-U.S. Equity AUM was up 3.9% to $16 billion.

Also, Victory Capital recorded $57.5 billion in Solutions, up 2.9% from $55.8 billion reported in June 2023. Fixed Income AUM was $26.2 billion, which increased slightly from the prior month’s figure. Money Market/Short Term assets rose marginally to $3.17 billion.

Nonetheless, the Alternative Investment assets balance was down 2.1% on a sequential basis to $3.23 billion.

The sound positioning of Victory Capital’s integrated multi-boutique business model in a rapidly evolving industry and the effectiveness of the distribution platform are likely to support its performance in the coming days. Also, favorable market performance is a tailwind.

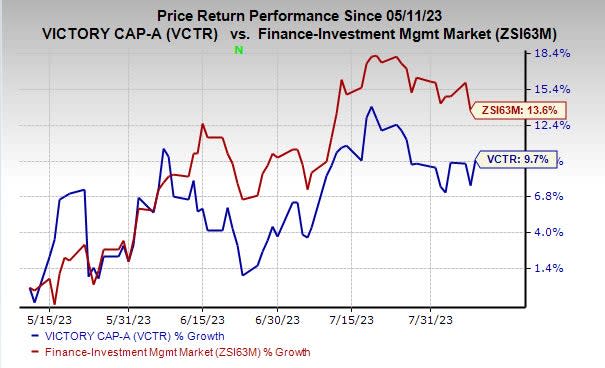

Shares of VCTR have gained 9.7% over the past three months compared with the industry's upside of 13.6%.

Image Source: Zacks Investment Research

Currently, Victory Capital carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

Cohen & Steers, Inc. CNS reported a preliminary AUM of $82.3 billion as of Jul 31, 2023, which reflected an increase of 2.4% from the prior-month level. Market appreciation of $1.86 billion and net inflows of $231 million supported the rise. However, it was partially offset by distributions of $162 million.

CNS recorded total institutional accounts of $34.43 billion at the end of July 2023, rising 3.5% from the June-end level. Of the total institutional accounts, advisory accounts were $19.53 billion while the rest were sub-advisory.

Virtus Investment Partners, Inc. VRTS recorded a sequential increase in its preliminary AUM balance for July 2023, driven by favorable market returns. The company reported a month-end AUM of $171.9 billion, which reflected a rise of 2.1% from Jun 30.

Excluded from the above-mentioned AUM balance, other fee-earning assets were $2.6 billion, to which Virtus Investment provided services.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Victory Capital Holdings, Inc. (VCTR) : Free Stock Analysis Report