Viper Energy Inc (VNOM) Posts Strong Q4 and Full Year 2023 Results

Consolidated Net Income: Q4 consolidated net income of $125.9 million; full year net income of $501.3 million.

Earnings Per Share: Q4 net income attributable to VNOM of $57.0 million, or $0.70 per common share; full year $2.69 per Class A common share.

Production: Q4 average production of 24,533 bo/d (43,783 boe/d); full year average production up 13% from the previous year.

Dividends: Declared Q4 2023 base cash dividend of $0.27 and variable cash dividend of $0.29 per Class A common share.

Share Repurchase: Repurchased 1.0 million Class A common shares in Q4 2023 for $28.7 million; full year repurchase of 3.4 million shares for $95.2 million.

Proved Reserves: Year-end 2023 proved reserves of 179,249 Mboe, up 20% year over year.

2024 Outlook: Initiating average daily production guidance for Q1 2024 of 25,000 to 25,500 bo/d and full year guidance of 25,500 to 27,500 bo/d.

Viper Energy Inc (NASDAQ:VNOM), a subsidiary of Diamondback Energy, Inc., released its 8-K filing on February 20, 2024, announcing financial and operating results for the fourth quarter and full year ended December 31, 2023. The company, formed by Diamondback Energy in 2014, owns mineral royalty interests in the Permian Basin and has shown a robust increase in production and financial performance.

Financial and Operational Performance

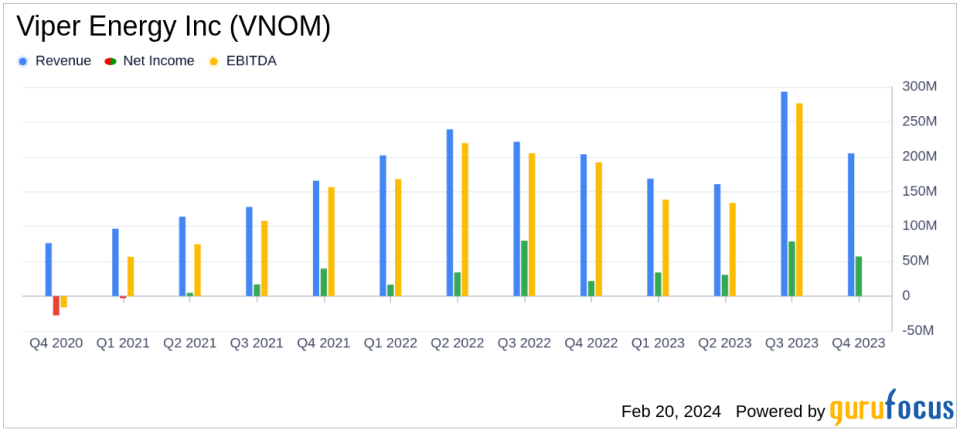

Viper Energy Inc (NASDAQ:VNOM) reported a Q4 2023 consolidated net income of $125.9 million, with net income attributable to VNOM at $57.0 million, or $0.70 per common share. The company's full year 2023 consolidated net income was a significant $501.3 million, translating to $2.69 per Class A common share. These results were bolstered by an average production of 24,533 barrels of oil per day (bo/d) in Q4 and a full year average production of 21,995 bo/d, marking a 13% increase compared to the previous year.

The company's financial achievements, including a total Q4 2023 return of capital of $61.9 million, or $0.72 per Class A common share, are critical in the oil and gas industry where consistent production and efficient capital allocation are key indicators of success. The declared dividends of $1.82 per Class A common share during the full year 2023 and the repurchase of 3.4 million common shares for $95.2 million underscore VNOM's commitment to shareholder returns.

Strategic Acquisitions and Reserves Growth

The strategic GRP acquisition closed in Q4 2023 has been a significant contributor to VNOM's growth, providing high-quality undeveloped inventory and clear visibility to future development. Proved reserves as of December 31, 2023, stood at 179,249 Mboe, an increase of 20% year over year, with oil reserves up 14% from year-end 2022. This reserve growth is a testament to the company's successful exploration and acquisition strategy.

2024 Outlook and Governance Enhancements

Looking ahead to 2024, VNOM has initiated production guidance for both Q1 and the full year, with expectations of continued production growth and a strong cost structure that should enable substantial capital return to shareholders. Additionally, the conversion into a Delaware corporation is expected to deliver increased governance rights for shareholders and position VNOM for further growth.

Financial Health and Capital Allocation

As of December 31, 2023, VNOM had a cash balance of $25.9 million and total long-term debt of $1.1 billion, resulting in net debt of $1.1 billion. The company's capital allocation strategy, including share repurchases and dividends, reflects a disciplined approach to maximizing shareholder value.

Conclusion

Viper Energy Inc (NASDAQ:VNOM)'s strong Q4 and full year 2023 results highlight the company's successful operational strategy and prudent financial management. With increased production, strategic acquisitions, and a focus on shareholder returns, VNOM is well-positioned for continued growth in 2024.

For detailed financial tables and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Viper Energy Inc for further details.

This article first appeared on GuruFocus.