Virtu Financial Inc (VIRT) Reports Mixed Fourth Quarter and Full Year 2023 Results

Q4 Net Income: $6.7 million, down from $39.6 million in Q4 2022.

Full Year Net Income: $263.9 million, a decrease from $468.3 million in 2022.

Q4 Total Revenues: Increased by 7.7% to $536.0 million.

Full Year Total Revenues: Decreased by 3.0% to $2,293.4 million.

Adjusted EBITDA Margin: Declined to 37.9% in Q4 and 46.9% for the full year.

Share Repurchase Program: $44.0 million in Q4, totaling $210.0 million for the full year.

Dividend: Quarterly cash dividend declared at $0.24 per share.

Virtu Financial Inc (NASDAQ:VIRT), a leading technology-enabled market maker and liquidity provider, released its 8-K filing on January 25, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its Market Making and Execution Services segments, reported a mixed set of financial figures, with a notable decline in net income despite an increase in total revenues for the quarter.

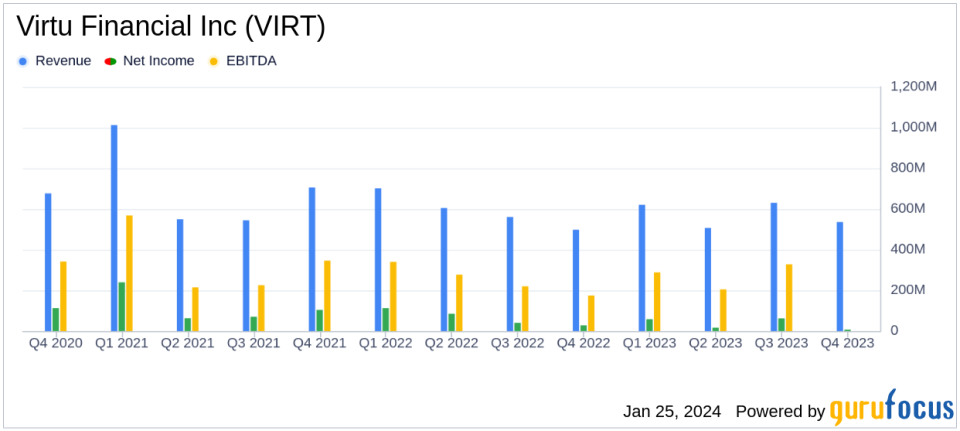

Virtu Financial's Q4 net income dropped significantly to $6.7 million from $39.6 million in the same period last year. The full year net income also saw a sharp decline to $263.9 million from $468.3 million in 2022. However, Q4 total revenues rose by 7.7% to $536.0 million, compared to $497.8 million in the prior year's quarter. Conversely, the full year total revenues decreased by 3.0% to $2,293.4 million.

The company's Adjusted EBITDA for Q4 was $99.0 million, a decrease of 20.7% from the same period in the previous year. The Adjusted EBITDA Margin also contracted to 37.9% in Q4 and 46.9% for the full year. Despite the downturn in some financial metrics, Virtu Financial continued its Share Repurchase Program, buying back $44.0 million worth of shares in Q4, culminating in a total of $210.0 million for the full year.

The Board of Directors declared a quarterly cash dividend of $0.24 per share, payable on March 15, 2024, to shareholders of record as of March 1, 2024. This move reflects the company's commitment to returning value to its shareholders despite the challenging market conditions.

Financial Condition and Market Presence

As of December 31, 2023, Virtu had a strong liquidity position with $855.5 million in cash, cash equivalents, and restricted cash. The company's total long-term debt stood at $1,751.8 million. The Share Repurchase Program has been active since November 2020, with approximately 44.2 million shares repurchased for about $1,121.8 million, leaving a remaining capacity of approximately $98.2 million for future purchases.

Virtu's performance reflects the dynamic nature of the capital markets industry, where fluctuations in trading volumes and market volatilities can significantly impact financial outcomes. The company's ability to navigate these challenges while maintaining a robust liquidity position and returning capital to shareholders is crucial for long-term stability and growth.

Investors and stakeholders are encouraged to review the detailed financial results and listen to the earnings conference call for a deeper understanding of Virtu Financial's performance and strategic direction.

For more information on Virtu Financial's financial results, including detailed segment performance and non-GAAP financial measures, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Virtu Financial Inc for further details.

This article first appeared on GuruFocus.