Virtu Financial (VIRT) Falls 1.4% Despite Q3 Earnings Beat

Virtu Financial, Inc. VIRT shares have declined 1.4% since it reported third-quarter 2023 results on Nov 2. Although it reported better-than-expected third-quarter results on the back of surging interest and dividends income, most of the figures were down from the year-ago levels. The positives were partially offset by rising operating expenses and lower Market Making adjusted net trading income concerning the investors.

It reported third-quarter 2023 adjusted earnings per share of 45 cents, which beat the Zacks Consensus Estimate by 12.5%. The bottom line, however, dropped 26.2% year over year.

VIRT’s adjusted net trading income of $298 million in the third quarter beat the consensus mark by 4.9%. The top line, however, declined 10% year over year.

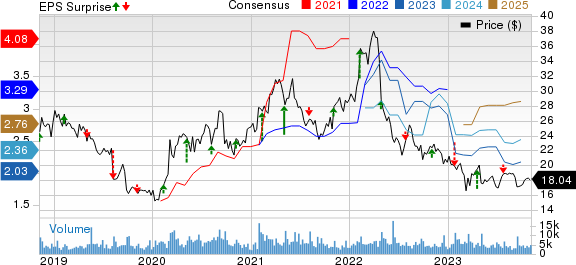

Virtu Financial, Inc. Price, Consensus and EPS Surprise

Virtu Financial, Inc. price-consensus-eps-surprise-chart | Virtu Financial, Inc. Quote

Q3 Performance Details

Revenues from commissions, net and technology services declined 8.9% year over year to $110.3 million. However, the metric beat our estimate of $103.4 million. Interest and dividends income increased 192.7% year over year in the third quarter to $127.7 million. The metric surpassed our estimate of $83.6 million.

Adjusted EBITDA amounted to $139.5 million, which fell 22.8% from the prior-year quarter but beat our estimate of $138.1 million. The adjusted EBITDA margin declined to 46.8% from 54.6% a year ago.

Total operating expenses of $492.1 million increased 7.1% from the year-ago figure and was 4.8% higher than our estimate. VIRT recorded increases in communication and data processing, interest and dividend expenses, operations and administrative costs. This was partially offset by lower net brokerage, exchange and clearance fees and payments for order flow expenses.

Segmental Update

Market Making: The segment reported an adjusted net trading income of $208.1 million, which declined 12.7% from the prior-year figure. The metric missed our estimate by 0.5%. Segmental total revenues jumped 15.5% to $517.4 million in the third quarter of 2023 and comfortably beat our estimate.

Execution Services: The adjusted net trading income of the segment declined 3.2% to $89.9 million in the third quarter but remained well above our estimate. Total revenues declined 6% in the quarter under review to $112.5 million. However, the metric beat our estimate by 12.7%.

Financial Update (as of Sep 30, 2023)

Virtu Financial exited the third quarter with cash and cash equivalents of $688.8 million, which declined from the 2022-end level of $981.6 million. Total assets of $17.6 billion increased from $10.6 billion at 2022-end.

Long-term borrowings, net, amounted to $1.78 billion, down from the 2022-end figure of $1.80 billion. Short-term borrowings, net, at the third-quarter end were $97.2 million.

Total equity was $1.5 billion, down from $1.7 billion at 2022-end.

Share Repurchase and Dividend Update

In the quarter under review, Virtu Financial (as part of its share repurchase program) bought back shares worth $48.8 million. It had $136.3 million remaining under its share buyback authorization for future purchases.

It announced a cash dividend of 24 cents per share. The dividend will be paid out on Dec 15 to shareholders of record as of Dec 1.

Zacks Rank & Key Picks

Virtu Financial currently has a Zacks Rank #5 (Strong Sell).

Investors interested in the broader Finance space can consider better-ranked companies like Blue Owl Capital Corporation OBDC, Trupanion, Inc. TRUP and Globe Life Inc. GL, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus mark for Blue Owl Capital’s current year earnings indicates a 32.6% year-over-year increase. It beat earnings estimates in all the past four quarters, with an average surprise of 4.5%. Furthermore, the consensus estimate for OBDC’s revenues in 2023 suggests 28.7% year-over-year growth.

The Zacks Consensus Estimate for Trupanion’s current year earnings has improved by a penny in the past 30 days. It beat earnings estimates twice in the past four quarters and missed on two occasions. Also, the consensus mark for TRUP’s revenues in 2023 suggests 20.1% year-over-year growth.

The Zacks Consensus Estimate for Globe Life’s current year earnings is pegged at $10.59 per share, which indicates 29.9% year-over-year growth. It has witnessed one upward estimate revision against none in the opposite direction in the past week. It beat earnings estimates in each of the past four quarters, with an average surprise of 2.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trupanion, Inc. (TRUP) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

Globe Life Inc. (GL) : Free Stock Analysis Report

Blue Owl Capital Corporation (OBDC) : Free Stock Analysis Report